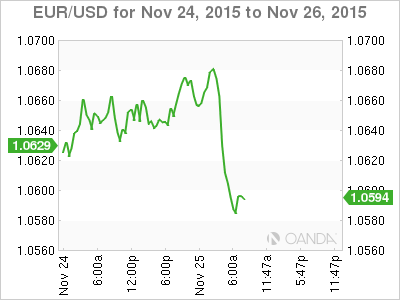

EUR/USD has posted strong losses on Wednesday, as the pair trades at 1.0590 in the European session. In economic news, the euro has lost ground as reports have surfaced that the ECB will implement further easing measures by increasing asset purchases. As well, the ECB released its Financial Stability Review. Later in the day, the US will release two major events – Core Durable Goods Orders and Unemployment Claims.

There was good news out of Germany on Tuesday, as Ifo Business Climate, a key indicator, jumped to 109.0 points in November, up from 108.2 points a month earlier. This figure beat the forecast of 108.3 points, and marked the indicator’s best showing since June 2014. German GDP posted a modest gain of 0.3% in the third quarter, matching the forecast. Meanwhile, Eurozone PMIs kicked off the week on a positive note. German and French Manufacturing PMIs were both slightly above the forecast, with German Manufacturing PMI coming in at 52.6 points, and the French indicator at 50.8 points. All of the Services and Manufacturing PMIs in November were above the 50-point level, which separates contraction from expansion. This points to expansion in the manufacturing and services sectors, which is welcome news, as the Eurozone economy has been hampered by weak growth.

There were no surprises from US Preliminary GDP in the third quarter. The revised GDP report came in at 2.1%, very close to the Advanced GDP reading of 2.0%. Although these numbers pale in comparison to the blistering 3.7% we saw in Q2, they nonetheless point to respectable growth by the US economy in a difficult global environment. Meanwhile, Consumer Confidence slipped badly, dropping to 90.4 points, compared to 97.6 points a month earlier. This was well off the estimate of 99.3 points, and marked the indicator’s weakest showing in 12 months. After this disappointing consumer confidence reading, the markets will be keeping a close eye on Wednesday’s consumer spending indicators, with the release of October’s durable goods reports.

Will the Federal Reserve press the rate trigger at the December policy meeting? Last week’s Fed minutes did not confirm a December rate hike, but most analysts feel that the long-awaited move will indeed occur next month. The Fed hinted at a rate hike in its October policy statement, and the markets have been abuzz ever since. Last week, New York Fed President William Dudley said there is a “strong case” for a rate hike in December as long as economic data remains strong. At the past two policy meetings, the vote against a rate hike was 9-1, but that clearly will not be the outcome at the December meeting. With the US economy showing improvement and employment and consumer indicators pointing upwards, the markets appear prepared for a small hike of 0.25% or 0.50%, and there is a growing view that modest, incremental moves would not cause unwanted turbulence on the global markets. One fly in the ointment is that of weak inflation levels. as the Fed has repeatedly stated that inflation is a key consideration in any decision to raise rates. With the critical Fed meeting only a few weeks away, every key indicator and comment from a Fed member will be under close scrutiny from the markets.

Eurozone inflation levels continue to point downward, as underlined by weak German inflation numbers last week. The ECB remains very concerned about deflation, as indicated in the minutes of its recent November policy meeting. The central bank has revised downwards its inflation outlook, and the markets are keeping a close eye on the next policy meeting on December 3. This will be a critical meeting, as the ECB could elect to cut rates or expand the current asset-purchasing program in order to combat deflation and try to breathe some life into the sluggish economy. Any of these steps will likely weigh on the struggling euro, which is trading at 7-month lows against a strong US dollar.

EUR/USD Fundamentals

Wednesday (Nov. 25)

- 10:00 ECB Financial Stability Review

- 10:00 Italian Retail Sales. Estimate +0.5%. Actual -0.1%

- Tentative – German 10-year Bond Auction

- 13:30 US Core Durable Goods Orders. Estimate 0.5%

- 13:30 US Unemployment Claims. Estimate 273K

- 13:30 US Core PCE Price Index. Estimate 0.1%

- 13:30 US Durable Goods Orders. Estimate 1.6%

- 13:30 US Personal Spending. Estimate 0.3%

- 13:30 US Personal Income. Estimate 0.4%

- 14:00 US HPI. Estimate 0.5%

- 14:45 US Flash Services PMI. Estimate 55.2 points

- 15:00 US New Home Sales. Estimate 500K

- 15:00 US Revised UoM Consumer Sentiment. Estimate 93.2 points

- 15:00 US Revised UoM Inflation Expectations

- 15:30 US Crude Oil Inventories. Estimate 1.2M

- 17:00 US Natural Gas Storage. Estimate 5B

*Key releases are highlighted in bold

*All release times are GMT

EUR/USD for Wednesday, November 25, 2015

EUR/USD November 25 at 11:25 GMT

EUR/USD 1.0580 H: 1.0689 L: 1.0583

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0287 | 1.0359 | 1.05 | 1.0659 | 1.0732 | 1.0847 |

- EUR/USD posted slight gains in the Asian session but then reversed directions and has dropped sharply in European trade.

- On the upside, 1.05 has some breathing room as the pair has lost ground.

- 1.0500 is providing support.

- Current range: 1.0500 to 1.0659

Further levels in both directions:

- Below: 1.05, 1.0359 and 1.0287

- Above: 1.0659, 1.0732, 1.0847 and 1.0941

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged, despite losses by the euro on Wednesday. The ratio has a slight majority of long positions (52:48). This indicates slight trader bias towards the pair moving higher.