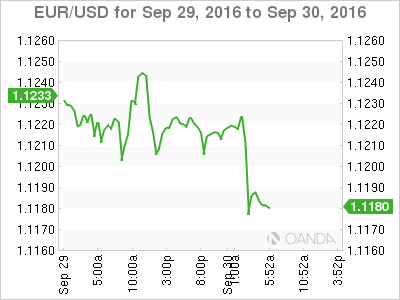

EUR/USD has posted losses on Friday, dropping below the 1.12 line. Currently, the pair is trading at 1.1180. It’s a busy day on the economic front in both Europe and the US. German Retail Sales declined 0.4%, below the forecast of a 0.2% decline. Eurozone CPI beat the forecast, gaining 0.4%. In the US, Friday’s highlight is UoM Consumer Sentiment, with the markets predicting a strong reading of 90.1 points.

There was positive news out of the Eurozone on Thursday. Economic sentiment index climbed to 104.9 in September, up from 103.5 in August. The markets had expected the indicator to remain unchanged. Economic sentiment is an early signal of trends in growth, so the solid release will be welcome news to the markets, which remain concerned about the impact of the Brexit vote on Europe. Services sentiment improved to 10.0, edging above the previous release of 9.9. Consumer confidence remains weak, but there was some improvement in September, as the indicator rose from -8.5 to -8.2.

Is inflation picking up in the Eurozone? September data showed some improvement, which is welcome news. Eurozone CPI is expected to climb 0.4%, up from 0.2% in August, according to the EU statistical office. This would mark its strongest gain since January. On Thursday, German Preliminary CPI edged up to 0.1%, above the forecast of 0.0%. Stronger inflation numbers would give the ECB some breathing room, which is under pressure to adopt further easing in order to coax inflation levels upwards.

As if the Mario Draghi & Co. don’t have enough problems to contend with, Deutsche Bank (DE:DBKGn) is in trouble and there are concerns that the German government may have to step in and rescue the giant bank. On Thursday, Bloomberg reported that some hedge funds have cut their exposure with Deutsche Bank, raising concerns in the markets and weighing on the euro. The bank has also been hit with a staggering $14 billion fine from the US Justice Department over mortgage securities irregularities, and its shares have plunged over 50% since July 2015. Deutsche Bank’s woes have raised the uncomfortable question about the stability of the entire European banking system, which has had to contend with rock-bottom interest rates and a listless Eurozone economy.

The US economy expanded 1.4% in the second quarter, revised from the preliminary estimate of 1.1%. Consumer spending has been strong, making up for sluggish business investment and weaker demand for US exports. The US consumer is optimistic about the economy, as underscored by recent CB consumer confidence surveys, which have been above the 100-level for two months running. On the labor front, unemployment claims came in at 254 thousand, marking the eighth straight week that jobless claims have come in below the forecast.

US consumer confidence numbers continue to impress the markets. The CB Consumer Confidence jumped to 104.1 points in September, much higher than the forecast of 98.6 points. This excellent release improved upon a strong August report of 101.1 points. Stronger consumer confidence often translates into increased spending by consumers, which is vital for economic growth. If upcoming consumer spending numbers also move higher, the likelihood of a December hike will likely increase. Currently, the markets have priced in a quarter-point hike in December at 48 percent.

EUR/USD Fundamentals

Friday (September 30)

- 6:00 German Retail Sales. Estimate -0.2%. Actual -0.4%

- 6:45 French Consumer Spending. Estimate 0.4%. Actual 0.7%

- 6:45 French Preliminary CPI. Estimate -0.3%. Actual -0.2%

- 8:00 Italian Monthly Unemployment Rate. Estimate 11.4%. Actual 11.4%

- 9:00 Eurozone CPI Flash Estimate. Estimate 0.4%

- 9:00 Eurozone Core CPI Flash Estimate. Estimate 0.9%

- 9:00 Italian Preliminary CPI. Estimate -0.3%

- 9:00 Eurozone Unemployment Rate. Estimate 10.0%

- 12:30 US Core PCE Price Index. Estimate 0.2%

- 12:30 US Personal Spending. Estimate 0.2%

- 12:30 US Personal Income. Estimate 0.2%

- 13:45 US Chicago PMI. Estimate 52.1

- 14:00 US Revised UoM Consumer Sentiment. Estimate 90.1

- 14:00 US Revised UoM Inflation Expectations

*All release times are EDT

* Key events are in bold

EUR/USD for Friday, September 30, 2016

EUR/USD September 29 at 9:25 GMT

Open: 1.1218 High: 1.1227 Low: 1.1167 Close: 1.1182

EUR/USD Technicals

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0957 | 1.1054 | 1.1150 | 1.1278 | 1.1376 | 1.1467 |

- EUR/USD showed limited movement in the Asian session. The pair has posted losses in European trade

- There is resistance at 1.1278

- 1.1150 has weakened in support as EUR/USD has posted losses in the European session

Further levels in both directions:

- Below: 1.1150, 1.1054, 1.0957 and 1.0821

- Above: 1.1278, 1.1376 and 1.1467

- Current range: 1.1150 to 1.1278

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged in the Friday session. Currently, short positions have a majority (56%), indicative of trader bias towards EUR/USD continuing to lose ground.