The euro is flat on Friday, as EUR/USD continues to trade shy of the 1.34 level in the European session. In economic news, Spanish and Italian Manufacturing PMIs softened in June, disappointing the markets. It's a busy day in the US, with three key events later in the day - Nonfarm Employment Change, Unemployment Rate and ISM Manufacturing PMI. We'll also get a look at consumer confidence levels, with the release of UoM Consumer Sentiment.

It's been a quiet week for the euro, but that could change on Friday, as the US releases key employment data. On Thursday, Unemployment Claims came in at 302 thousand, higher than the week before but very close to the estimate of 303 thousand. Earlier in the week, ADP Nonfarm Payrolls posted a sharp drop. If the official NFP release follows suit and misses expectations, the euro could make up some ground against the dollar.

Eurozone Manufacturing PMIs are closely tracked by analysts, as they are important gauges of the health of the manufacturing sectors in the Eurozone economies. The Spanish PMI came in at 53.9 points and the Italian figure at 51.9. Although these fell short of the estimates, they both remained above the 50-point level, which marks expansion. Eurozone Manufacturing PMI was unchanged at 51.8, almost matching the estimate of 51.9.

On Thursday, Eurozone CPI, one of most important indicators, edged lower to 0.4%. Although this was close to the estimate of 0.5%, this figure was the lowest in almost five years, and raises concerns of deflation. There was better news from the Eurozone Unemployment Rate, which dipped to 11.4%, its lowest level since September 2012. German data was positive, led by Retail Sales which jumped 1.3%, beating the estimate of 1.1%. German Unemployment Change posted a decline of 12,000, easily surpassing the estimate of a drop of 5,000.

US GDP exceeded expectations in the second quarter, expanding at an annual rate of 4.0%. This easily beat the estimate of 3.1% and marked the strongest quarter of economic growth since Q4 of 2009. The boost in economic activity was helped by strong consumer confidence and business investment, as well as solid employment data. The US dollar took advantage of the strong numbers, posting gains against its major rivals.

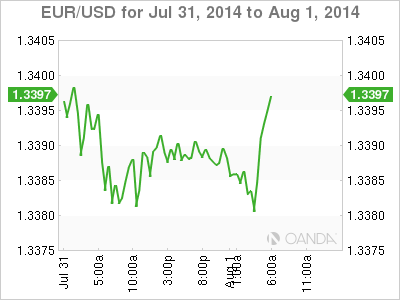

EUR/USD August 1 at 7:50 GMT

- EUR/USD 1.3381 H: 1.3392 L: 1.3380

EUR/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3175 | 1.3295 | 1.3346 | 1.3487 | 1.3585 | 1.3651 |

- EUR/USD is almost unchanged, with little activity in the Asian and European sessions.

- 1.3346 continues to provide support. 1.3295 is stronger.

- On the upside, 1.3487 has some breathing room as the pair trades below the 1.34 line.

- Current range: 1.3346 to 1.3487

Further levels in both directions:

- Below: 1.3346, 1.3295, 1.3175 and 1.3104

- Above: 1.3487, 1.3585, 1.3651 and 1.3786

OANDA's Open Positions Ratio

EUR/USD ratio is unchanged in Friday trade, continuing the trend seen a day earlier. This is consistent with the lack of movement displayed by the pair. The ratio has a majority of long positions, indicative of trader bias towards the euro breaking out and moving higher.

EUR/USD Fundamentals

- 7:15 Spanish Manufacturing PMI. Estimate 54.8 points.

- 7:45 Italian Manufacturing PMI. Estimate 52.8 points.

- 8:00 Eurozone Final Manufacturing PMI. Estimate 51.9 points.

- 12:30 US Nonfarm Employment Change. Estimate 231K.

- 12:30 US Unemployment Rate. Estimate 6.1%.

- 12:30 US Average Hourly Earnings. Estimate 0.2%.

- 12:30 US Core PCE Price Index. Estimate 0.2%.

- 12:30 US Personal Spending. Estimate 0.5%.

- 12:30 US Personal Income. Estimate 0.4%.

- 13:45 US Final Manufacturing PMI. Estimate 56.3 points.

- 13:55 US Revised UoM Consumer Sentiment. Estimate 81.5 points.

- 13:55 US Revised UoM Inflation Expectations.

- 14:00 US ISM Manufacturing PMI. Estimate 56.1 points.

- 14:00 US Construction Spending. Estimate 0.4%.

- 14:00 US ISM Manufacturing Prices. Estimate 58.6 points.

- All Day - US Total Vehicle Sales. Estimate 16.8M.