GROWTHACES.COM Trading Positions

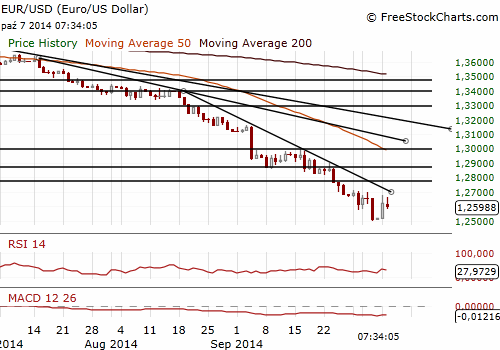

EUR/USD: short at 1.2605, target 1.2465, stop-loss 1.2700

USD/JPY: long at 109.05, target 110.50, stop-loss 108.15

USD/CHF: long at 0.9590. target 0.9750, stop-loss 0.9450

USD/CAD: long at 1.1150, target 1.1290, stop-loss 1.1060

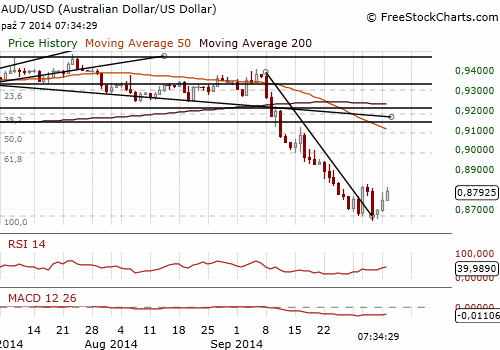

AUD/USD: short at 0.8800, target 0.8610, stop-loss 0.8915

EUR/CHF: long at 1.2085, target 1.2160, stop-loss 1.2045

We encourage you to visit our website and subscribe to our newsletter to receive trading positions summary for major pairs and crosses.

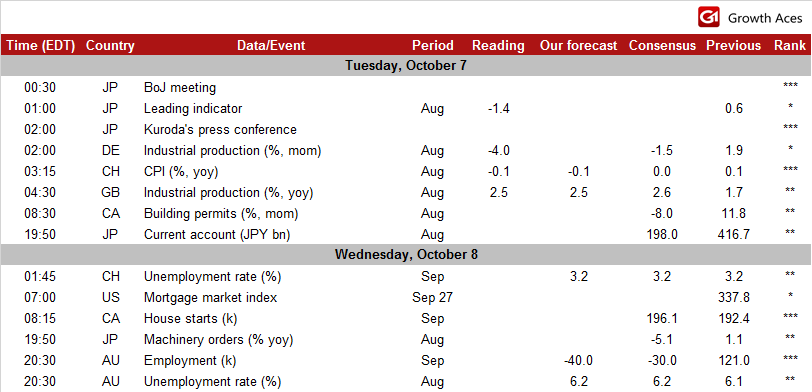

ECONOMIC CALENDAR

EUR/USD: Germany criticizes the ECB’s plans to buy ABS

(short again, the target is 1.2465)

- The European Central Bank's plans to buy ABS have drawn sharp criticism from officials in Germany.

- Bundesbank chief Jens Weidmann said that there was a danger the ECB would buy "low-quality loan securitisations" at inflated prices as part of its programme to buy ABS. ABS are created by banks pooling mortgages and corporate, auto or credit card loans, and selling them to insurers, pension funds or now, the ECB. Then the credit risks taken by private banks would be transferred to the central bank. Weidmann added that the global financial crisis had shown how dangerous it could be to abandon the principle: Those who derive benefit from something should bear the loss if there are negative developments.

- Former ECB chief economist Juergen Stark, a German who resigned in 2011 in protest over the ECB's intervention in the government bond markets, said that the ECB's unconventional measures were "an act of desperation". Stark said the ECB would put "incalculable risks" on its balance sheet with its ABS programme and eurozone taxpayers would be liable for these in case of losses.

- Germany's industrial output slumped 4.0% mom in August and posted its biggest drop since January 2009. The median forecast assumed a fall of 1.5% mom

- Kansas City Federal Reserve Bank President Esther George, who does not have a vote on the Fed's policy-setting committee this year, is the opinion that inflation measures remain relatively stable, but the Federal Reserve needs to move to raise interest rates if price pressures increase quickly.

- The EUR/USD recovered to higher levels than we assumed and hit a high of 1.2675 today. We went short at 1.2605, in line with our trading strategy. 10-dma level is a strong resistance and protect the short trade. We have seen two failed attempt to broke above this level. Our target is 1.2465 and stop-loss is at the level of 1.2700.

Significant technical analysis' levels:

Resistance: 1.2662 (10-dma), 1.2675 (high Oct 6), 1.2676 (high Oct 3)

Support: 1.2504 (low Oct 6), 1.2501 (low Oct 3), 1.2493 (low Aug 31)

AUD/USD: Slightly more hawkish RBA due to concerns over housing market

(we are short again at 0.8800, the target is 0.8610)

- Australia's central bank kept its cash rate steady at a record low of 2.5% for a 13th straight meeting. The decision was widely expected. The RBA governor Glenn Stevens said: “The Bank still expects growth to be a little below trend for the next several quarters.”

- The RBA reiterated that the currency was still high by historic standards, even though it has fallen sharply in the past month. The recent depreciation of the AUD against the USD cushioned miners from the impact of lower commodity prices and made domestic businesses more competitive.

- Less welcome to policymakers in recent months has been a surge in borrowing to buy investment properties. In Sydney, annual price growth was running at a rapid 14.3% with Melbourne following at 8.1%. The RBA statement was interpreted as slightly more hawkish than a month earlier due to concerns over the state of the housing market.

- The AUD/USD opened on Tuesday at 0.8765. The AUD was under pressure in Asian morning trades but then recovered ahead of the RBA decision. After slightly more hawkish statement than expected, the AUD/USD fell again, but only for a while. The AUD/USD reached a high at 0.8810. In line with our trading idea, we used the level of 0.8800 to get short again. Our target is 0.8610 and stop-loss is at the level of 0.8915.

Significant technical analysis' levels:

Resistance: 0.8813 (high Sep 26), 0.8885 (high Sep 25), 0.8897 (Sep 24)

Support: 0.8663 (low Oct 1), 0.8660 (low Jan 24), 0.8623 (low Jul 8, 2010)

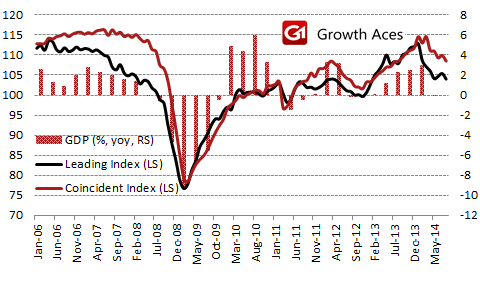

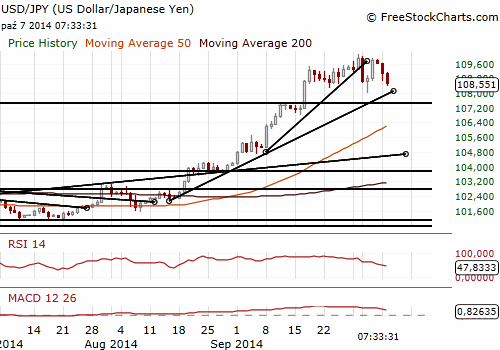

USD/JPY: BOJ sees no urgency to ease monetary policy further

(we went long, the target is 110.50)

- As widely expected, the Bank of Japan maintained its pledge of increasing base money, or cash and deposits at the central bank, at an annual pace of JPY 60-70 tr via purchases of government bonds and risky assets.

- The central bank downgraded its assessment of industrial output in October due to inventory adjustments and tax hike from April 1. The statement said that the tax hike weighed also on private consumption. Despite these concerns, the BOJ maintained its overall assessment of the country's economic situation saying "Japan's economy has continued to recover modestly as a trend," but adding, "some weakness particularly on the production side has been observed."

- The BOJ governor Kuroda acknowledged that the tax-hike pain and bad summer weather had weighed on consumption longer than expected. But he stressed that after a temporary soft patch, growth will pick up enough to accelerate inflation toward the BOJ's price target.

- Kuroda also stuck to his view that a weak yen is positive for Japan's economy. But he slightly modified his tone by nodding to concerns from the business community that further yen declines will hurt small firms and households by boosting import costs.

- Kuroda also stressed that the BOJ's quantitative and qualitative easing will not be automatically terminated when the two-year deadline for meeting its price target approaches.

- Japanese Prime Minister Shinzo Abe said a weaker yen has both benefits and costs as it will help exporters while negatively impact importers of raw materials.

- The index of coincident economic indicators, which consists of 11 indicators such as industrial output, employment and retail sales data, fell a preliminary 1.4 points mom in August. The index of leading economic indicators, compiled using data such as the number of job offers and consumer sentiment measures, a gauge of the economy a few months ahead, also fell 1.4 points mom.

- Comments from Bank of Japan Governor Haruhiko Kuroda, who told a news conference there was no need to adjust monetary policy if the bank's inflation goal of 2% can be met in the middle of the financial year starting next April, gave a boost to the JPY. The USD/JPY fell below 108.40 from an intraday high of 109.25, but then recovered slightly.We went long on the USD/JPY at 109.05, as we assumed in GrowthAces.com Trading Positions Summary yesterday. Our target is 110.50.

Significant technical analysis' levels:

Resistance: 109.25 (session high Oct 7), 109.85 (high Oct 6), 109.91 (high Oct 3)

Support: 108.39 (low Oct 3), 108.01 (low Oct 2), 107.90 (23.6% of 100.81-110.09)