Open 1.3529

High 1.3565

Low 1.3412

Close 1.3535

On Wednesday EUR/USD increased with 95 pips. The European currency appreciated from 1.3565 to 1.3414 yesterday, matching the positive money flow sentiment at above +22%, closing the day at 1.3536. This morning the euro weakened slightly further, reaching 1.3535.

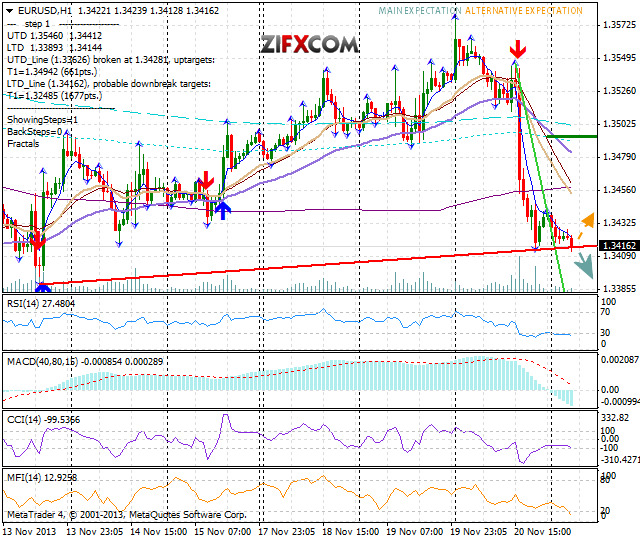

On the 1 hour chart quotes are breaking down of the trading range again, while on the 3 hour chart the upward channel is turning into range trading. Break above the nearest resistance and yesterday's top at 1.3565 may trigger further strengthening of the euro. Going below today's bottom and first support at 1.3412, however, would confirm continuation of the bearish trend, towards next objective downwards 1.3300.

Today's focus is on Germany and EMU PMI, and U.S. Initial jobless claims, PPI and Philadelphia Fed index, at 8:30, 9, 13:30, and 15 GMT respectively.

Quotes are moving below the 20 and 50 EMA on the 1 hour chart, indicating bearish pressure. The value of the RSI indicator is negative and calm, MACD is positive and declining, while CCI has crossed down the 100 line on the 1 hour chart, giving over all short signals.

Technical resistance levels: 1.3565 1.3677 1.3800

Technical support levels: 1.3412 1.3300 1.3178

Yesterday we made +13 pips profit/loss on EUR/USD from the following sent to clients only signal:

9:45 GMT Sell EUR/USD at 1.3526 SL 1.3552 TP 1.3476, exit sent at 13:30 GMT.

Total yesterday +95. EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="640" height="540">

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="640" height="540">