Forex News and Events

Eurozone Finance Ministers meet in Brussels today to discuss about the Greek situation. Greek PM Alexis Tsipras reiterates that his country is not willing to accept the extension of the bail-out package, no matter how hard Germany insists. Greece is ready to negotiate terms and procedures for existing debt payments says Tsipras, yet is clearly against paying the existing debt by contracting new debt, and therefore remaining stuck in this infernal vicious circle.

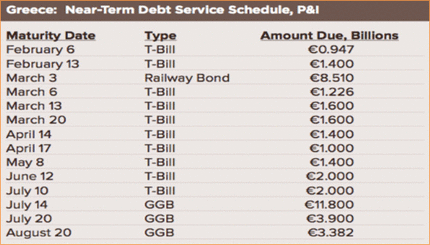

The Greek sovereign bonds yield above 20% for 2-year maturity, above 16% and 10% for 5-Year, 10-Year maturities respectively as Greek FinMin Varoufakis says debt cannot be paid in the near future. Varoufakis will take a try to push back the February 16th deadline to apply for a bail-out and seek alternative solutions to service the dangerously approaching repayment dates (see figure).

As the yield spread between Greek and German bonds widen, the 40-day rolling correlation between 10-year Greek/German spread and EUR/USD turns negative (-10%), from +20/40% range on ECB QE expectations and announcement era. Therefore leading us to think that the EUR-traders are increasingly skeptical on potential Grexit.

EUR/USD technicals are favorable for short-term pick-up to 1.1445/1.1534 (Fibonacci 23.6% on Dec’14-Jan’15 drop / post-Jan 22nd high) yet traders will be seller on rallies as long as uncertainties on Greece persist. We still don’t see a deal this week, as newly empowered Tsipras, will surely make unreasonable demands from the EU’s perspective.

After this short consolidation period, EUR/USD bearish trend should continue with a break of range floor at 1.1270 targeting 1.1098 year lows first than lower to 1.10 psychological support. Option barriers trail below 1.15 in preparation to today’s event risk.

Some color out of the UK

Hearing Cameron speaking, the small caps in the UK may also benefit from targeted liquidity injections if his party wins elections in May. The goal is to fill the funding gap of small firms in need to help them grow into medium then big caps. The project has a name “Help to Grow”, targeting 500 fastest growing firms to obtain “kind of finance their German equivalent still get”. The finance “gap” is estimated to sum up to 1 billion pound per year, which should not be hard to finance.

This billion pound project will be financed by private lenders, or public/private co-investing, whereas government’s balance sheet will be the guarantee to loans. Quiet good investment indeed. A 100 million pound worth pilot program will take place before elections, on next budget. The program will then extend if Cameron’s party successfully wins people’s support in May elections. If not, a labour-led government will most probably reject the program to reduce spending and consolidate UK’s budget.

The cable trades water, sweeping the top of Sep’14-Feb’15 downtrend top (1.5292). The GBP-bulls remain on the sidelines before Thursday’s Quarterly Inflation Report (QIR). We expect the BoE to maintain its dovish stance as the low inflation environment necessitates no rush to a premature policy normalization. Especially given the gloomy economic outlook in the neighboring Euro-zone. Technically, GBP/USD bias remains comfortably positive.

The 21-dma (1.5152) is seen as support before the QIR, while offers are presumed pre-1.5292 (downtrend top) if breached should send the pair into fresh bullish consolidation zone with vanilla calls supportive above 1.53 before the week’s closing bell. On the downside, the selling pressures should intensify below 1.51 in case the IR reveals unexpectedly bearish BoE stance.

Greece debt repayments approaching

The Risk Today

Luc Luyet

EUR/USD

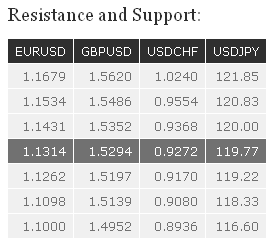

EUR/USD has thus far successfully tested the support at 1.1262. However, the inability to break the hourly resistance at 1.1359 suggests persistent selling pressures. Another hourly resistance can be found at 1.1431 (intra-day low, see also the declining trendline), whereas another support lies at 1.1098.

In the longer term, the symmetrical triangle favors further weakness towards parity. As a result, any strength is likely to prove temporary. A resistance lies at 1.1679 (21/01/2015 high), while a key resistance stands at 1.1871 (12/01/2015 high). Key supports can be found at 1.1000 (psychological support) and 1.0765 (03/09/2003 low).

GBP/USD has broken the key resistance at 1.5274 (06/01/2015 high). Even if the declining trendline remains thus far intact, further strength towards the resistance at 1.5486 is favoured. Hourly supports now stand at 1.5197 (10/02/2015 low) and 1.5139 (04/02/2015 low). An hourly resistance can be found at 1.5352 (06/02/2015 high). In the longer term, the break of the key resistance at 1.5274 (06/01/2015 high) suggests renewed buying interest. Upside potential are likely given by the resistances at 1.5620 (31/12/2014 high) and 1.5826 (27/11/2014 high). The strong support at 1.4814 should cap the medium-term downside risks.

USD/JPY has broken the resistance implied by its declining channel, confirming an improving technical structure. A test of the resistance area between 120.83 and 121.85 is favored. Hourly supports can be found at 119.22 (06/02/2015 high) and 118.33 (09/02/2015 low). A long-term bullish bias is favored as long as the key support 110.09 (01/10/2014 high) holds. Even if a medium-term consolidation is likely underway, there is no sign to suggest the end of the long-term bullish trend. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is likely. A key support can be found at 115.57 (16/12/2014 low).

USD/CHF is consolidating below the resistance at 0.9368 (15/10/2014 low, see also the 200-day moving average). Hourly supports stand at 0.9170 (30/01/2015 low) and 0.8936 (27/01/2015 low). Another resistance lies at 0.9554 (16/12/2014 low). Following the removal of the EUR/CHF floor, a major top has been formed at 1.0240. The break of the resistance implied by the 61.8% retracement of the sell-off suggests a strong buying interest. Another key resistance stands at 0.9554 (16/12/2014 low), whereas a strong support can be found at 0.8353 (intra-day low).