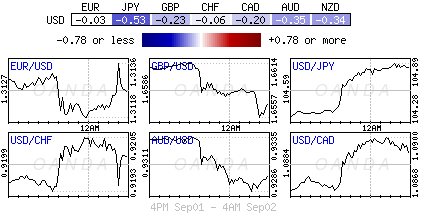

This is expected to be a tough week for investors. Central Bank rate decisions, mixed in with North American jobs reports will be expected to dominate capital markets risk landscape. Thus far, it's no surprise to see European markets maintain a cautious tone after the North American long holiday weekend. Investors are keeping an eye on the 'lingering conflict in Ukraine while trying to gauge the ECB intentions on how they will announce further stimulus measures, ahead of the ECB's policy meet later this week. Even the EUR and RUB are broadly unchanged outright, and this is in stark contrast to yesterday's sell-off which saw the currencies hit upon new multi-year record lows outright. The market has been waiting to see what North America wants to do.

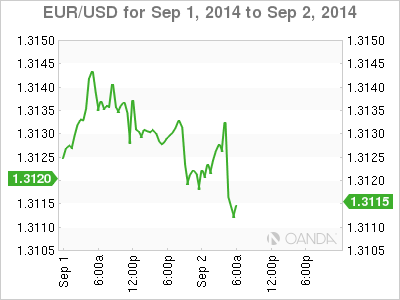

Thus far, many investors, via intraday trading, have been mostly influenced by geopolitical events. Nevertheless, many of the market's participants will now begin turning to the ECB and the possibility of the witnessing further rates cuts to stimulate the region's sluggish recovery for guidance. Perhaps their needs to be an announcement where the ECB may now be considering opting a broad based asset purchase program (ABS) to stimulate the regions struggling economy and bring inflation back in line with policy expectations. The market has some of this already priced in - maybe be the EUR will catch a bid on 'fact'?

ECB cannot afford to let investors linger

From an investor's standpoint, this is a 'big' call for Draghi and company this week. Quantitative easing is considered the last resort. Structurally, Europe is not ready for buying asset back securities. However, the ECB is very much backed into a corner when it comes to growth and inflation. With both elements struggling, can the Euro region continue to wait patiently for lower base rates and TLTRO to kick in before implementing QE?

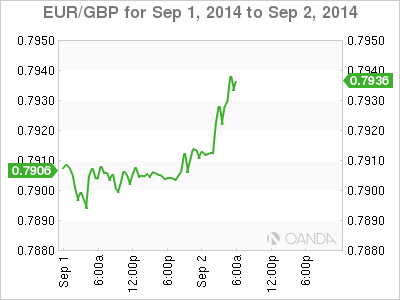

QE is untested and will not necessarily weaken the EUR to the desired levels called for by other struggling members, in particular France. It's a huge gamble for EU policy makers - it might not work and Europe will remain in a low growth, high unemployment state. Many expect that when the ECB does eventually launch QE, it will be able to guide the EUR/USD towards €1.20. Investors should be aware that QE does not always guarantee currency weakness. When the BoE first implemented the practice, the pound actually appreciated when the BoE was buying Gilts. The strength of the 18-member single unit will depend on what investors will be anticipating. If they expect higher asset prices after QE, than overseas investors will be demanding EUR's to invest in Euro asset's to capture some of that capital appreciation - eventually it will weaken.

Another rate cut to provide EUR support?

The benefits of a further modest rate cut could be marginal now that the deposit rate is already in negative territory. The weaker EUR (€1.3118), negative money market rates, and lower bond yields already suggest that the ECB can afford to be patient, wait and see the effectiveness of September's and Decembers TLTRO's before embarking on further credit easing. Many would probably view a token cut to base rates as an act of desperation by ECB policy makers to kick-start their low inflation dilemma. The ECB is expected to use the remaining few months in the calendar year to access the credit schemes power's, while stepping up pressure on regional politicians to deliver "pro-growth" structural reforms. The purchases of sovereign bonds remain high, but which ones? Nevertheless, credit easing by ABS purchases could be structurally up and running by year-end making ECB choice decisions easier.

The mighty dollar has enjoyed most of the markets support over the summer months, jumping to a seven-month high against JPY earlier this morning (¥104.90), on expectation that US monetary stimulus policy is near an end (QE is expected to finish by October), while a cabinet re-shuffle and a potential delay to their next sales tax hike could help improve the twin problems of growth and lack of inflation. The dollar continues to be supported by improving consumer confidence metrics and a stronger jobs market. This Friday's NFP will be able to provide the current lay of the land when it comes to US employment.

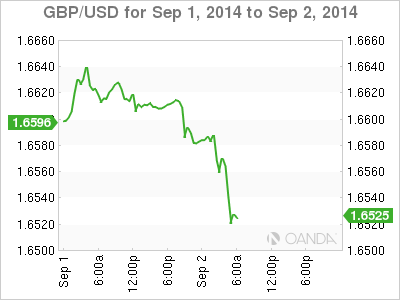

Sterling continues to labor

In contrast to yesterdays very disappoint UK manufacturing reading (52.5 vs. 55.5), this morning's UK construction PMI for last month pointed to a continued acceleration in the sector (64 vs. 61.5) and managed to reach the highest level in seven-months. The pound should have gather support on the headline; nevertheless GBP (£1.6525) came under political pressure after a narrowing in the opinion polls ahead of the Scottish independence on September 18th. Even the two-member MPC dissent, will be incapable of getting in the way of politics. The BoE is expected to remain on hold this coming Thursday - but perhaps more color on last months dissent views.

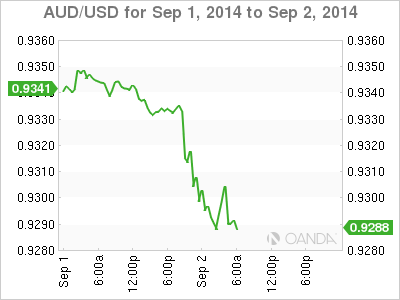

RBA deliveries

Supply pressures and profit taking ahead of big event risk later in the week are leaning on the fixed income markets, pushing both Bund and Gilt 10's down and steepening the curves after a few weeks of curve flatteners. The Aussies did what was expected of them in the overnight session. The Australia RBA kept the official cash rate at a record low of +2.50%, as widely expected. The Central Bank again forecasted no moves for a period of time (AUD$0.9287). Although the RBA said there has been some improvement in indicators for the labor market this year, but it will probably be some time yet before unemployment declines consistently. Governor Stevens has again attempted to talk his currency down from such lofty heights - he reiterated that the AUD is high by historical standards, particularly given the declines in commodity prices. The currency managed to back off quickly from AUD$0.9350. Nevertheless, with the lack of global yield, the 'carry' trade continues to favor the AUD on pullbacks.