Last week, we took a long-term look at EUR/USD in the wake of the ECB’s historic QE announcement in order to identify the next major support levels to watch (see “EUR/USD in Freefall, is Parity On the Cards?” for more). As we go to press, EUR/USD is still consolidating near the long-term Fibonacci retracement at 1.1200, despite the far-left Syriza party’s victory in this weekend’s Greek election. While many traders are understandably focused on EUR/USD (which is, after all, the world’s most widely-traded currency pair), EUR/GBP is also testing a massively important long-term support level.

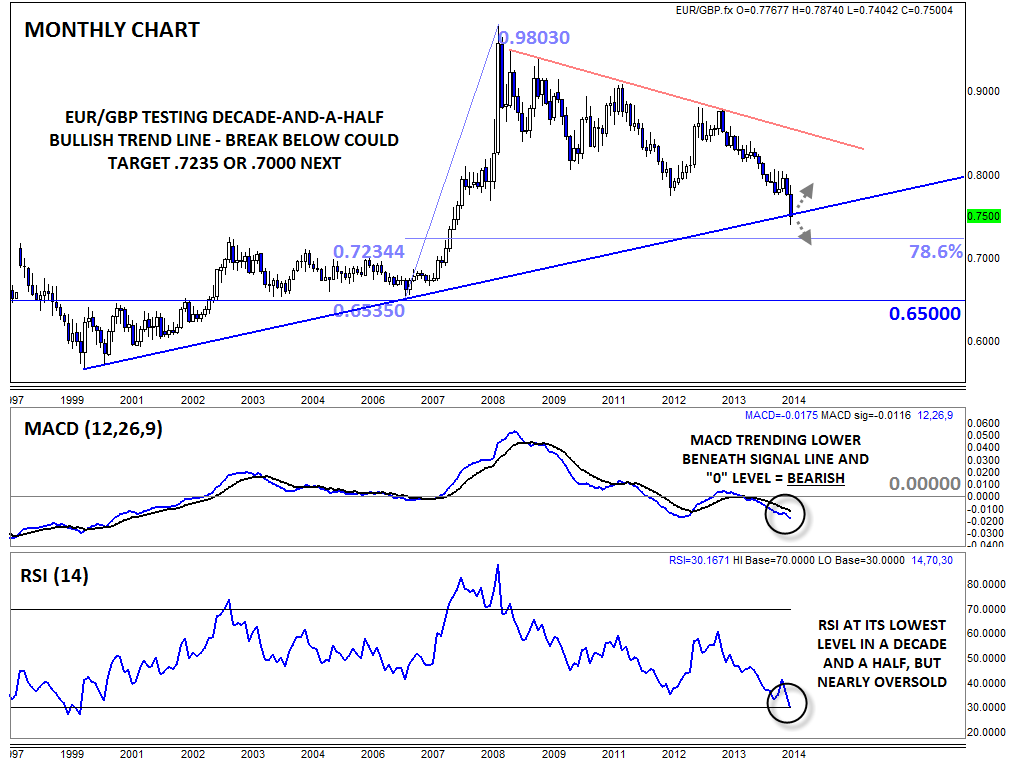

Zooming all the way out to a monthly chart (below), we can see that EUR/GBP has been broadly trending higher since bottoming at .6000 all the way back in Q2 2000. After the runaway surge nearly to parity in 2008, the pair has put in a series of lower highs and lower lows and is back down near .7500, threatening the decade-and-a-half bullish trend line off the 2000 low.

Of course, it will take more than just today’s brief thrust below .7500 to consider it broken, but the monthly MACD indicator is showing strong bearish momentum that could take rates through that floor. On the other hand, bulls can build the case for a bounce around the monthly RSI indicator, which is on the verge of oversold territory. From a fundamental perspective, there are a number of competing crosswinds impacting EUR/GBP: the current drama is centered around QE and Greece in the eurozone, but as the UK’s May election nears, the political risk may shift North of the English channel.

While few forex traders are holding trades for months or years at a time, this type of analysis can provide valuable perspective to help frame shorter-term setups; for instance, a failure to bounce in the next week or two would suggest that the 15-year bullish trend line has been broken, opening the door for a bearish continuation toward .7235 (78.6% Fibonacci retracement) or .7000 (key psychological support) next. Conversely, traders should also consider the possibility that EUR/GBP could bounce off this strong trend line, which would indicate scope for a relatively large bounce toward the key .8000 level or higher later this year.

(Source: FOREX.com)