Market Brief

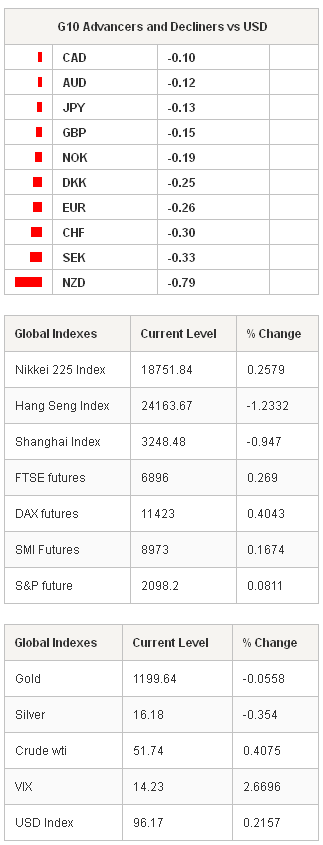

Today’s key events are the BoE, the ECB verdicts and ECB President Draghi’s press conference (at 12:00, 12:45 and 13:30 GMT respectively). The consensus is status quo on both meetings, while ECB President Draghi’s speech should trigger price action later in the day. The sell-off in the EUR-complex accelerated in New York yesterday, sending EUR/USD down to 1.1026 overnight, a fresh 11-year low. For some, the renewed EUR weakness is due to increased anxiety vis-à-vis the QE that will start by next week, for others the Greek turmoil is still an important weight on EUR’ shoulders. Improved economic outlook from the ECB is the risk for EUR-shorts today, yet the broad bias remains comfortably negative. Key support sits at 1.10 psychological level; stops and large option barriers trail below.

In the US, the ADP data showed the economy added 212’000 new private jobs in February as last month reading has been significantly revised up to 250K (from 213K). The USD-bulls remain in charge, especially against the EM currencies. USD/TRY hit new all-time-high of 2.5773 as USD/ZAR rallied to 11.8578. USD/BRL tested 3.00 although Brazil Central Bank raised the Selic rate by 50 basis points to 12.75% as expected. Already priced in, the rate hike did little on FX prices. There is good chance that the USD appetite dominates until Friday’s nonfarm payrolls, unemployment and wages announcement. The 10-Year US sovereign yields traded above the 100-dma (2.1163%) for the first time since Sep’14.

USD/JPY and JPY crosses were sluggish in Tokyo. USD/JPY offers above 120 remain solid with good option barriers to be cleared. The key resistance remains at 120.47/48 (Feb 11/12th double top), bids should jump in at 118.77/119.17 area (50/21-dma). EUR/JPY eased to a-month low, the MACD (12, 26) stepped in the bearish zone suggesting high sensibility to EUR-negative sentiment vis-à-vis the ECB/Draghi today. Option barriers trail below 132.80 at today’s expiry.

In Australia, the trade deficit widened above expected to AUD 890mn in January (vs -925mn exp. & -503mn revised in Feb). RBA’s Lowe said the policy changes across the globe put “upside pressures on the value of other currencies where the need for monetary stimulus has been less”. While the higher AUD leads to lower domestic demand, the signals for further stimulus weigh on the AUD-complex. AUD/USD remains offered at 0.7845/60 area. More resistance is eyed at 0.7943/0.8000 (50-dma / Oct’14 – Feb’15 downtrend top).

The Bank of Canada kept the bank rate unchanged at 0.75% in line with consensus. USD/CAD sold-off to 1.2407 (Jan-Feb triangle base). Trend and momentum indicators are supportive of further recovery in loonie whereas the symmetric triangle base building since January 22nd should lend support before the US and Canada jobs data (due Fri). A break below the base should intensify short covering in CAD as long as the oil prices hold ground.

Traders also watch French 4Q Unemployment Rate, German January Factory Orders m/m & y/y, Swedish January Industrial, Service Production and Industrial Orders m/m & y/y, UK February New Car Registrations, Italian 4Q Final GDP q/q & y/y, German, French, Italian and Euro-zone aggregate Retail PMI in February, US 4Q (Final) Nonfarm Productivity and Unit Labor Costs, US February 28th Initial Jobless & February 21st Continuing Claims, US January Factory Orders and Canadian February PMI index (Ivey).

| Today's Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| FR 4Q ILO Mainland Unemployment Rate | 10.00% | 9.90% | EUR / 06:30 |

| FR 4Q ILO Unemployment Rate | 10.40% | 10.40% | EUR / 06:30 |

| FR 4Q Mainland Unemp. Change 000s | 8K | 77K | EUR / 06:30 |

| GE Jan Factory Orders MoM | -1.00% | 4.20% | EUR / 07:00 |

| GE Jan Factory Orders WDA YoY | 2.60% | 3.40% | EUR / 07:00 |

| SW Jan Industrial Production MoM | 0.40% | 1.70% | SEK / 08:30 |

| SW Jan Industrial Production NSA YoY | -0.40% | -1.60% | SEK / 08:30 |

| GE Feb Markit Germany Construction PMI | - | 49.5 | EUR / 08:30 |

| SW Jan Industrial Orders MoM | - | 5.10% | SEK / 08:30 |

| SW Jan Industrial Orders NSA YoY | - | -11.40% | SEK / 08:30 |

| SW Jan Service Production MoM SA | 0.50% | -0.20% | SEK / 08:30 |

| SW Jan Service Production YoY WDA | - | 3.70% | SEK / 08:30 |

| UK Feb New Car Registrations YoY | - | 6.70% | GBP / 09:00 |

| NO Norway Releases 1Q Oil Investment Survey | - | - | NOK / 09:00 |

| IT 4Q F GDP WDA QoQ | 0.00% | 0.00% | EUR / 09:00 |

| IT 4Q F GDP WDA YoY | -0.30% | -0.30% | EUR / 09:00 |

| GE Feb Markit Germany Retail PMI | - | 52.3 | EUR / 09:10 |

| EC Feb Markit Eurozone Retail PMI | - | 46.6 | EUR / 09:10 |

| FR Feb Markit France Retail PMI | - | 44 | EUR / 09:10 |

| IT Feb Markit Italy Retail PMI | - | 41.2 | EUR / 09:10 |

| BOE Asset Purchase Target | 375B | 375B | GBP / 12:00 |

| Bank of England Bank Rate | 0.50% | 0.50% | GBP / 12:00 |

| US Feb Challenger Job Cuts YoY | - | 17.60% | USD / 12:30 |

| ECB Main Refinancing Rate | 0.05% | 0.05% | EUR / 12:45 |

| ECB Deposit Facility Rate | -0.20% | -0.20% | EUR / 12:45 |

| ECB Marginal Lending Facility | 0.30% | 0.30% | EUR / 12:45 |

| US 4Q F Nonfarm Productivity | -2.30% | -1.80% | USD / 13:30 |

| US 4Q F Unit Labor Costs | 3.30% | 2.70% | USD / 13:30 |

| US Feb 28th Initial Jobless Claims | 295K | 313K | USD / 13:30 |

| US Feb 21st Continuing Claims | 2395K | 2401K | USD / 13:30 |

| US Jan Factory Orders | 0.20% | -3.40% | USD / 15:00 |

| CA Feb Ivey Purchasing Managers Index SA | 48.5 | 45.4 | CAD / 15:00 |

Currency Tech

EUR/USD

R 2: 1.1245

R 1: 1.1155

CURRENT: 1.1049

S 1: 1.1000

S 2: 1.0794

GBP/USD

R 2: 1.5552

R 1: 1.5480

CURRENT: 1.5244

S 1: 1.5197

S 2: 1.4952

USD/JPY

R 2: 121.85

R 1: 120.48

CURRENT: 119.78

S 1: 118.77

S 2: 118.18

USD/CHF

R 2: 0.9831

R 1: 0.9710

CURRENT: 0.9663

S 1: 0.9532

S 2: 0.9451