The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Monday lower, medium confidence.

- ES pivot 2005.50. Holding below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

Friday began with a big pop as the market reacted to the Scotland vote. Then Mr. Market got a bad case of buyer's remorse and gave up all those gains by 1 PM. Then a small afternoon rally helped recover some of the day's gains. And there was a last minute sell-off, who knows why five minutes before the bell. By the end, after all that excitement the Dow managed a paltry 14 points. But then it was triple-witching and all. So now with that out of the way, let's see where the new week is headed. To the chart-pole, Robin!

The Technicals

The Dow: The Dow's Friday fade left us with a tall inverted hammer that traded entirely above its upper BB and exited the left side of the rising RTC, overbought indicators, and a stochastic on the verge of a bearish crossover. It's not clear how much of that is op-ex related but I don't like the looks of it. I cal this chart bearish now.

The VIX On Friday the VIX gained 0.67% on a bullish piercing pattern. We remain in a descending RTC and haven't quite reached support or oversold levels, but there's at least a suggestion of a move higher here Monday. VVIX, which formed a spinning top sitting right on its 200 day MA supports that idea.

Market index futures: Tonight all three futures are lower at 12:37 AM EDT with ES down a significant 0.55%. We've not seen a drop this big in the wee hours for quite some time. But Friday gave us a long-legged doji centered on the upper BB and the new overnight has broken support at 2000, fallen way out of the rising RTC for a bearish setup and a clearly completed bearish stochastic crossover. All the indicators have now turned lower and RSI has come off overbought. That all spells lower for Monday in my book.

ES daily pivot: Tonight the ES daily pivot rises from 2001.42 to 2005.50. We now find ourselves considerably below the new pivot so this indicator turns bearish.

US Dollar Index: The mighty dollar seems unstoppable, gapping up on Friday to a level not seen in over a year. That completed a bullish stochastic crossover but the candle is a hanging man in evening star position. So this chart is conflicted and I won't call it.

Euro: The euro has now alternated between up and down for six straight sessions . Friday's down move closed at 1 2844, like the dollar a level not seen in over a year. But it's now very close to some strong multi-year support and the overnight seems to be respecting that so there's at least a chance of a move higher here on Monday.

Transportation: In a bit of bearish divergence on Friday, the trans lost 0.49% on a bearish engulfing pattern that bounced off the upper BB and sent all the indicators lower from overbought. And the stochastic is now on the verge of a bearish crossover. This chart looks bearish too.

I'm hearing the growls of bears getting louder on the charts tonight, enough to just go ahead and call Monday lower.

ES Fantasy Trader

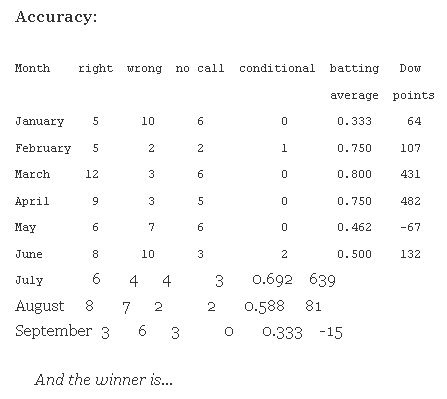

Portfolio stats: the account remains $114,250 after eight trades in 2014, starting with $100,000. We are now 6 for 8 total, 4 for 4 long, 2 for 3 short, and one push. Tonight we stand aside. It's a shame too because it looks like a good chance for a lower close on Monday. I'm just worried that we missed the boat on this trade. And multi-day shorts have been quite risky all year long.