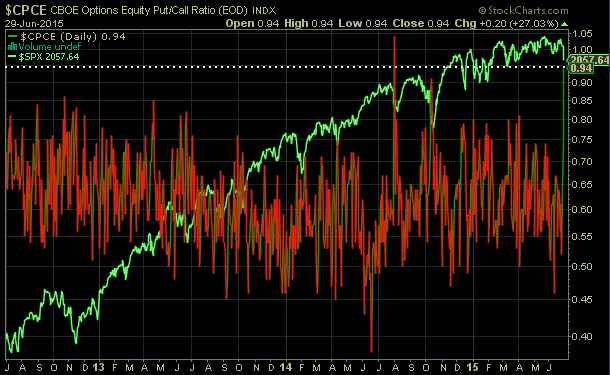

It seems as though the Greece situation has been one that has been ongoing for years and was the cause for today's market decline and jump in the equity put/call ratio to .94 from .54 on Friday. As we noted in a May post in 2012, a spike in the put/call ratio to .99 was partly caused by "the lack of confidence in Europe handling its sovereign debt issues." Nearly three years later, the same issues are again challenging investors. For investors, the equity put/call ratio...:

...measures the sentiment of the individual investor by dividing put volume by call volume. At the extremes, this particular measure is a contrarian one; hence, P/C ratios above 1.0 signal overly bearish sentiment from the individual investor.

|

| From The Blog of HORAN Capital Advisors |

When countries live and spend beyond their means, an unlimited supply of funding eventually drys up. The contagion concern is associated with countries like Spain, Portugal and Italy. In the U.S., Puerto Rico has now become an issue and broadly, the U.S. is living far beyond its means, which needs to be addressed sooner versus later.

In the near term though, the markets sometimes become disconnected and sentiment does suggest an overly bearish investor when looking at the put/call ratio. Other individual investor sentiment measures also are bearish (AAII bullish sentiment). Overly pessimistic sentiment indicators are contrarian indicators and are indicative of potential market bounces.