Entergy Corporation (NYSE:ETR) is currently in talks with Exelon Corporation (NYSE:EXC) regarding a potential sale of its James A. FitzPatrick nuclear power plant in Scriba, NY.

This followed the New York Department of Public Service’s proposal to subsidize zero-emission attributes of upstate nuclear power plants, including Fitzpatrick.

Note that in addition to the challenges in the electricity market, rising operating costs and declining revenues prompted Entergy to decide in Nov 2015 to retire the FitzPatrick nuclear power plant.

On the latest development, Entergy has disclosed that if negotiations with Exelon do not have a positive outcome, the company will cease operations of the plant next January.

Apart from the Clean Energy Standard, a transaction between Entergy and Exelon would be subject to other regulatory approvals.Entergy and Exelon expect to come to a conclusion by mid-August. Hence, the potential terms of the agreement have been kept under wraps.

Strategic Initiatives

Entergy is gradually transforming itself from a merchant power to a pure-play utility. Keeping with this, the company plans to lower its exposure in the risk-prone and volatile wholesale commodities market by scaling down the Entergy Wholesale Commodities (“EWC”) business. This strategy should be prudent given that regulated spending offers a secured rate of return.

The company has also outlined plans for growth at its utility segment and maintaining a smaller footprint at EWC. It has already closed the Vermont Yankee unit in 2014 and its Pilgrim nuclear unit is expected to be shut down by May 2019. Thereafter, Entergy will be left with Indian Point only, which has a power purchase agreement through 2022.

Disadvantages of Nuclear Generation

In spite of all safety standards maintained at nuclear plants, risks of potential accidents are a major concern. Insurance does not always cover all expenses related to such accidents either. In case of a major accident, the company has to bear the entire expense alone, which puts its margin under considerable pressure. Moreover, the cost of operating old plants is also very high.

Exelon operates the largest fleet of nuclear plantsin the U.S. But it is facing its own share of economic troubles with the units. Last month,the company announced itsplan to close Quad Cities and Clinton facilities for economic reasons. Exelon has also stated that its Byron and Three Mile Island plants are at a risk of closure.

The Upside

Entergy would become a more regulated utility if the sale of FitzPatrick is successfully completed. On the other hand, Exelon will be able to increase its economies of scale by adding FitzPatrick to its other reactors in New York – Nine Mile Point and R.E. Ginna.

Note that with subsidies being considered in New York, Nine Mile Point and R.E. Ginna would be eligible to receive the same under the Department of Public Service proposal. If the proposal gets approved, Exelon is likely to invest significantly in upstate nuclear plants. As per Exelon these two nuclear power plants produce 2.4 billion watts of zero-carbon electricity.

Zacks Rank & Key Picks

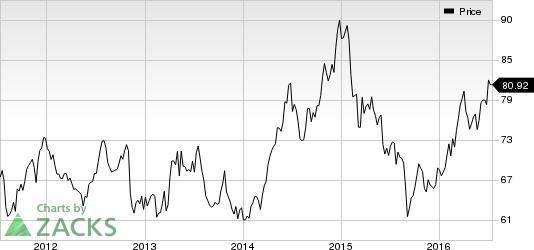

Entergy currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the same space are Black Hills Corporation (NYSE:BKH) and Alliant Energy Corporation (NYSE:LNT) . While Black Hills sports a Zacks Rank #1 (Strong Buy), Alliant Energy has a Zacks Rank #2 (Buy).

EXELON CORP (EXC): Free Stock Analysis Report

ENTERGY CORP (ETR): Free Stock Analysis Report

BLACK HILLS COR (BKH): Free Stock Analysis Report

ALLIANT ENGY CP (LNT): Free Stock Analysis Report

Original post

Zacks Investment Research