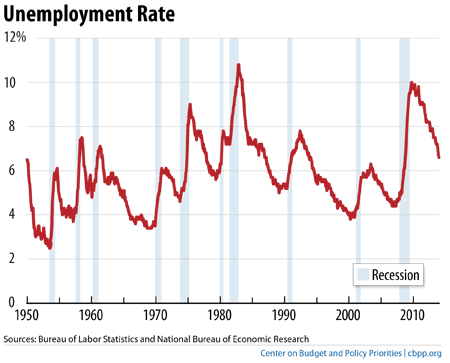

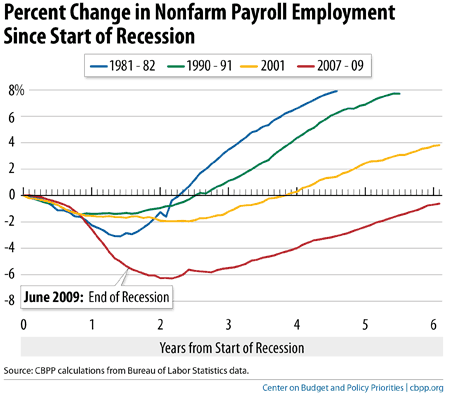

A consequence of this below trend growth has been a stubbornly high unemployment rate. The unemployment rate has declined, yet this recovery has not resulted in employment reaching the level prior to the recession as the two below charts show. In January the unemployment rate declined to 6.6% while the broader U-6 rate equals 12.7%.

...At the average pace of 167,000 jobs a month achieved so far, it will take another 5 months for employment to exceed its level in December 2007 — and much longer to reach full employment, since the population and potential labor force are now larger. Economic growth will have to pick up substantially to reach those goals sooner (emphasis added.)

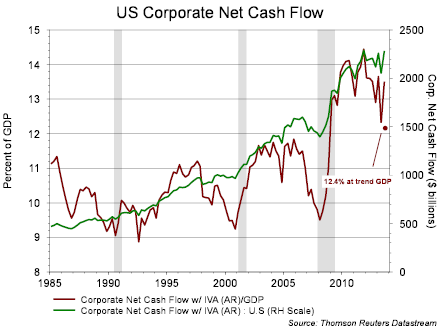

Notable in this recovery is the fact the corporate sector has been performing well. The strength of the stock market since the bottom of the recession is one confirming data point. Just looking at corporate net cash flow and corporate cash flow as a percentage of GDP, both are at elevated levels. For companies to exhibit a high level of cash flow is a positive. A high level of cash flow as a percentage of GDP is not a positive when economic growth, or GDP, is below trend level. The green line in the below chart shows the strength of corporate net cash flow. If the economy were growing at a trend growth rate, cash flow to GDP would equal 12.4% as denoted by the maroon dot.

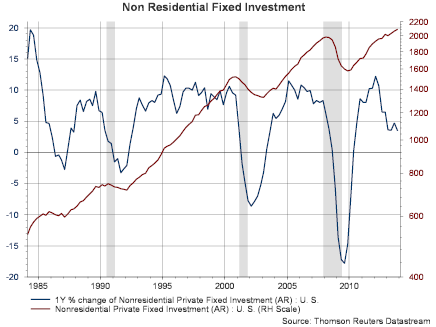

Companies have been using this flow to reinvest in their business, increase dividends and increase stock buybacks. Non residential fixed investment, a GDP input defined as expenditures by firms on capital such as commercial real estate, tools, machinery, and factories, has surpassed the level prior to the recession. And on a percentage change basis, the peak growth following the recession matches the level achieved subsequent to prior recoveries (see below chart.) Of concern is this reinvestment rate is slowing to levels reached prior to the onset of past recessions.

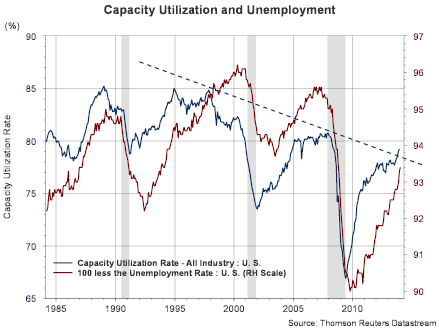

Business reinvestment has occurred in spite of a capacity utilization rate below historical levels. Additionally, as capacity utilization has increased, the level of employment has not kept pace with this increased manufacturing activity. We wrote about this in a blog post in 2010, Is The Economy Rolling Over? In that article we reference the utilization rate and employment level which was first noted by Mark Thoma, a professor of economics at the University of Oregon. He noted in an article on his Economist's View website,

"In the past, there was a fairly close contemporaneous relationship between capacity utilization and unemployment. However, much like the relationship between output and unemployment, a lag in the relationship has developed in the last two recessions (see graph). That is, in past recessions an upturn in capacity utilization was matched by an upturn in employment, there was no delay in the relationship, but in recent recessions there has been about a half year delay before unemployment reacts to changes in capacity utilization (or perhaps even a bit longer)."

As the above chart shows, the capacity utilization rate has finally broken above a resistance level that began in 1998. This higher capacity utilization is a positive for employment and we believe it is this increased level of hiring that can push the economy into its so-called "escape velocity." But what might be restraining hiring by companies?