Since emerging market equities have been under pressure...

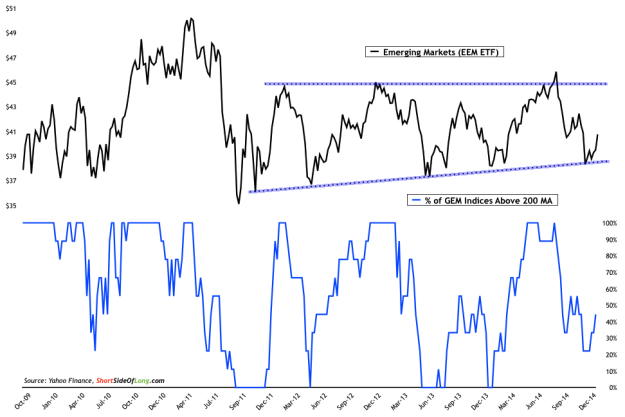

Emerging market equities have been under-performing since May 2011 and have essentially gone sideways since late 2009. This is a huge contrast when compared to US equities, however it offers a great investment opportunity. iShares MSCI Emerging Markets ETF index (ARCA:EEM), seen in the Chart 1, remains in a consolidation zone and can be best described as an ascending triangle. Price resistance is around $45 while support seems to be found around $38 range. Recent sell off about 20% from intra-day highs in early September, all the way to intra-day lows into middle of December, has pushed breadth to oversold levels.

...fund managers have dramatically reduced their net exposure!

Not only have the breadth readings fallen, but hedge funds exposure has also been dramatically reduced. According to the recent January survey by Merrill Lynch, global fund managers are -13% underweight towards Emerging Markets. While sentiment is not as negative as it was in March 2014 (-31% underweight), it is still negative enough to indicate a possible bottom when compared to +17% overweight exposure we saw in August 2014 (just before the sell off). Interestingly, just as hedge funds started to get bearish in recent weeks, the price is starting to rebound from its well defined technical support level.

Chinese equities are breaking out after years of consolidating

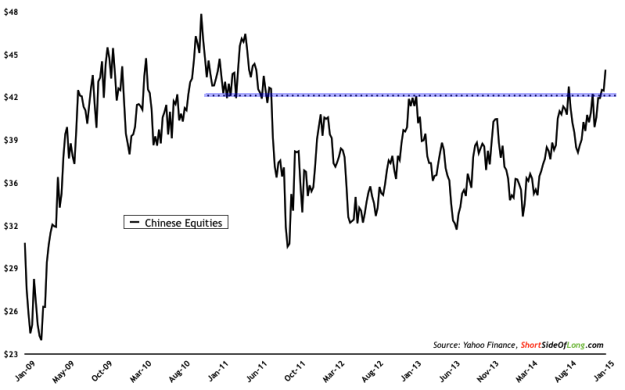

Two biggest Emerging Market weightings by region are China and South Korea. Chinese equities are currently outperforming the EM space, after years and years of under-performance. The index is now attempting to break out from a significant consolidation pattern, which resembles a very strong base. If the break out holds in coming days and weeks (without any sharp reversals), then a move towards 2010 highs is very possible very quickly.

At the same time, South Korean equities are now finding some kind of support, after under-performing in recent months. Technically, the trend line support in the Korean index has been tested many times before, so It is very important to watch how strong the rebound will be this time. If bulls are enthusiastic, we should see a sharp rise with strong similarities to 2010, 2011 and 2013 bottoms. On the other hand, a mild rebound followed by a reversal could be a signal of more trouble ahead.

South Korean equities have found support after a recent decline