As we noted Tuesday morning, the US dollar got back on track against its biggest G10 rivals last week and that outperformance has also carried over against the major emerging-market currencies. As we anticipated in last week’s EM Rundown, the ruble was a strong performer, but just about every other emerging-market currency lost ground against the dollar last week. Below, we highlight some of the key EM regions, levels and data announcements to keep an eye on this week:

USD/MXN: MiXiNg It Up Near 15.00

After strengthening for nearly an entire month, the Mexican peso abruptly reversed its trend last week. Beyond the broad-based dollar strength, the peso was also hurt by a disappointing industrial output report, which came out at just 0.2% m/m in February, below expectations of a 0.4% rise. On the whole, it looks like Mexico is in for relatively disappointing growth in first quarter growth, much like its close trading partner to the North. With the Fed seemingly on track to hike interest rates later this year, USD/MXN may make another run for its all-time high around 15.60.

Source: FOREX.com

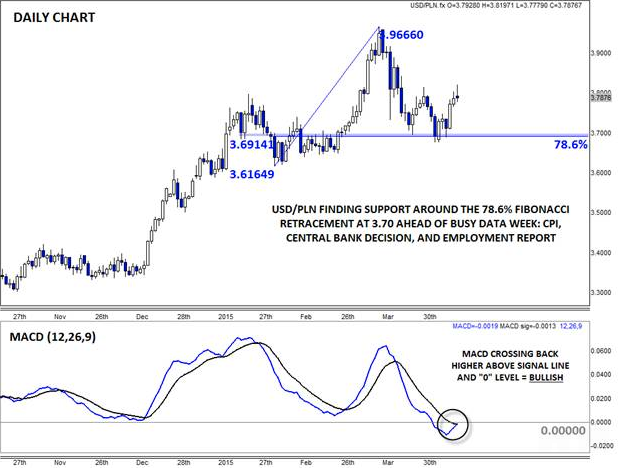

USD/PLN: USD Bulls PiLiNg On

Just like the peso, the Polish zloty also reversed its recent gains last week, bouncing from 78.6% Fibonacci support at 3.70 back toward 3.80 Monday. Action-oriented traders may want to keep a close eye on the PLN this week as Poland will release the three most impactful economic reports for currencies. Wednesday, traders will see the March CPI data out the country, which is expected to edge up to a still-depressing -1.4% y/y from -1.6% y/y in February. Later that day, Poland’s central bank will announce its interest rate decision, with no change expected, but odds skewed toward a more dovish statement. Finally, Friday will bring the country’s employment report, which is expected to edge up by 0.1%. If these reports miss expectations, the zloty could quickly “catch down” with the recent performance of the euro.

Source: FOREX.com

USD/ZAR: BiZARre Similarity to USD/MXN

One final area of excitement for EM FX traders this week could be in South Africa, where the chart of the rand’s performance looks eerily similar to that of the peso. After dipping briefly below previous support at 11.75 last week, USD/ZAR surged back above 12.00 and may soon make another run at 13-year high around 12.50. From a fundamental perspective, the only release of note will be Wednesday’s Retail Sales figure, which is expected to bounce back into growth territory after two months of decline. While month-to-month retail sales have been choppy of late, the year-over-year growth rate has been pretty consistent around 2% for seven months, now, but if that starts to fall toward 1.0%, USD/ZAR bulls may turn their eyes back toward the key 12.50 barrier.

Source: FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom)