With Q2 earnings taking center stage, this week is going to be a crucial one for the Wall Street. Though earnings growth has been negligible, the precipitous decline in the S&P 500 index has been checked to some degree so far this season. Notably, the releases this week will lend investors an insight into the earnings performance of as many as 189 S&P 500 members.

As per the latest Zacks Earnings Trend, 126 S&P 500 companies have reported earnings with 70.6% topping earnings estimates and 55.6% beating revenue estimates. Overall, the report suggests that earnings for S&P 500 companies is expected to decline 3.4% compared with a steeper decline of 6.5% recorded in the previous quarter. Similarly, revenues are expected to be down 0.5% compared with the 0.9% decline recorded at the end of first-quarter 2016.

The report also suggests that nine out of the 16 Zacks Sectors are expected to witness negative growth, highlighting the fact that Q2 is most likely to be the fifth negative quarter of earnings decline in a row. While the Energy sector (expected to be 78.7% down) has dealt a heavy blow, Utilities (+20.9%), Autos (up +18.4%), and Conglomerates (+17.6%) are expected to be the saviors.

Meanwhile, the Industrial Products sector is likely to conclude the quarter in the negative territory with earnings decline of 8% and revenue drop of 5.8%. However, these figures are better compared to the bottom and top line declines of 22.2% and 8%, respectively, recorded at the end of first-quarter 2016. Within Industrial Products, we take a look at how a few major electrical companies are positioned ahead of their second-quarter quarterly release on Jul 26.

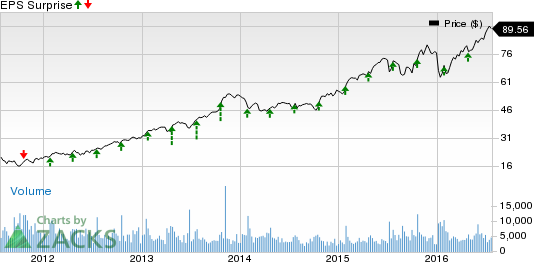

AO Smith Corp. (NYSE:AOS) is one of the leading manufacturers of commercial and residential water heating equipment as well as water treatment products in the world. The company specializes in innovative and energy-efficient solutions. AO Smith has an Earnings ESP of 0.00% and a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for the quarter’s earnings is pegged at 91 cents.

In the last reported quarter, AO Smith posted a positive earnings surprise of 7.8%. The company has had a solid earnings record, beating estimates in each of the trailing four quarters. The average earnings surprise over the last four quarters is 9.3%.

The company’s second-quarter earnings are expected to benefit from thriving residential and commercial water heater sales. With the construction sector picking up steam, the company is expecting solid volume growth of residential water heater. Similarly, surge in the commercial water heater industry is boosting U.S. commercial water heater volumes. Also, the company’s solid traction of water heater sales in China is expected to be conducive to the top and bottom line.

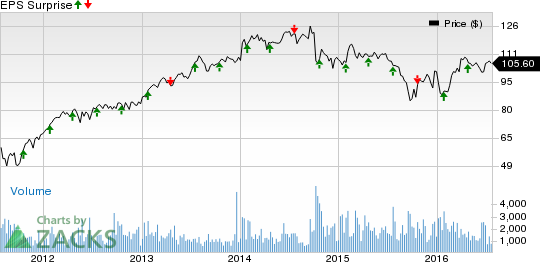

Hubbell Inc. (NYSE:HUBB) is engaged in the design, manufacture and sale of electrical and electronic products to commercial, industrial, utility and telecommunications markets. Hubbell has an Earnings ESP of 0.00% and a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for second-quarter earnings is pegged at $1.43.

In the last reported quarter, Hubbell posted a positive earnings surprise of 9.4%. The company has had an impressive earnings history, beating earnings estimates three times in the last trailing four quarters. The average earnings surprise over the last four quarters is 8.5%.

Franklin Electric Co., Inc. (NASDAQ:FELE) is the world's largest manufacturer of submersible electric motors and a leading manufacturer of engineered specialty electric motor products and electronic controls for original equipment manufacturers. The company has an Earnings ESP of 0.00% and a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for the quarter is pegged at 49 cents.

In the last reported quarter, Franklin Electric posted a negative earnings surprise of 3.3%. The company has had a choppy earnings history with one beat and one miss and two quarters of in-line results. The average earnings surprise for the last four quarters stands at 0.9%.

SMITH (AO) CORP (AOS): Free Stock Analysis Report

FRANKLIN ELEC (FELE): Free Stock Analysis Report

HUBBELL INC (HUBB): Free Stock Analysis Report

Original post

Zacks Investment Research