There’s an ongoing catastrophe taking place in Ecuador. Not only has a significant part of the Amazon (O:AMZN) been polluted by toxic waste oil left behind from the wonderful folks at Texaco when the company started drilling for oil in Ecuador back in the 1970’s, but the low oil price has totally gutted the oil industry.

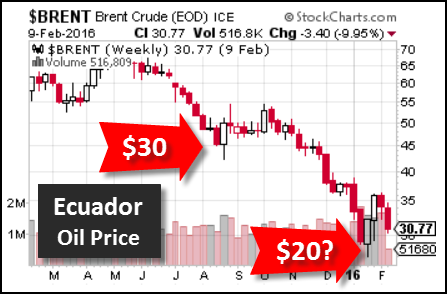

BLOOMBERG President Rafael Correa said on Tuesday that the South American nation is receiving as little as $30 a barrel for its crude, while production costs average about $39. The warning comes after several other members of the Organization of Petroleum Exporting Countries, including Algeria and Libya, said the group should consider holding an emergency meeting to respond to the drop in oil prices.

Ecuador was receiving as little as $30 a barrel back in August 2015 when that article was written. However, today its likely getting a price closer to $20 for a barrel of oil. If Ecuador was in serious trouble last year due to low oil prices, the situation today is nothing short of a catastrophe for it’s oil industry and economy.

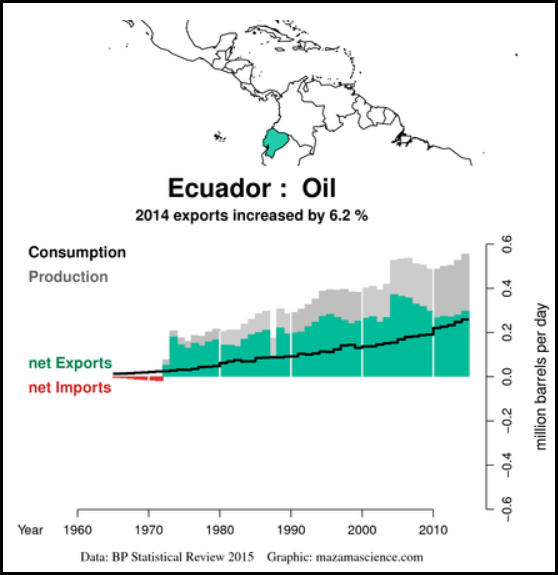

Even though Ecuador isn’t a large producer of oil, it produced a little more than 556,000 barrels a day (bd) in 2014, while total consumption was 259,000 bd. Thus, it exported nearly 300,000 bd in 2014. Here is a chart of Ecuador’s net oil exports since the 1970’s:

What is interesting in the chart above, is the increase in Ecuador’s domestic oil consumption. Even though overall production increased significantly since the 1970’s, so has consumption (black line). Ecuador’s total production increased from 200,000 bd in the 1970’s, to 556,000 bd, however net exports (green) did not increase all that much due rising domestic consumption.

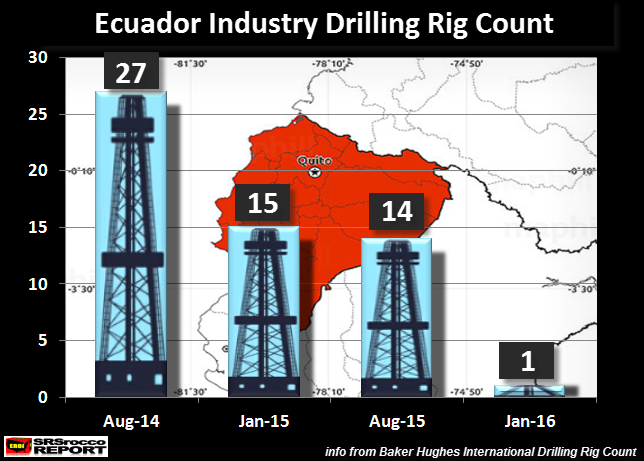

The Collapse Of Ecuador’s Drilling Rig Industry

While the drilling rig count in the U.S. and world has fallen considerably over the past 18 months, nothing can compare to the collapse that has taken place in Ecuador. When oil was trading over $100 in August 2014, Ecuador had 27 drilling rigs working in the country. Today… they have one:

Thus, the low price of oil has totally gutted Ecuador’s drilling rig industry…. a 96% collapse in just 18 months. Again, the reason for the huge decline in Ecuador’s drilling rig industry has to do with simple economics–you can’t continue producing something as a loss, especially at a huge loss.

Ecuador Review: In 1972, the military Government of General Guillermo Rodríguez Lara instigated a mini oil boom. In Quito, his regime exhibited the first barrel of oil produced by a consortium between transnational Texaco and the fledgling Ecuadoran State Petroleum Corporation (CEPE for its Spanish acronym). Nearly half a century later, the Government of Rafael Correa Delgado ends the extractive cycle, squeezing the last drops of black gold from the earth. The depletion of Ecuador’s crude reserves, combined with the collapse in oil prices, spells economic tragedy for a country that has tied its fate to hydrocarbons.

…. In 2015, at an average price of $50 per barrel, the situation is catastrophic. The country expects to make $9.942 billion from oil exports and derivatives, but production and import costs of $10.145 billion leave a shortfall of $226 million.

Unfortunately, for Ecuador, it’s now receiving a price closer to $20 a barrel. This is the reason the county only has one lousy drilling rig. And that was based Baker Hughes International rig count as of Jan.

While Ecuador’s oil troubles are worse than other oil exporting countries, due to shortsighted government energy policies, I believe it will be blueprint that will spread throughout the world. Why? Because, I don’t believe oil prices will recover for quite some time. Matter-a-fact, I think we are going to see the price of oil to reach the $20’s before a bottom is made.

Zerohedge: On Wednesday, BP (L:BP) CEO Robert Dudley – who earlier this month reported the worst annual loss in company history – is out warning that storage tanks will be completely full by the end of H1. “We are very bearish for the first half of the year,” Dudley said at the IP Week conference in London Wednesday. “In the second half, every tank and swimming pool in the world is going to fill and fundamentals are going to kick in,” he added. “The market will start balancing in the second half of this year.”

Maybe. Or maybe excess supply will simply be dumped on the market once all the “swimming pools” are full.

If that happens, don’t be surprised to see crude crash into the teens as attempts to clear and dump excess inventory spread like wildfire across the market.

BP suffered the worst annual loss in the company’s history. So, it’s not just the lousy shale oil companies that are losing money, now its the MAJOR’s. For example, Chevron made $14.8 billion in cash from operations in the first three quarters of 2015, but spent $22 billion on capital expenditures and paid $6 billion in dividends. Thus, Chevron paid out $13.2 billion more than it made from operations.

Furthermore, ConocoPhillips (N:COP) only made $5.9 billion in cash from operations (Q1-Q3 2015), but spent $8 billion on capital expenditures and paid out $2.7 billion in dividends. Which means, ConnocoPhillips spent $4.8 billion more than it received from operating cash.

The largest U.S. oil company did a little better than Chevron and ConnocoPhillips, but not by much. ExxonMobil (N:XOM) received $25.9 billion in cash from operations (Q1-Q3 2015), but spent $20.3 billion on capital expenditures and paid out $9.1 billion in dividends. Unfortunately, ExxonMobil also paid out more than it made in operating cash… to the tune of $3.5 billion.

This means, if the price of oil continues to remain low (highly likely), watch for the top three U.S. Major Oil Companies to start slashing dividends. Investors still holding onto these energy stocks… YOU HAVE BEEN WARNED.

ChevronToxico Dumped 18 Billion Gallons Of Toxic Oil Waste In Ecuador

DW: Canada’s Supreme Court ruled Friday (04.09.2015) that Ecuadorian villagers can seek to enforce a judgment in Canada for $9.5 billion (8.5 billion euros) against United States oil company Chevron Corporation (N:CVX) on a legal case over pollution in the Amazon rainforest.

The Ecuador Supreme Court had ruled in 2012 that Chevron owes this amount as compensation for dumping more than 18 billion gallons (68 billion liters) of oil and toxic waste in the Ecuadorian Amazonia region, where the company operated for 25 years.

While Chevron didn’t drill oil in Ecuador when the oil pollution took place, Texaco did. When Chevron acquired Texaco in 2000, it inherited the mess it left behind in Ecuador. According to several sources, it’s the worst case of oil pollution on the planet, 30 times more than the Exxon Valdez oil spill in Alaska.

Lastly, I believe the disaster taking place in Ecuador’s oil industry and economy will spread throughout the rest of the world. There is just too much debt in the world and with the low oil price, it is gutting economies everywhere.