Forex News and Events

The ECB comes at the center of attention this Monday, the results of the ECB stress test were surprisingly negative in our view, almost 20% of the banks failed the test (25 out of 130). The situation in some Euro area countries is quite alarming: 9 Italian banks, 3 Greek and 3 Cypriot banks couldn’t pass the stress test. These results reveal that the balance sheets in some peripheral regions are not stable enough. On the other hand, none of the leading banks fell short of capital requirements. And this has been the good news sending the Spanish-German 10-year government yield spread lower this Monday. The 40-day rolling correlation between EUR/USD and Spain/German yield spread advanced to 55%, keeping the pressures tight on the EUR/USD’s upside attempts towards 1.27+.

The attention remains on the ECB today. At 13:30 GMT, the ECB will reveal how much covered bonds it purchased last week. Market estimates 800 million euro operation, yet the official results will give more clarity on how fast the ECB may reach its goal of 1 trillion euro balance sheet expansion. An important question is whether or not the ECB would launch the additional QE program. Higher the covered bond and ABS purchases, lower would be the budget for a QE program. Released in the morning, the M3 money supply increased at the higher pace of 2.5% in year to September (vs. 2.2% exp. & 2.0% last), pulling the 3-month M3 growth average up from 1.8% to 2.1%.

The sentiment in EUR remains solidly negative; the EUR-short speculative positioning confirms the negative outlook in the market. The CFTC data prints -0.159M net non-commercial EUR future contracts on week to Oct 21st – these are the lowest levels over the past two years. A trillion euro expansion on the ECB balance sheet can only increase negative pressures on the EUR. The top-selling strategies in EUR should therefore remain the most popular in mid-long run portfolios. The 3-month EUR/USD cross currency basis remains close to zero, suggesting that the Fed/ECB divergence should continue favoring USD vs. EUR in the mid-run. The 3-month EUR/GBP basis is still strongly in favor of GBP, although GBP-bulls lost momentum with delayed BoE rate hike expectations.

In the short-run however, numerous factors will interfere with the global EUR negative outlook.

EUR/USD opens the week well-supported despite the worrying stress test results in the Euro area. In addition, the IFO survey revealed that the business climate and current assessment in Germany deteriorated in October, alongside with expectations in the Euro-zone. If none of the above pulled EUR/USD significantly down, it is certainly because Wednesday’s FOMC jitters counterweigh the EUR weakness. The greenback started the week weaker against its G10 peers as Wall Street bets against the USD before the Fed decision. As the QE3 is finally coming to an end, traders will continue chasing hints concerning the timing of the first Fed fund rate hike. Will the FOMC reveal more detail on how long the “considerable time” may be after the end of asset purchases, or will the uncertainties continue? There is good chance of hearing flexible language regarding the timing of the first rate hike. Yet sooner or later, the Fed is moving closer to tighter rates and this should keep the USD firm in the mid-long run positions.

Today's Key Issues (time in GMT)

- 2014-10-27T11:00:00 GBP Oct CBI Reported Sales, exp 25, last 31

- 2014-10-27T13:45:00 USD Oct P Markit US Services PMI, exp 58, last 58.9

- 2014-10-27T13:45:00 USD Oct P Markit US Composite PMI, last 59

- 2014-10-27T14:00:00 USD Sep Pending Home Sales MoM, exp 1.00%, last -1.00%

- 2014-10-27T14:00:00 USD Sep Pending Home Sales YoY, exp 2.20%, last -4.10%

- 2014-10-27T14:30:00 USD Oct Dallas Fed Manf. Activity, exp 11, last 10.8

The Risk Today

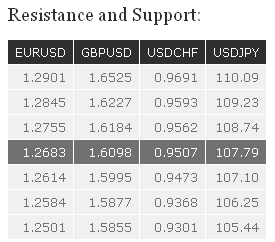

EURUSD EUR/USD needs to break the hourly resistance at 1.2743 to alleviate concerns of a quick decline towards the key support at 1.2501. Another resistance stands at 1.2845 (16/10/2014 high), while an hourly support can be found at 1.2614 (23/10/2014 low). In the longer term, EUR/USD is in a downtrend since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) has opened the way for a decline towards the strong support at 1.2043 (24/07/2012 low). As a result, the recent strength in EUR/USD is seen as a countertrend move. A key resistance stands at 1.2995 (16/09/2014 high).

GBPUSD GBP/USD has bounced near the hourly support defined by the 61.8% retracement (1.5995). However, the technical structure favour a bearish bias as long as prices remain below the resistance area between 1.6184 (21/10/2014 high) and 1.6227. Another support stands at 1.5877. In the longer term, given the significant deterioration of the technical structure since July, the strong resistance area between 1.6525 (19/09/2014 high) and 1.6644 (01/09/2014 high) is expected to cap any upside in the coming months. Monitor the current consolidation phase near the strong support at 1.5855 (12/11/2013 low).

USDJPY USD/JPY seems to fade near its recent high at 108.35. A break of the initial support at 107.79 (24/10/2014 low) would confirm a weakening bullish momentum. An hourly support lies at 107.10. Another resistance can be found at 108.74. A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. Despite the recent decline near the major resistance at 110.66 (15/08/2008 high), a gradual move higher is eventually favoured. Another resistance can be found at 114.66 (27/12/2007 high). A key support lies at 105.44 (02/01/2014 high).

USDCHF USD/CHF has thus far failed to break the resistance at 0.9562. However, as long as the hourly support at 0.9473 holds, a bullish bias is still favoured. Another support stands at 0.9368, whereas another resistance can be found at 0.9593. From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. As a result, the recent weakness is seen as a countertrend move. A key support can be found at 0.9301 (16/09/2014 low). A resistance now lies at 0.9691 (06/10/2014 high).