For the 24 hours to 23:00 GMT, the EUR rose 0.17% against the USD and closed at 1.0889, after the European Central Bank (ECB) President, Mario Draghi, indicated that the central bank does not want interest rates to remain in the negative territory for a prolonged period as it is aware of the risk of growing costs to the financial sector. Further, he shrugged off criticism that aggressive actions taken by the central bank to revive the economy had widened the gap between rich and poor. However, he also hinted that the ECB would keep its policies in place until it reaches its inflation target.

Elsewhere, in Germany, the Ifo business climate index climbed more-than-expected to a level of 110.5 in October, hitting its highest level since April 2014, indicating that growth in the Euro-zone’s largest economy is set to pick-up after being hit by the historic Brexit vote. The index recorded a level of 109.5 in the previous month whereas markets anticipated it to climb to a level of 109.6. Additionally, the nation’s Ifo business expectations index unexpectedly advanced to a level of 106.1 in October, against market expectations for it to remain steady at a level of 104.5, recorded in the previous month. Also, the nation’s Ifo current assessment index rose to a level of 115.0 in October, compared to a reading of 114.7 in the prior month.

Macroeconomic data indicated that, the US consumer confidence index fell to a three-month low level of 98.6 in October, following uncertainty regarding upcoming Presidential election. Meanwhile, markets expected for a fall to a level of 101.0 and after recording a revised reading of 103.5 in the previous month. On the other hand, the nation’s housing price index gained by 0.7% on a monthly basis in August, beating investor consensus for a rise of 0.4% and compared to an advance of 0.5% in the prior month. Also, the nation’s IBD/TIPP economic optimism index edged up to a level of 51.3 in October, from a level of 46.7 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.0888, with the EUR trading marginally lower against the USD from yesterday’s close.

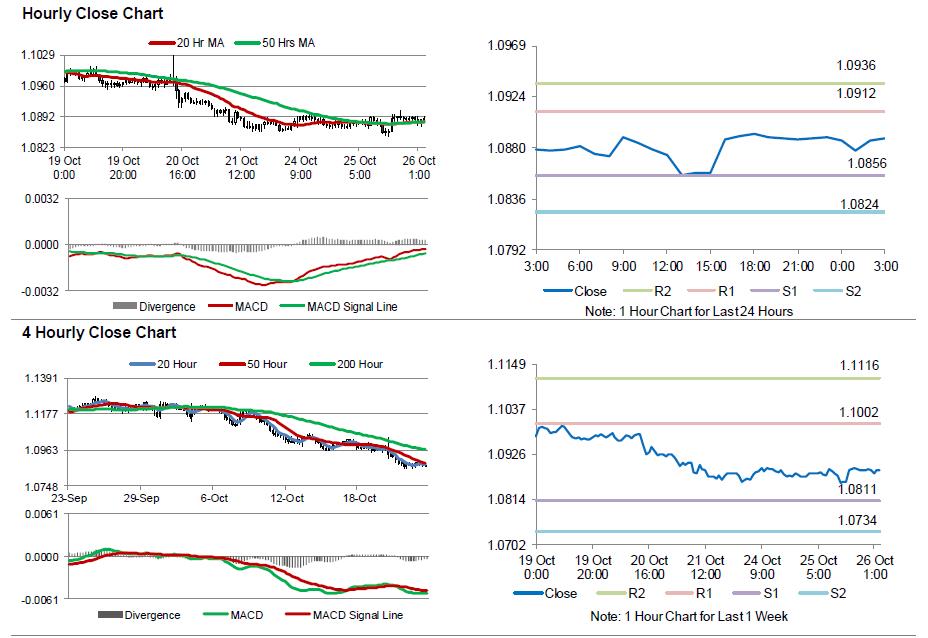

The pair is expected to find support at 1.0856, and a fall through could take it to the next support level of 1.0824. The pair is expected to find its first resistance at 1.0912, and a rise through could take it to the next resistance level of 1.0936.

Looking ahead, investors would focus on Germany’s GfK consumer confidence survey for November, slated to release in some time. Additionally, the US new home sales and advance goods trade balance, both for September and flash Markit services PMI for October, due to release later today, would garner a lot of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.