Media pundits have attributed recent stock skittishness to geopolitical tension in Eastern Europe, military conflict in the Middle East, a 4.0% initial reading for 2nd quarter GDP growth, a hawkish dissenter in the ranks of the Federal Reserve, a surprisingly strong jump in employment costs, a 10-basis point pop higher in the 10-year yield, deflation in the euro-zone, trouble at a prominent Portuguese bank, an Argentinian sovereign debt default and even low summertime trading volume. The truth is actually much simpler; investors fear that when an economy has been propped up by ultra-low borrowing costs for five-and-a-half years an economy will likely falter without a continuation of the ultra-easy monetary policy.

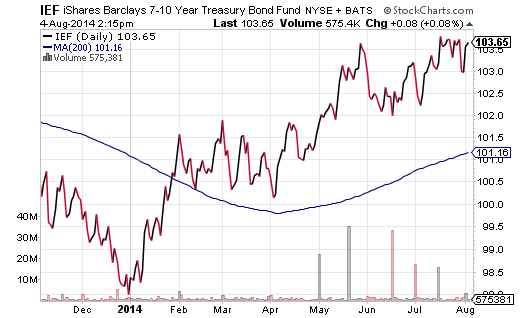

I recognize that a number of economists, analysts and thinkers disagree with me. They believe the “recovery” is gaining traction. (Why we still talk about a “recovery” after five-plus years is telling in and of itself, but I digress.) These are the same folks who predicted that the 10-year yield would rise from 3.0% to 3.4% before the year was out. Instead, the durability of longer-term treasuries has become the monster story of 2014, as investors sought refuge in an environment where self-sustaining economic growth has yet to materialize.

Think of the U.S. economy as a tricycle. It has three wheels that, if they are all working together, you can get extraordinary and very real growth. The back two tires include the size of the workforce and inflation-adjusted family income. The front tire is credit — an ability to borrow and spend. If two or more of these tires have the right amount of air in them, the tricycle is likely to move down the sidewalk. If all three are properly inflated, you probably have an economy that will perform at its peak for a period.

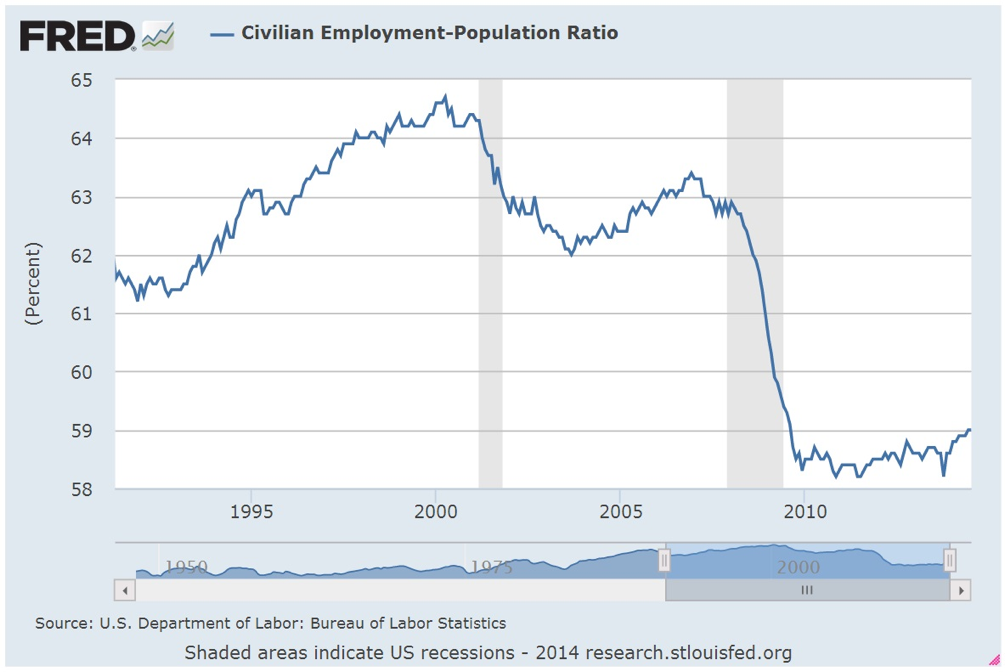

Over the last five-plus years, though, the back two tires have been entirely flat. Inflation-adjusted median income has gone nowhere, and as many people have left the workforce as have been joining it. Indeed, the proportion of the country’s working-aged population has flat-lined since 2010.

Now imagine the front tire — borrowing-n-spending — doing all of the work. The U.S. Federal Reserve has maintained 0% overnight lending rates for the entire “recovery” as well as created electronic money to buy bonds for the purpose of pushing down interest rates. The lower rates allowed businesses to refinance debts as well as buy back shares of stock, while some consumers have been able to acquire additional real estate and others have been bold enough to purchase new cars. Yet what happens if the Federal Reserve lets air out of the front tire of the trike? How can the economy grow at its sub-standard, paltry 2% when neither the size of the workforce is expanding nor the size of the family’s collective wallet is growing?

The yield curve is the flattest that it has been in roughly five years. That is a sign that the bond market is more afraid of a monetary policy mis-step by the Fed – and a subsequent beleaguered economy – than it worries about the raising of short-term lending rates themselves. You’ve heard the expression, “Don’t fight the Fed.” Well, you should not fight the trend either, and the trend for influential intermediate-term treasuries in iShares 7-10 Year Treasury Bond (ARCA:IEF) is very strong.

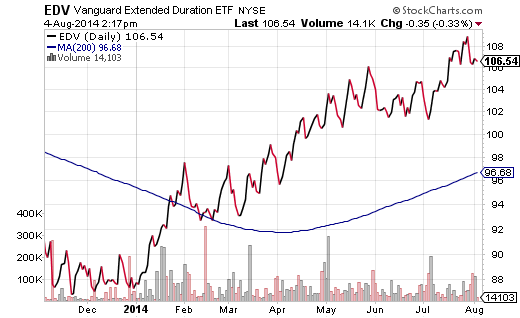

Equally impressive? Vanguard Extended Duration (NYSE:EDV). The longest end of the yield curve with bonds in the 25+ arena is one of the strongest performers year-to-date. Moreover, EDV has yet to show signs of a significant slowdown. In essence, monthly job growth averaging 200,000 is having little impact on safety-seekers, whereas a larger percentage of workers in the workforce coupled with actual wage growth is what would be required to take down the long-term bond beast.

This is not to suggest that stock ETFs have rolled over completely. On the contrary. Some stock ETFs look ripe for additional dollars. I have been a big advocate for Asia fro many months, whether you are a single country fan of SPDR S&P China (NYSE:GXC) or a regional fan of iShares MSCI Asia excl. Japan (NASDAQ:AAXJ). You can stick with large-cap proxies in the U.S. until you hit stop-limit loss orders or experience a trendline breach. By the same token, be mindful of institutional asset managers selling on strength as well as the ratio between advancers and decliners. The deterioration in this ratio may be hinting at eventual trouble for all U.S. index trackers.