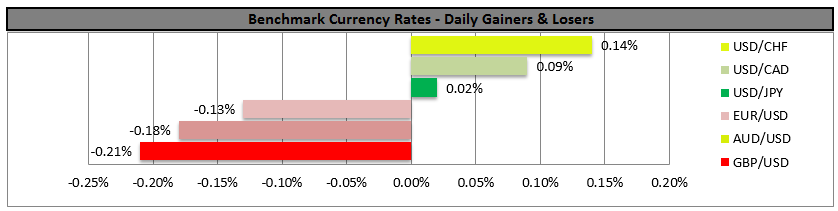

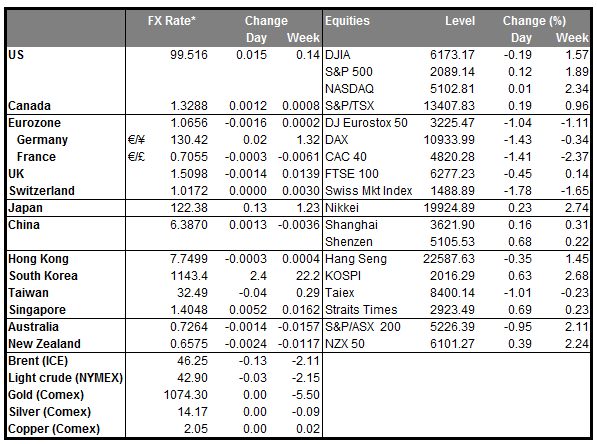

• Dollar trades in a consolidative mode in post-holiday trade The dollar index stuck to a narrow range in thin trade following the US Thanksgiving Day holiday. With a relatively light calendar today as well and the US trading day to end early, the action in the markets could remain subdued. However, it is the end of the week (and almost the month), so repositioning and profit taking could cause some volatility.

• Overnight, Japanese household spending unexpectedly fell in October for a second consecutive month, even as unemployment continued to decline touching its lowest level since May 1995. The data stressed the difficulty Premier Shinzo Abe faces in persuading companies to increase wages and undermined BoJ Governor Kuroda’s confidence that the tightening job market will lead to wage gains and boost consumption. The core national CPI for October fell at the same pace as in September, matching market expectations of a 0.1% yoy drop.

• Today’s highlights: During the European day, the main event will be the 2nd estimate of the UK’s Q3 GDP. The forecast is for the revision to confirm the initial estimate. The slowdown from Q2 shown in the first estimate was primarily driven by weakness in the construction and the manufacturing sectors. However, unlike the first estimate, here we will get details on the expenditure subcomponents, which we expect to show that growth was mainly driven by domestic demand, mainly private consumption. The employment report for September showed strong accelerating wages, which may have boosted consumption more than expected. Therefore, I see the possibility for an upward revision. This could strengthen the pound a bit.

• From Eurozone, we get the final consumer confidence index for November. Even though the figure is expected to confirm the preliminary reading, this indicator is usually not a major market mover.

• In Sweden, we get retail sales for October. The figure is expected to show a slowdown to 0.2% mom, from 0.7% mom in September. Since April the actual rate has been falling short of expectations. This comes in contrast with the Riksbank’s view that expansionary monetary policy is supporting the continued improvement of the Swedish economy. Having that in mind and that the ECB looks willing to expand its stimulus program at its next week policy meeting, the Swedish central bank might also have to reconsider the magnitude or effectiveness of its current policy approach. As a result, SEK could come under renewed selling pressure.

• Norway’s retail sales for October are coming out as well. Expectations are for a rebound in October after two consecutive months of contraction. This could reduce the risk of a more serious downturn. The country’s official unemployment rate for November is expected to have remained unchanged at 2.9%, but the net change in employment is forecast to have continued increasing. It has been doing so since October 2014. These data could strengthen somewhat NOK, which has been supported also from the rebound in oil prices in the last few days. However, the overall trend of USD/NOK remains to the upside in my view, especially as the probability for a rate hike by the Fed in December continues to increase. As a result, I would treat any possible setbacks as providing renewed buying opportunities.

• The US markets will close early tomorrow due to the Thanksgiving Day holiday, as such, the US trading session will be relatively light as no indicators are coming out.

• We have no speakers on Friday’s agenda.

The Market

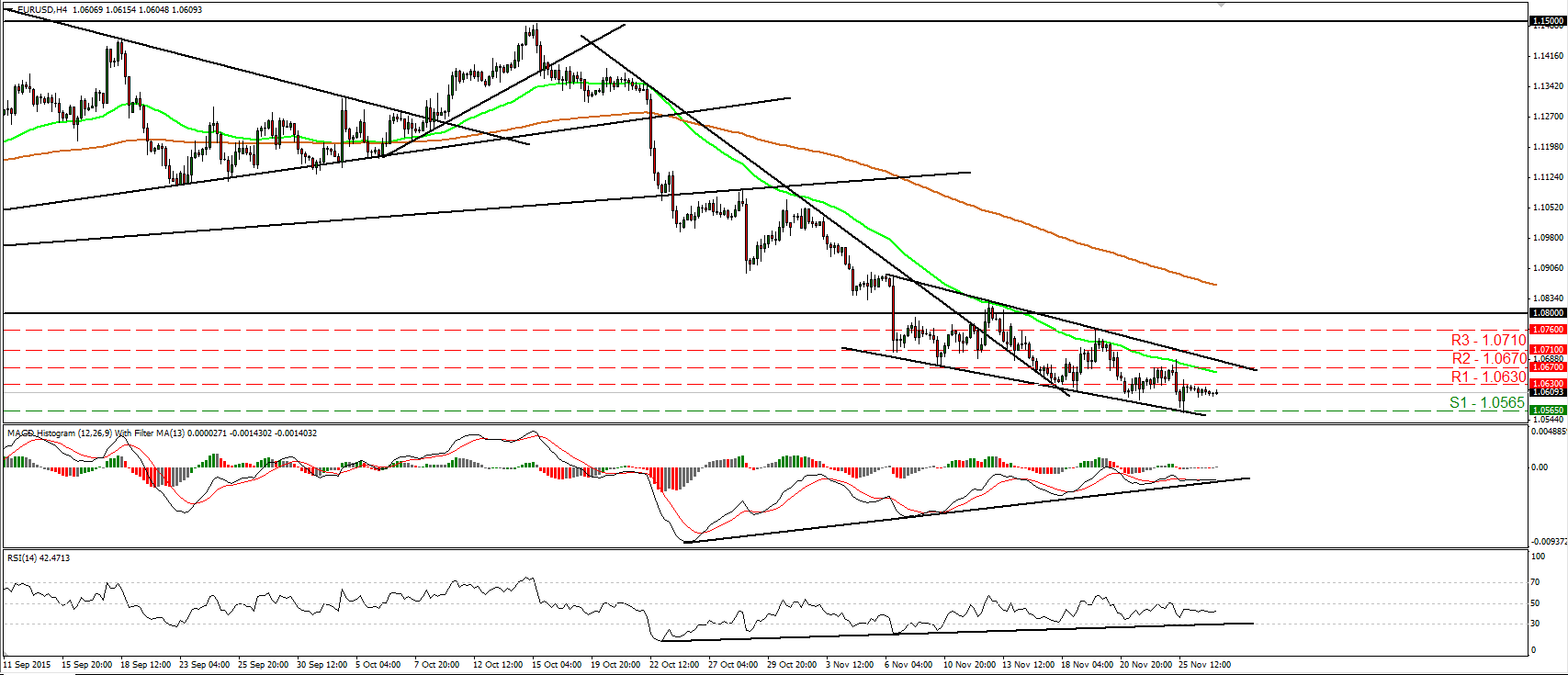

EUR/USD trades in a quiet mode

• EUR/USD traded in a very quiet mode yesterday, staying slightly below the 1.0630 (R1) resistance level. The short-term trend remains negative in my view and therefore, I would expect the bears to seize control again at some point and aim for another test at the 1.0565 (S1) support zone. A clear move below that support is likely to open the way for the next one at 1.0530 (S2), defined by the lows of the 13th and 14th of April. Looking at our short-term oscillators I see that the RSI is moving sideways, slightly below its 50 line, while the MACD stands negative and points east as well. These signs support yesterday’s flat momentum. However, there is still positive divergence between the two oscillators and the price action. This make me believe that a corrective bounce is possible before the next negative leg, perhaps for another test neat the 1.0670 (R2) zone. In the bigger picture, as long as the pair is trading below 1.0800, the lower bound of the range it had been trading since the last days of April, I would consider the longer-term outlook to stay negative. I would treat any possible near-term advances that stay limited below 1.0800 as a corrective phase.

• Support: 1.0565 (S1), 1.0530 (S2), 1.0500 (S3)

• Resistance: 1.0630 (R1), 1.0670 (R2), 1.0710 (R3)

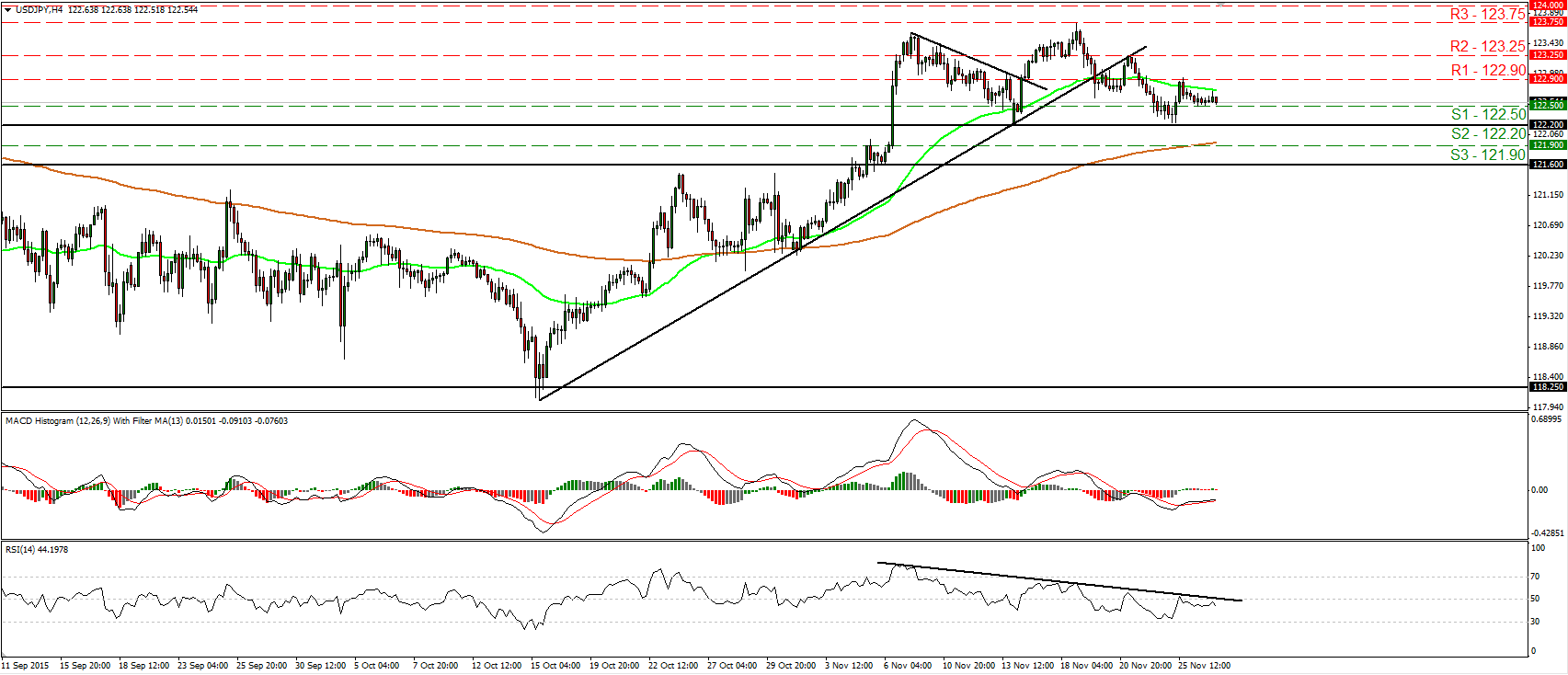

USD/JPY stays slightly above 122.50

• USD/JPY traded in a consolidative manner, staying fractionally above the 122.50 (S1) line. The short-term outlook remains somewhat negative in my view and hence, I would expect a decisive dip below 122.50 (S1) to open the way for another test at the key support hurdle of 122.20 (S2). Our short-term oscillators support somewhat the notion. The RSI hit resistance near its 50 line and turned down, while the MACD, already negative, shows signs that it could top and fall below its trigger line. However, a break below the 122.20 (S2) obstacle is needed to confirm a forthcoming lower low on the 4-hour chart, something that could initially aim for the 121.90 (S3) level. As for the broader trend, the break above 121.60 signaled the upside exit of the sideways range the pair had been trading since the last days of August and turned the longer-term picture back positive. This supports that USD/JPY could continue higher in the not-too-distant future and thus, I would treat any possible future near-term declines that stay limited above the 121.60 area as a corrective phase for now.

• Support: 122.50 (S1), 122.20 (S2), 121.90 (S3)

• Resistance: 122.90 (R1), 123.25 (R2), 123.75 (R3)

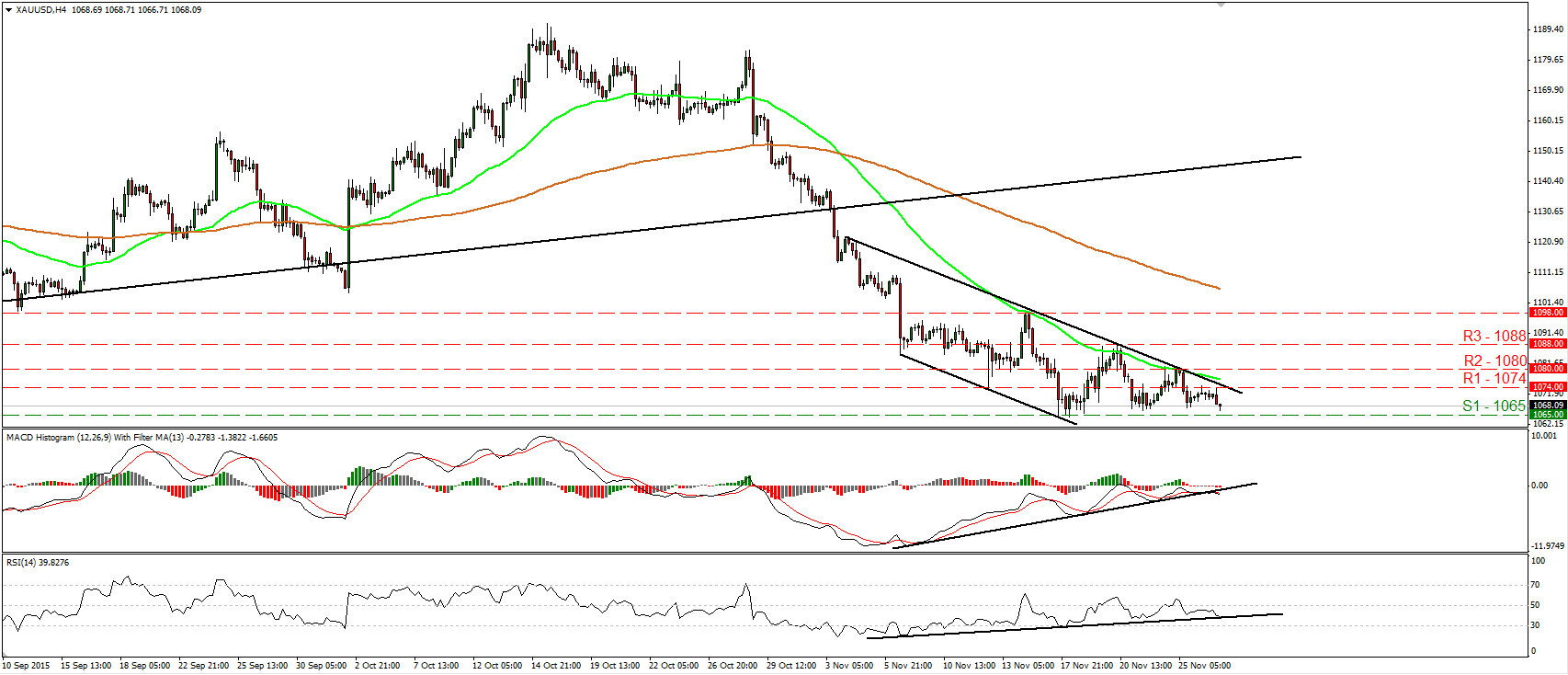

Gold is headed towards 1065

• Gold traded somewhat lower yesterday after it hit resistance near the 1074 (R1) barrier and the upper bound of the downside channel that has been containing the price action since the 4th of November. As long as the metal is trading within that channel, I would consider the short-term picture to stay cautiously negative. Nevertheless, I would like to see a clear move below 1065 (S1), before getting more confident on the downside. Something like that would confirm a forthcoming lower low on the 4-hour chart and could set the stage for our next support of 1055 (S2). Shifting my attention to our momentum studies, I see that the RSI turned down and looks ready to fall below its upside support line, while the MACD, already negative, has topped and fallen below both its trigger and upside support lines. These indicators detect bearish momentum and support further declines. On the daily chart, I see that the plunge below the upside support line taken from the low of the 20th of July has shifted the medium-term outlook to the downside. As a result, I believe that the metal is poised to continue its down road in the foreseeable future.

• Support: 1065 (S1), 1055 (S2), 1050 (S3)

• Resistance: 1074 (R1), 1080 (R2), 1088 (R3)

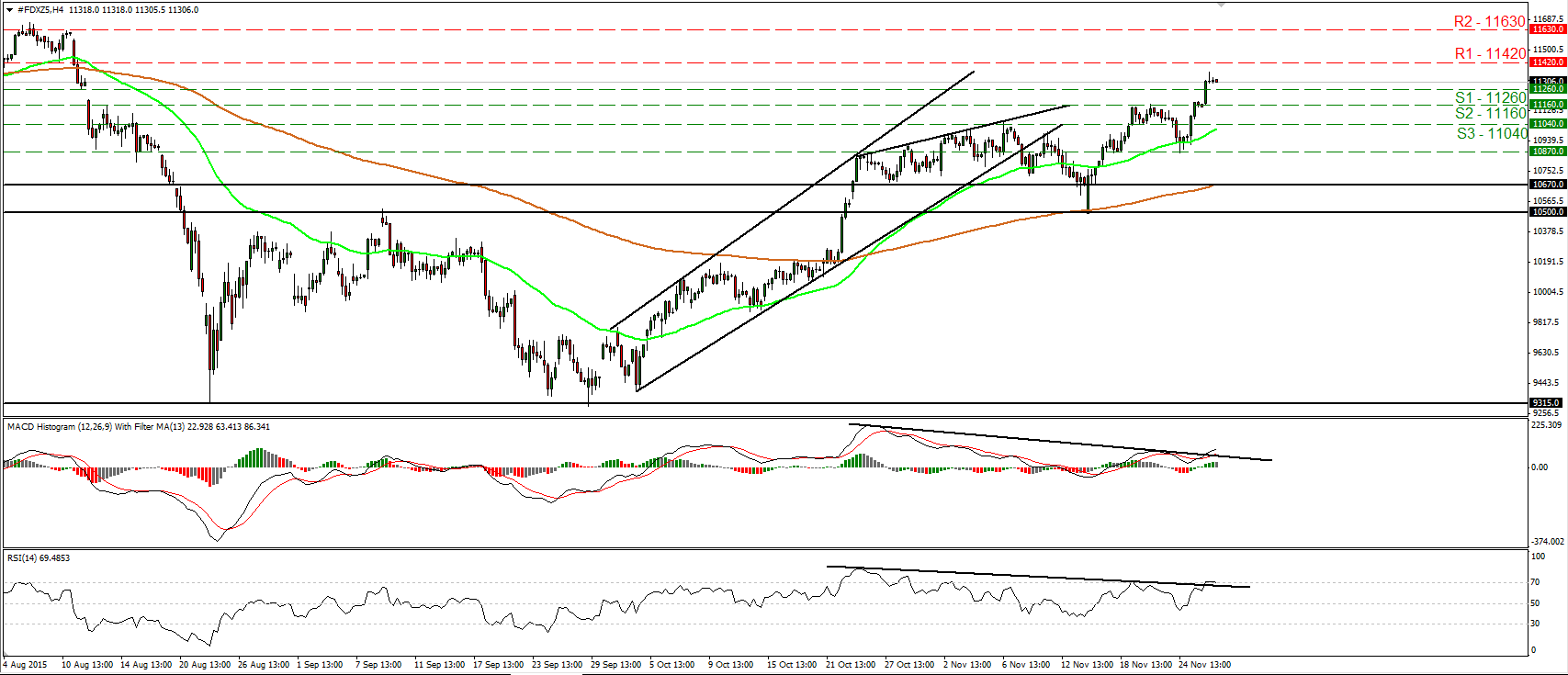

DAX futures surge

• DAX futures rallied yesterday and managed to emerge above our resistance (now turned into support) barrier of 11260 (S1). The price structure on the 4-hour chart still points to a short-term uptrend and as a result, I would expect a clear move above 11420 (R1) to see scope for extensions towards the 11630 (R2) area, marked by the peak of the 10th of August. Our momentum studies detect strong upside speed and support the positive outlook. The RSI emerged above 70 and above its downside resistance line, while the MACD, already positive has bottomed and crossed above its trigger line. It overcame its downside resistance line as well. However, I see that the RSI shows signs of topping within its overbought zone and thus, I would be careful of a possible setback before the bulls decide to shoot again. On the daily chart, the break above the psychological zone of 10500 on the 22nd of October signalled the completion of a double bottom formation. What is more, the rebound on the 16th of November from that psychological area adds to my view that the medium-term path remains positive.

• Support: 11260 (S1), 11160 (S2), 11040 (S3)

• Resistance: 11420 (R1), 11630 (R2), 11800 (R3)

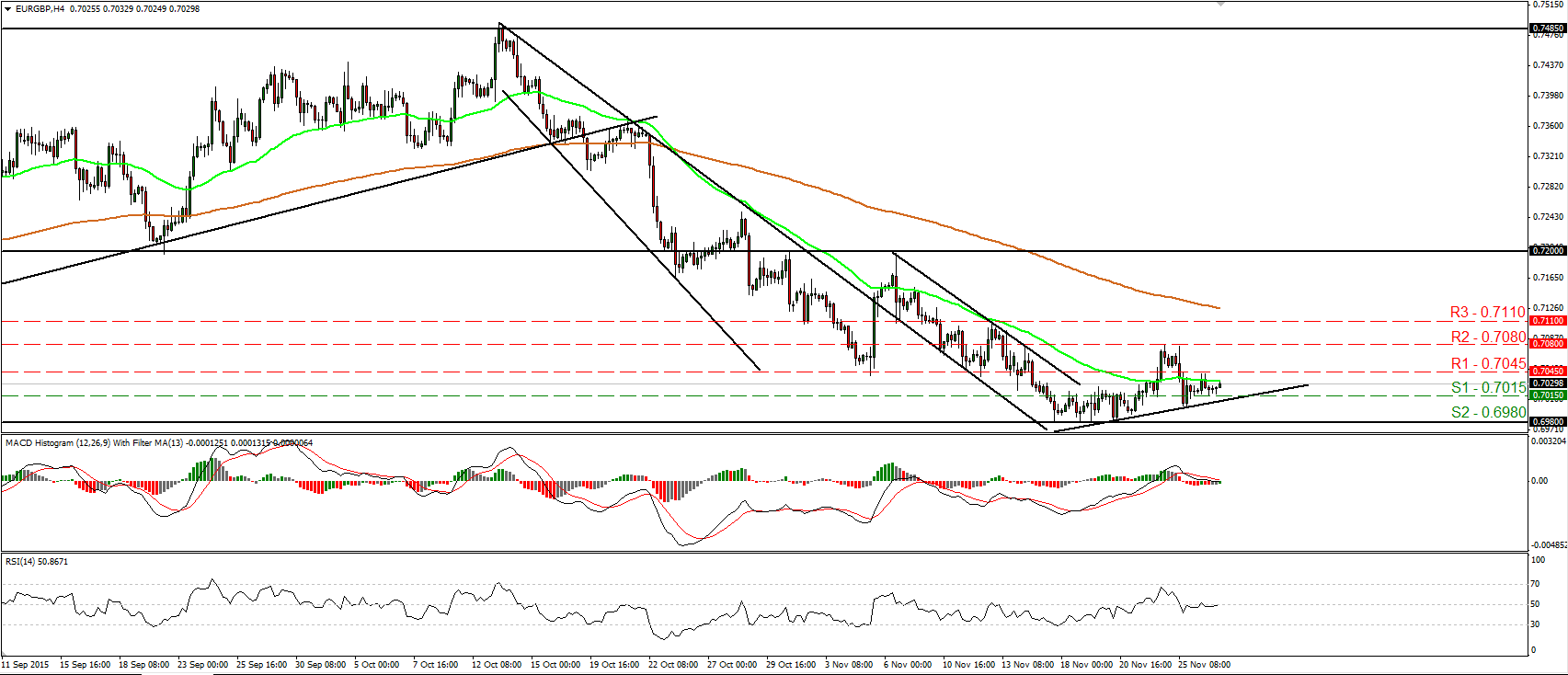

EUR/GBP looks ready to move above 0.7045

• EUR/GBP traded in a sideways mode yesterday, staying between the support of 0.7015 (S1) and the resistance of 0.7045 (R1). The rate lies above the short-term upside support line taken from the low of the 20th of November and this makes me believe that a positive move could be looming. A break above the resistance of 0.7045 (R1) is likely to confirm that and could pave the way for the 0.7080 (R2) zone, marked by Tuesday’s and Wednesday’s peaks. Our short-term oscillators give evidence of a possible rebound as well. The RSI just poked its nose above its 50 line, while the MACD shows signs that it could start bottoming fractionally above its zero line. Switching to the daily chart, I see that the dip below the 0.7200 hurdle on the 28th of October has confirmed the negative divergence between the daily oscillators and the price action, and has also turned the longer-term outlook back negative. Therefore, I would expect the pair to turn lower at some point in the future and I would treat any short-term advances as a corrective phase for now.

• Support: 0.7015 (S1), 0.6980 (S2), 0.6950 (S3)

• Resistance: 0.7045 (R1), 0.7080 (R2), 0.7110 (R3)