- The US Dollar trades at key highs, but we see two key risks for the Greenback

- Extreme positioning and low FX volatility support case for Dollar pullback

- Strategy remains to trade major support and resistance levels on big pairs

The US Dollar trades at yearly highs versus the Euro and is strengthening versus other major counterparts, but these two key factors favor a Dollar pullback.

Put simply, there are two key factors against a major Dollar break higher versus the Euro at these levels.

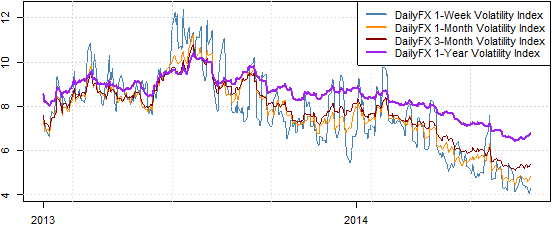

First: current market conditions warn that few traders are positioning or envisioning a major USD move. In fact our DailyFX Volatility Indices, which track prices paid/received on FX options, remain near record-lows. No one is betting on or hedging against major Dollar moves.

Data source: Bloomberg, DailyFX Calculations

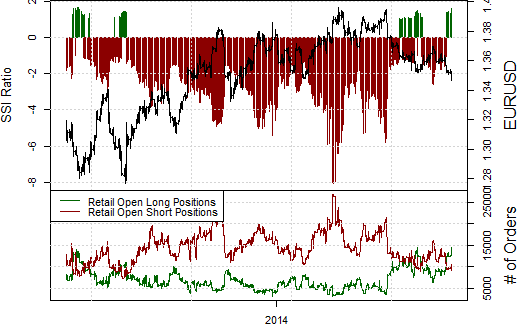

Second and just as importantly: we’re seeing important signs that FX positioning and sentiment have become very stretched. Recent futures positioning data shows that large speculators are their most short EUR/USD since it traded above $1.30 through mid-2013. Our retail speculator-based trader sample is likewise at its most stretched since the same lows, and the confluence warns of a potentially significant turn.

Source: FXCM Retail FX Positioning Data, Prepared by David Rodriguez.

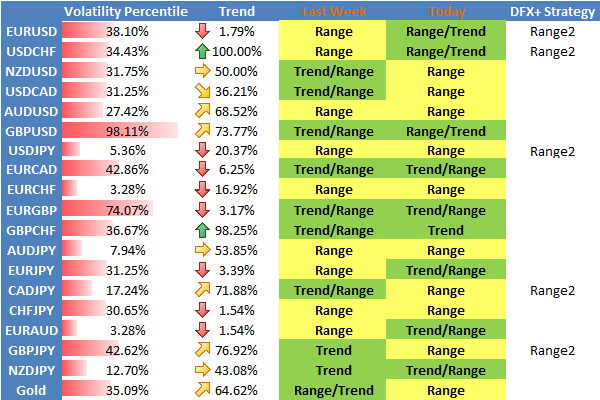

These two factors are no guarantee that price will turn. Yet we trade on probabilities: the coincidence of key warnings suggests that US Dollar pairs may stick to broad trading ranges.

Thus from a trading perspective we’ll look to major support and resistance to hold and perhaps get short the US Dollar versus major counterparts. For the Euro, our Senior Strategist notes that a close below $1.3460 would point to a much more substantial breakdown. Absent such a break however, our focus remains on a EUR/USD bounce.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com