The US dollar trimmed its losses yesterday after a brief test to the 95.00 support in the US dollar index saw prices closing higher. Price action continues to remain range bound with no evidence of trends being established just as yet. This should see a minor pullback among USD crosses in the near term. Still, the dollar index remains vulnerable as a breakdown below 95.00 could spell further declines.

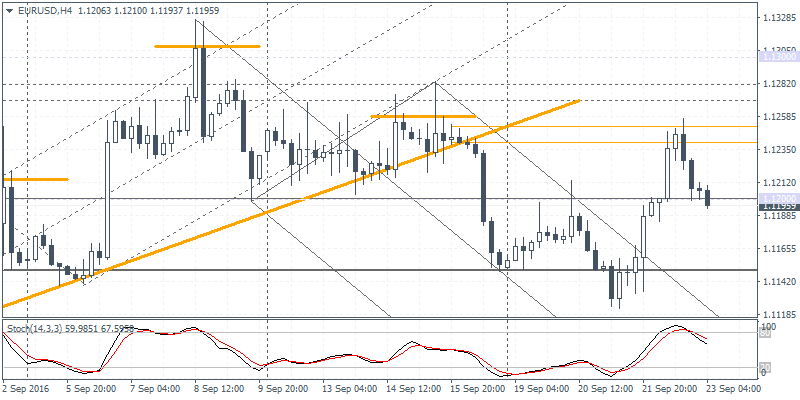

EUR/USD Daily Analysis

EUR/USD (1.1195): EUR/USD's failure to close above 1.1200 resistance yesterday keeps prices flat for the most part with the range of 1.1100 likely to remain in play. However, the reversal near 1.1251 yesterday marks a retest of the breakout from the neckline level of the head and shoulders pattern that was formed. This could indicate further declines on a convincing close below 1.1200. A retest to 1.1100 remains very much a possibility, but any declines below that will need to be convincing to ascertain the case for a dip to 1.1000. To the upside, any reversal off 1.1200 could spell further strength in the single currency which could aim for aretest to 1.1270 - 1.1281 resistance.

USD/JPY Daily Analysis

USD/JPY (101.14): USD/JPY is seen posting a reversal after a dip to the 100.00 psychological level. Price action is seen heading towards 102.00 in the near term, but there are no distinctive signs that further upside could be maintained. On the daily chart, the support at 100.00 has been tested twice within the descending triangle pattern. Failure to breakout above 102.00 to extend the gains could signal further weakness in USD/JPY with the potential to break down below the 100.00 handle.

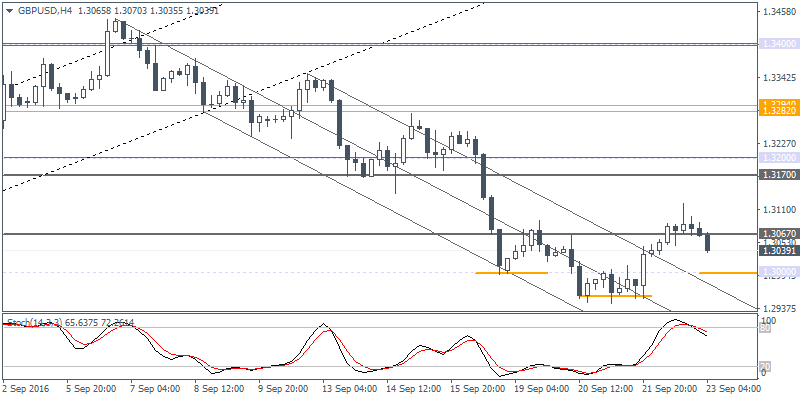

GBP/USD Daily Analysis

GBP/USD (1.3039): GBP/USD, failing to capitalize on the gains from the FOMC is seen trending lower today with a retest back to 1.3000 quite possible. On the 4-hour chart time frame, there is scope for an inverse head and shoulders pattern that could be forming with the left shoulder and the head formed already. A higher low around 1.3000 region could send an initial signal of a reversal that could take place. A breakout rally to the neckline resistance at 1.3067 could validate the inverse head and shoulders pattern that could send GBP/USD towards 1.3200 - 1.3170 resistance level. To the downside, a breakdown below 1.3000 could see further weakness in the cable with the potential for price to fall back to the previous lows at 1.2950.

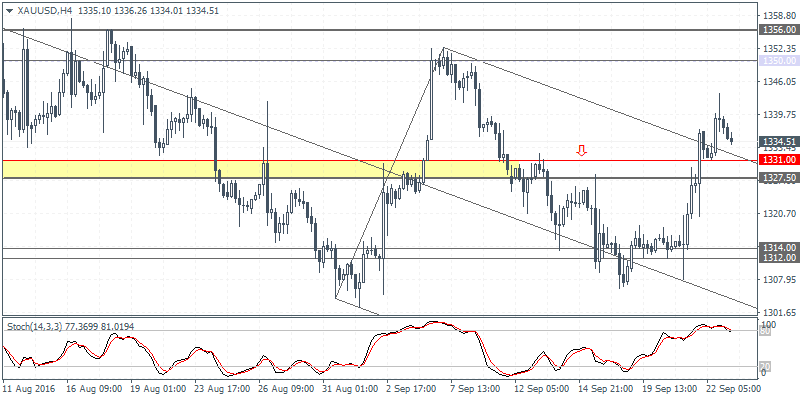

Gold Daily Analysis

XAU/USD (1334.51): Gold prices closed in a doji yesterday above the support at 1331 - 1327.50. Depending on how today's price action unfolds, we could expect some near-term correction to prices. On the 4-hour chart, support at 1331 - 1327.50 will no doubt offer a short-term bounce, but further weakness can be expected if the support gives way. Gold prices could be seen falling back to the previous support at 1314 - 1312 region.