Friday August 26: Five things the markets are talking about

Capital markets will be fully focused on Fed Chair Yellen’s speech today at Jackson Hole symposium (10am EDT), looking for clues on the timing of the next Fed rate hike. Will they get it? History will say no.

Her speech is titled “The Federal Reserve’s Monetary Policy Toolkit” and is expected to focus on the Fed’s ammunition to fight the next economic downturn.

Obviously, there is an outside possibility that Ms. Yellen may indicate a shift in Fed policy away from market accommodation and back toward normalizing rates.

Nonetheless, despite this outside threat, investors remain net long S&P, the dollar floundering and yields tightly contained. In translation, investors are positioned for a continued risk-on rally driven by a combination of supportive monetary policy and expectations of better economic growth in the quarters ahead.

Today’s event risk is if the Fed chair should turn unexpectedly hawkish, if so, the markets bullishness will be expected to fade very quickly. A safer bet is probably another confusing message.

1. Global bourses contained

Shares in Asia drifted lower overnight, as investors seek guidance from Fed Chair Yellen later this morning.

The S&P/ASX 200 dropped -0.5%, while South Korea’s KOSPI and Singapore’s FTSE Straits Times Index fell -0.3% each. However, the Shanghai Composite Index was up +0.1% and Hong Kong’s Hang Seng Index closed +0.4% higher, while in Japan, the Nikkei Stock Average closed down -1.2%.

After yesterday’s slump, Euro indices are little changed, with the Stoxx Europe 600 swinging between small gains and losses. Commodity and mining stocks trade higher in the FTSE 100.

Currently, futures point to a flat opening on Wall Street.

Indices: Stoxx50 -0.2% at 2,983, FTSE -0.1% at 6,812, DAX -0.2% at 10,507, CAC-40 -0.2% at 4,399, IBEX-35 -0.1% at 8,951, FTSE MIB -0.6% at 16,618, SMI -0.3% at 8,120, S&P 500 Futures flat

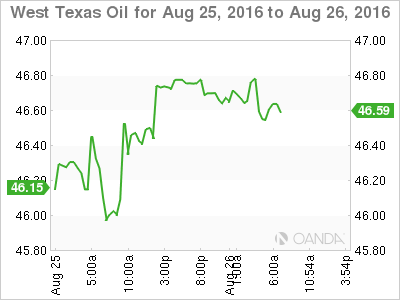

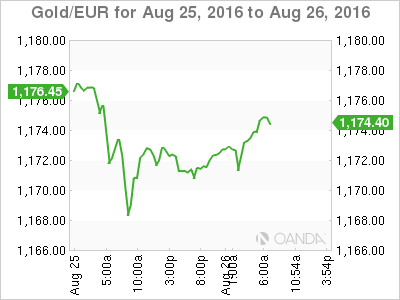

2. Oil slips, gold unphased

Global crude prices are contained as investors wait for the dollar’s reaction to Ms. Yellen’s speech today (a rate hike provides support for the dollar, which would make oil more expensive for traders who conduct business in other currencies).

The October contract for Brent is down -0.46% at +$49.44 a barrel, while WTI has fallen -0.06% to +$47.29 a barrel.

OPEC meeting aside, providing some support for ‘black gold’ this week is China. After a summer of muted oil demand, storage units constructed for China’s strategic petroleum reserve are coming back on line over the next few months and this is supporting the higher demand.

Crude bulls will be looking closely at Baker Hughes weekly rig count data later today. Last week saw ten new rigs come back on line, which supports energy prices.

Gold is little changed, trading atop of its four-week low (+$1,325) this morning as concerns over the possibility of an interest-rate increase by the Fed is pressuring the weaker ‘long’ positions to close out their bets on the precious metal.

3. September rate hike odds tighten

Looking at the front end of the U.S yield curve, fed fund futures suggests that investors are turning slightly more hawkish, now that Kansas City Fed President Esther George reiterated her call that higher rates are warranted and Dallas Fed chief Robert Kaplan suggested that “the case is strengthening” for another increase earlier this week.

Currently, futures prices indicate that there is a +32% chance that U.S policy makers will tighten at the September 20-21st meeting. That is double what it was two weeks ago, and up from a zero possibility after the U.K. voted to exit the E.U in June.

The chance U.S. policy makers will raise rates by year-end is +57%, up from +36% at the end of July.

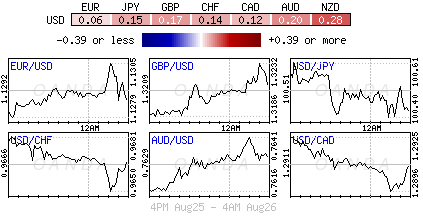

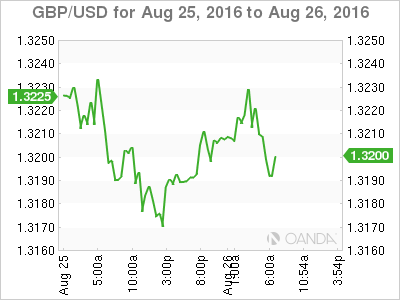

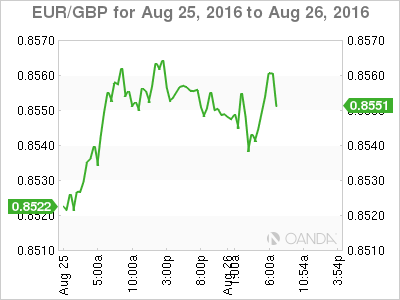

4. Forex not sold on rate hike

The FX market is not as bullish on rates as fixed income, in fact, current U.S dollar prices would suggest that dealers are relatively ‘dovish’ as the ‘mighty’ buck continues to trade under pressure against G10 currency pairs.

In overnight trading, the dollar index fell -0.25% to 94.54. A ‘dovish’ Yellen is expected to weaken the dollar further. The EUR is hovering just under the psychological €1.1300 level, the Yen is little changed at ¥100.50 while the sterling ‘bears’ wits continue to be tested as the pound trades atop of £1.3200 handle.

5. Keep an eye on GDP

Despite Ms. Yellen being the main event today (10:00 am EDT) capital markets will get some insight on how the U.S economy has being doing in Q2. At 08:30 am EDT, the Bureau of Economic Analysis will release its revised estimate of the U.S’s Q2 GDP (+1.1% e vs. +1.2%).

If those figures confirm the growth in household spending seen in the preliminary release, it will definitely supports the bulls argument that a U.S rate hike is warranted by year-end.