The idea of doing the total opposite of what feels right (or expected) has been my trading mantra this whole year, and again we saw that in the AUD price action yesterday, with AUD finding buyers on the day despite political instability.

In the equity space banks initially found sellers but rallied well into the afternoon. We are staring at a stronger open for the financial sector today, with Commonwealth Bank Of Australia (AX:CBA), for example, likely to open 0.5% to 1% higher.

Interestingly, if we look at the ASX 200 financial sector, we can see the ratio has fallen to 1.0928x and the lowest levels since March 2014, showing strong underperformance from the banks since late 2015.

Clearly the market is underweight banks at this juncture, with better buying seen in utilities, energy and materials of late.

BHP Billiton (AX:BHP) is likely to open on the back foot today (the ADR suggests an open 2.8% weaker), but support from the banks should be enough to lift the broader market into the 5290 - 5300 level.

Technically, there seems to be some indecision among participants, and there has been a lack of impetus to push the index through both the May downtrend and the 22 June highs. Traders would do well to watch price from here, because if we see the market roll over it would print its fourth consecutive lower high. Not particularly bullish.

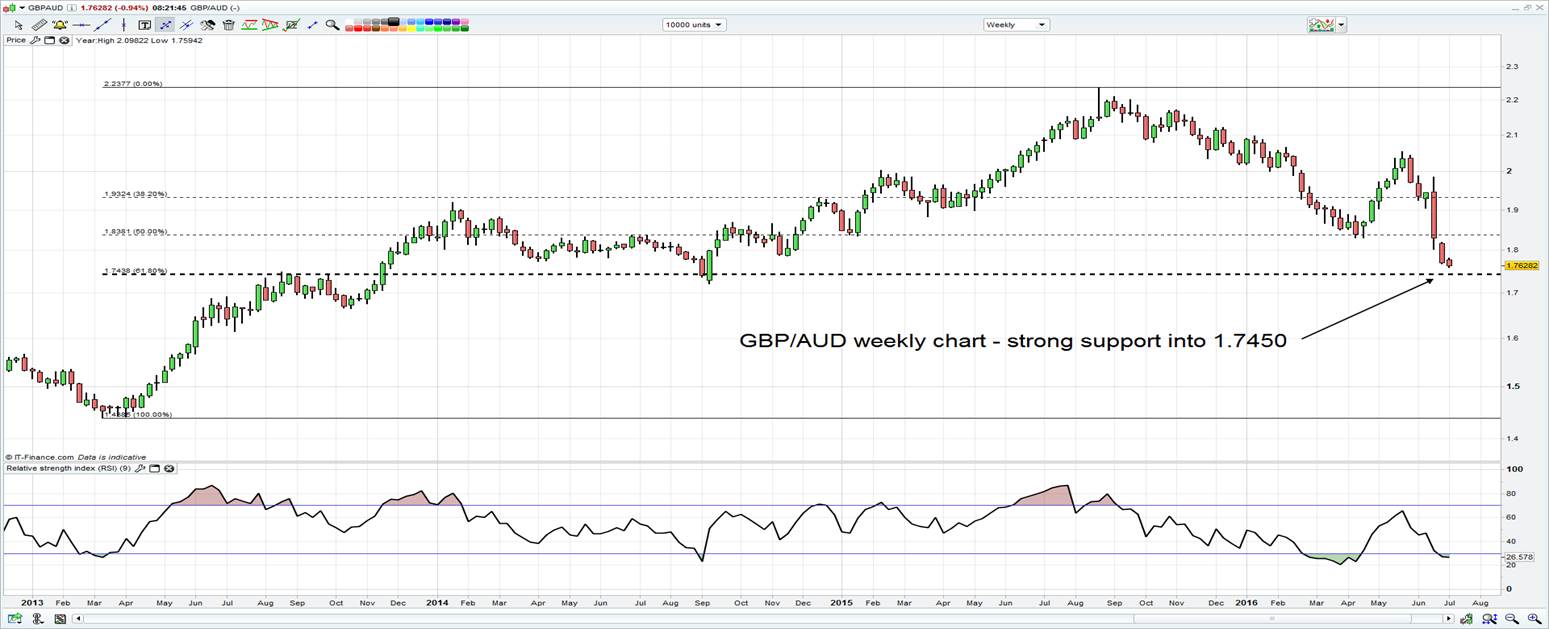

On the FX side the pair to watch has to be GBP/AUD, with today’s RBA meeting and the UK stability report in focus. Importantly, BoE governor Mark Carney holds a press conference at 20:00 AEST, and this should see the GBP move around more aggressively.

The interesting dynamic, aside from the pair being about as technically oversold as you’ll ever see (the 9-day RSI is at 17), is that the market has all but priced in easing from the Bank of England at next week’s central bank meeting. In Australia the market has a 53% probability of easing at the August meeting, and this would be in stark disagreement from the economist community who would largely be gunning for a cut.

In effect, with this market pricing Mark Carney is going to have to say something new to keep the downside momentum in GBP/AUD going. Today’s RBA statement should largely be unchanged from the June statement, which in theory could support the AUD, with all the focus ironically on their view on the effects of the UK referendum.

However, given Australia’s inflation dynamic, the possibility of re-introducing a view that ‘continued low inflation may provide scope’ to cut interest rates is also high, and should support GBP/AUD.

On the support side any moves into A$1.7450 (the 61.8% retracement of the 2013 to 2015 rally) look like excellent buying. I am sceptical we'll get there however.

In the commodity space all the focus is on silver, but I would urge not to chase this move from here and buy into weakness. However, put iron ore futures on the radar, with price up 13 of the last 14 days.