Discover Financial Services (NYSE:DFS) is slated to report third-quarter 2016 results after the market closes on Oct 25, 2016. Last quarter, the company posted a positive earnings surprise of 16.54%. Let’s see how things are shaping up for this announcement.

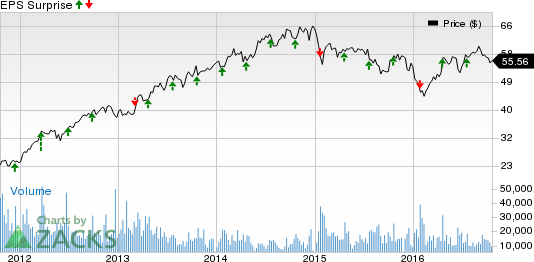

With respect to the surprise trend, Discover Financial surpassed expectations in three of the last four quarters. However, the company missed the Zacks Consensus Estimate by 12.31% in fourth-quarter 2015, which led to the average negative surprise of 0.49% in the trailing four quarters.

The company’s share price has been fluctuating over the last few days. We wait to see how the stock reacts to the quarter’s results.

Factors to be Considered this Quarter

Discover Financial’s new accounts are likely to have driven sales, which in turn are expected to have supported loan growth. Double rewards campaign in new accounts and the launch of credit score cards in the last quarter are likely to have been the main growth drivers.

Several marketing activities during the quarter are expected to have generated impressive sales volume in savings accounts and balances.

Both student and personal loans are likely to have performed well driven by digital investments and increased marketing, and should support Discover Financial’s originations levels.

Diners Club volume is also expected to have seen strong growth in the Asia Pacific region.

Discover Financial received a non-objection from the Fed with respect to its proposed capital actions for the four quarters ending Jun 30, 2017. Accordingly it has planned to repurchase almost $2 billion of its common stock over the next 12 months. Continued share buyback should boost the bottom line in the quarter.

However, the company is likely to have witnessed a rise in expenses due to several marketing and business development initiatives undertaken during the third quarter. Nonetheless, Discover Financial continued to enhance its compliance program to meet the terms of its consent orders. The effective cost control is likely to have offered some respite.

Earnings Whispers

Our proven model does not conclusively show that Discover Financial is likely to beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

DISCOVER FIN SV Price and EPS Surprise

Zacks ESP: Discover Financial has an Earnings ESP of -0.68%. This is because the Most Accurate estimate stands at $1.47, while the Zacks Consensus Estimate is pegged at $1.48.

Zacks Rank: Discover Financial carries a Zacks Rank #3 (Hold). Though the company has a favorable Zacks Rank, its negative ESP complicates surprise prediction.

Stocks to Consider

Here are some companies from the finance sector that you may want to consider as these have the right combination of elements to post an earnings beat this quarter:

Ally Financial Inc. (NYSE:ALLY) , which is expected to report third-quarter earnings results on Oct 26, has an Earnings ESP of +1.70% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Santander (MC:SAN) Consumer USA Holdings Inc. (NYSE:SC) has an Earnings ESP of +3.70% and a Zacks Rank #2 (Buy). The company is expected to report third-quarter earnings results on Nov 3.

Everest Re Group Ltd. (NYSE:RE) has an Earnings ESP of +2.41% and also has a Zacks Rank #2. The company is scheduled to report third-quarter earnings on Oct 24.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

DISCOVER FIN SV (DFS): Free Stock Analysis Report

ALLY FINANCIAL (ALLY): Free Stock Analysis Report

EVEREST RE LTD (RE): Free Stock Analysis Report

SANTANDER CNSMR (SC): Free Stock Analysis Report

Original post

Zacks Investment Research