The world’s central banks and derivatives traders have been having their usual fun with gold and silver lately, dumping huge volumes of futures contracts into thin markets to produce massive declines — just when precious metals SHOULD have been soaring in response to near-global debt monetization.

But something interesting happened as this latest smack-down really got going. Physical buyers — who goldbugs have for years been expecting to ride to the rescue, finally did. Chinese and Indian gold imports, which had trailed off earlier in the year, soared in response to the recent price declines. There’s some debate about exactly how much these guys are buying, but it certainly looks like they’re talking all that’s being produced by the world’s mines, and then some.

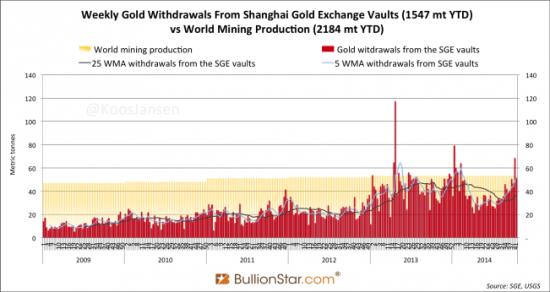

Here’s a chart from gold analyst Koos Jansen showing Chinese imports spiking lately:

In silver, the response of individual coin buyers has been even more dramatic. The US Mint, which in a good month sells 5 million one-ounce silver eagles, sold 2 million of them in two hours on November 5, ran out of inventory, and suspended sales until further notice.

For more on the recent tsunami of precious metals buying, see here, here and here

So it looks like physical buyers at long last have decided to tell the precious metals market what the US government and Federal Reserve have been telling the stock, bond and real estate markets markets since the 1990s heyday of Fed chair Alan Greenspan: Relax, we’ve got your back. We’ll short-circuit small declines before they can turn into big ones, and failing that we’ll ramp up a new bubble so quickly that you’ll hardly notice the blip.

There is of course no way to know what the manipulators will do in response, and whether they’ll succeed. They do, after all, have trillions of dollars of fiat currency at their disposal. But at least there’s now a real fight going on in which physical buyers are landing some punches.