Diageo (LON:DGE) plc. (NYSE:DEO) was upgraded to a Zacks Rank #3 (Hold) from a Zacks Rank #4 (Sell) on Sep 16, 2016. Going by the Zacks model, stocks carrying a Zacks Rank #3 are likely to perform in line with the broader market in the quarters ahead.

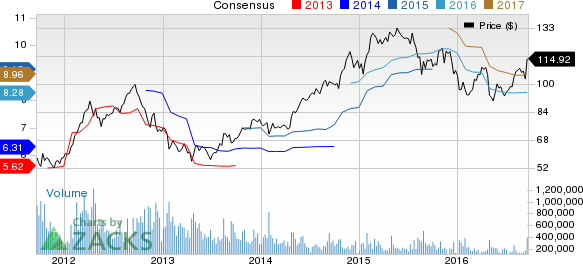

The company has seen its stock price surge 9.03% over the past three months and nearly 3.33% on a year-to-date basis. The earnings for Diageo are expected to grow by 8.05% in the long term.

Why Upgraded to Hold?

Diageo, a global leader in spirits, has majority market share in nearly every spirit category in Europe and the U.S., its two largest markets.

We note that the spirits and wine market is benefiting from favorable demographic trends. The baby-boomer generation is reaching its peak spirits and wine consuming age as they reach their 50s and 60s both in Europe and US. Younger generations are also consuming more spirits. Diageo is geared to capture the growing market of spirits and is innovating newer varieties of spirits to woo the growing consumer base. Further the company is penetrating fast into emerging markets with the help of acquisitions to tap the growing market in these areas.

Diageo is putting greater thrust on high-margin products. With regards to its decision, the company ended a 16-year old distribution deal with Jose Cuervo, a non-premium tequila brand in Dec 2013, and shifted towards more premium brands in America. The shift to high-margin brand is expected to be beneficial for the company.

Though the above mentioned positive aspects boost our confidence in the stock, certain inherent issues raise our concerns for the same. Declining volumes has been a drag on top line for the past few quarters. Moreover, increasing restrictions on alcohol consumption by governments across the world have dented revenue growth.

Over the last 60 days, Zacks Consensus Estimate for the stock has been revised downwards for 2017 but raised up for 2018.

Stocks to Consider

Some better-ranked stocks within the broader consumer staples industry include Sanderson Farms Inc. (NASDAQ:SAFM) , Omega Protein Corp. (NYSE:OME) and The Kraft Heinz Company (NASDAQ:KHC) . While Sanderson Farms and Omega Protein sport a Zacks Rank #1 (Strong Buy), Kraft Heinz carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

SANDERSON FARMS (SAFM): Free Stock Analysis Report

OMEGA PROTEIN (OME): Free Stock Analysis Report

KRAFT HEINZ CO (KHC): Free Stock Analysis Report

Original post

Zacks Investment Research