Consumer Discretionary Underperforming

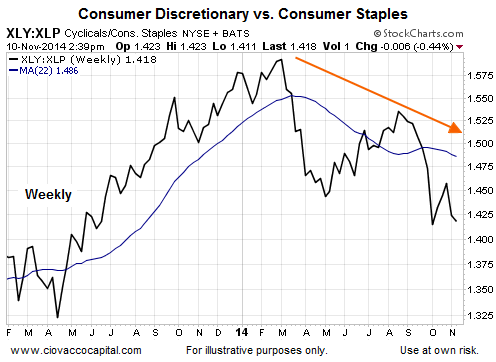

The chart below shows the performance of consumer discretionary stocks relative to consumer staples. For most of 2013, discretionary sectors were leading defensive sectors (ratio was rising in 2013). 2014 has been a different story with more conservative stocks, such as Procter & Gamble (NYSE:PG), taking on a leadership role.

Is This A Major Red Flag For The Bull Market?

While there is no question defensive leadership speaks to a more tentative market, have the bulls ever remained in control under similar circumstances? This week’s video provides some historical insight, along with how the Fed may be impacting the SPDR Consumer Discr. Select Sector (ARCA:XLY) vs. SPDR - Consumer Staples (ARCA:XLP) ratio.

Earnings Provide Some Insight

Dean Foods and Toll Brothers both provided some backing for the bullish case Monday by reporting better than expected profits and sales projections. From Bloomberg:

“The numbers in the third quarter showed a steady economy, we continue to have oil below $80, consumers feeling confident, low interest rates, and that’s a combination that works well for stocks,” Mark Kepner, an equity trader at Chatham, New Jersey-based Themis Trading LLC, said by phone. “Central banks have also been quite accommodative in what they’ve been saying and it seems to be working.”

Investment Implications – The Weight Of The Evidence

If defensive leadership becomes a problem for the current rally, deterioration in the market’s tolerance for risk will begin to spill over into other areas, something that we have not seen yet. In fact, the observable evidence continues to show improvement, allowing us to reduce exposure to conservative assets (TLT) while increasing exposure to equities (VOO). With a relatively light economic calendar this week, the market may focus on earnings in the United States and abroad.