In today’s world, we have a huge amount of debt outstanding. Academic researchers Carmen Reinhart and Kenneth Rogoff have become famous for their book This Time is Different: Eight Centuries of Financial Folly and their earlier paper This Time is Different: A Panoramic View of Eight Centuries of Financial Crises. Their point, of course, is that the same thing happens over and over again. We can learn from past crises to solve our current problems.

Part of their story is of course correct. Governments have gotten themselves into problems with debt, time after time. This is happening again now. In fact, the same two authors recently prepared a working paper for the International Monetary Fund called Financial and Sovereign Debt Crises: Some Lessons Learned and Some Lessons Forgotten, talking about ideas such as governments inflating their way out of debt problems and pushing problems off to insurance companies and pension funds, through regulations requiring investment in certain securities.

Many seem to believe that if we worked our way out of debt problems in the past, we can do the same thing again. The same assets may have new owners, but everything will work together in the long run. Businesses will continue operating, and people will continue to have jobs. We may have to adjust monetary policy, or perhaps regulation of financial institutions, but that is about all.

I think this is where the story goes wrong. The situation we have now is very different, and far worse, than what happened in the past. We live in a much more tightly networked economy. This time, our problems are tied to the need for cheap, high quality energy products. The comfort we get from everything eventually working out in the past is false comfort.

If we look closely at the past, we see that in some cases the outcomes are not benign. There are situations where much of the population in an area died off. This die-off did not occur directly because of debt defaults. Instead, the same issues that gave rise to debt defaults, primarily diminishing returns with respect to food and other types of production, also led to die off. We are not necessarily exempt from these same kinds of problems in the future.

Why the Current Interest in Debt Levels and Interest Rates

The reason I bring up these issues is because the problem of too much world debt is now coming to the forefront. The Bank for International Settlements, which is the central bank for central banks, issued a report a week ago in which they said world debt levels are too high, and that continuing the current low interest rate policy has too many bad effects. Something needs to be done to normalize monetary policy.

Janet Yellen, Federal Reserve Chair, and Christine Lagarde, managing director or the International Monetary Fund, have also been making statements about the issue of how to fix our current economic problems (News Report; Video). There is the additional rather bizarre point that back in January, Lagarde used numerology to suggest that a major change in policy might be announced in 2014 (on July 20?), with the hope that the past “seven miserable years” can be followed by “seven strong years.” The IMF has talked in the past about using its special drawing rights (SDRs) as a sort of international currency. In this role, the SDRs could act as the world’s reserve currency, be used for issuing bonds, and be used for setting the prices of commodities such as gold and oil. Perhaps a variation on SDRs is what Lagarde has in mind.

So with this background, let’s get back to the main point of the post. How is this debt crisis, and the likely outcome, different from previous crises?

1. We live in a globalized economy. Any slip-up of a major economy would very much affect all of the other major economies.

Banks hold bonds of governments other than their own. If a major government fails to make good on its promises, it can affect other governments as well. Smaller countries, like Greece or Cyprus, can be bailed out or their problems worked around. But if the United States, or even Japan, should run into major difficulties, it would affect the world as a whole. See my post, Twelve Reasons Why Globalization is a Huge Problem.

2. Our problem now is not simply governmental debt; it is debt of many different types, affecting individuals and businesses of all kinds, as well as governments.

In the studies of historical debt by Reinhart and Rogoff, the focus is on governmental debt. Now there is much more debt, some through banks, some through bonds, and some through less traditional sources. There are also derivatives that are in some ways like debt. In particular, if there are sharp moves in interest rates, it is possible that some issuers of derivatives will find themselves in financial difficulty.

There are also promises that are in many ways like debt, but that technically aren’t guaranteed, because legislatures can change the promised benefits whenever they choose. Examples of these are our current Social Security program and Medicare benefits. Citizens depend on these programs, even if there is no promise that they will continue to exist in their current form. With all of these kinds of debt and quasi-debt, we have a much more complex situation than in the past.

3. Our economy is a self-organized system that has properties of its own, quite apart from the properties of the individual consumers, businesses, governments, and resources that make up the system. Circumstances now are such that the world economy could fail, even though this could not happen in the past.

I recently wrote about the nature of a networked economy, in my post Why Standard Economic Models Don’t Work–Our Economy is a Network. In that post, I represented our networked economy as being somewhat like this dome that can be built with wooden sticks.

Years ago, when a civilization collapsed, the network of connections was not as dense as it is today. Most food was not dependent on long supply chains, and quite a bit of manufacturing was done locally. If one economy collapsed, even a fairly large one like the Weimar Republic of Germany, the rest of the world was not terribly dependent on it. Figuratively, the “hole” in the dome could mend, and over time, the economy could strengthen and go on as before. We cannot count on this situation today, however.

4. Fossil fuels (coal, oil and natural gas) available today are what enable tighter connections than in the past, and also add vulnerabilities.

Early economies relied mainly on the sun’s energy to grow food, gravity to help with irrigation, human energy and animal energy for transport and food growing, wind energy to power ships and wooden windmills, and water energy to operate water wheels. Wood was used for many purposes, including heating homes, cooking, and making charcoal to provide the heat needed to smelt metals and make glass.

In the past two hundred years we have added fossil fuels to our list of fuels. This has allowed us to make metals in quantity, as well as concrete and glass in quantity, enabling the development of much technology. The use of coal enabled the building of hydroelectric dams as well as electrical transmission lines, thus enabling widespread use of electricity. Fossil fuels enabled other modern fuels as well, including nuclear energy, and the manufacture of what we today call “renewable energy,” including today’s wind turbines and solar PV.

Of the fossil fuels, oil has been especially important. Oil is particularly good as a transport fuel, because it is easily transported and very energy dense. With the use of oil, transport by smaller vehicles such as cars, trucks and airplanes became possible, and transport by ship and by rail was improved. Such changes allowed international businesses to grow and international trade to flourish. Economies were able to grow much more rapidly than in the pre-fossil fuel era. Governments became richer and began offering education to all, paved roads, and benefits such as unemployment insurance, health care programs, and pensions for the elderly.

Thus, fossil fuels enable a very different lifestyle, and very different governments and government programs than existed prior to fossil fuels. If something were to happen to all fossil fuels, or even just oil, most businesses would have to cease operation. Governments could not collect enough taxes to continue functioning. Very few farmers would be able to produce food and transport it to market, because oil is used to transport seeds to farmers, to operate machinery, to operate irritation equipment, to transport soil amendments, and to create herbicides and pesticides.

This situation now is very different from the past, when most food was produced using human and animal labor, and transport was often by a cart pulled by an animal. Before fossil fuels, even if governments collapsed and most people died off, the remaining people could continue growing food, gathering water, and going about their own lives. If we were to lose oil, or oil plus electricity (because oil is required to maintain electric transmission and because businesses tend to close when they are missing either oil or electricity), we would have a much harder time. Most of our jobs would disappear. Banks wouldn’t be able to operate. Our water and sewer systems would stop working. We would find it necessary to “start over,” in a very different way.

5. Because of the big role of debt today, economic growth is essential to keeping the current economic system operating.

It is much easier to pay back debt with interest when an economy is growing than when it is shrinking, because when an economy is shrinking, people are losing their jobs. Even if only, say, 10% lose their jobs, this loss of jobs creates many loan defaults. Banks are likely to find themselves in a precarious position and are likely to cut back on lending to others, making the situation worse.

If the economy starts shrinking, businesses will also have difficulty. They have fixed costs, including rent, management salaries, and their own debt repayments. These costs tend to stay the same, even if total revenue shrinks because of an economic slowdown. Because of these problems, businesses are also likely to find it increasingly difficult to pay back their own debt in a recession. They are likely to find it necessary to lay off workers, making the recession worse.

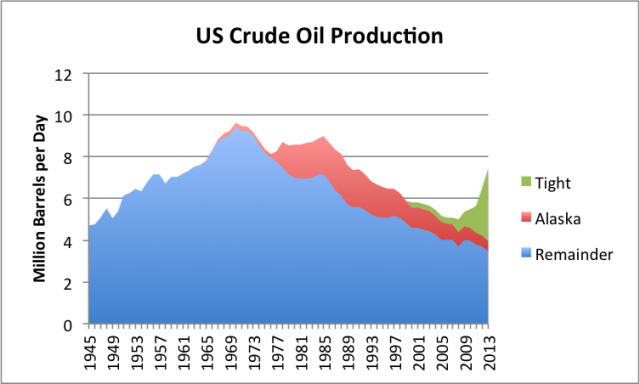

If economic growth is very low, this lack of growth can to some extent be covered up with very low interest rates. But such very low interest rates tend to be a problem as well, because they encourage asset bubbles of many sorts, such as the current run-up in stock market prices. It is not always clear which bubbles are being run up by low interest rates, either. For example, it is quite possible that the recent run-up in US oil extraction (see Figure 4, below) is being enabled by ultra-low interest rates debt (since this is a cash-flow negative business) and by investors who a desperate for an investment that might yield a slightly higher yield than current low bond yields.

Actually, the current need for growth to prevent defaults is not all that different from the situation in the past 800 years. In Reinhardt and Rogoff’s academic paper mentioned above, the authors remark, “It is notable that the non-defaulters, by and large, are all hugely successful growth stories.” Reinhardt and Rogoff didn’t seem to understand why this occurred, however.

6. The underlying reason regarding why we are headed toward debt problems is different from in the past. We now are dependent both on oil products and electricity, two very concentrated carriers of energy, instead of the more diffuse energy types used in the past. Our problem is that these energy carriers are becoming high-cost to produce. It is these high costs (a reflection of diminishing returns) that lead to economic contraction.

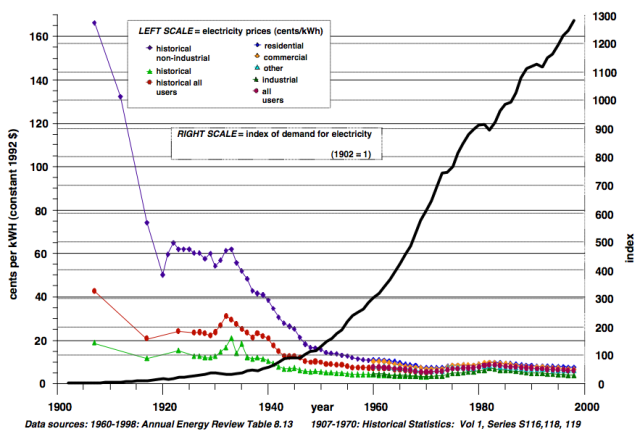

This time, in order to continue economic growth, we need a growing supply of very high-quality energy products, namely oil products and non-intermittent electricity, to support the economy that we have built. These products need to be low-priced, if customers are to afford them. Thus, it should not be surprising that economic growth in the past seems to have been driven by a combination of (1) falling prices of electricity as we learned to more efficiently produce it, and (2) continued low prices for oil.

Figure 2. Electricity prices and electrical demand, USA 1900 – 1998 from Accounting for Growth, the Role of Physical Work by Robert Ayres and Benjamin Warr, Structural Change and Economic Dynamics, February, 2004).

According to Ayres and Warr (Figure 2), power stations in 1900 converted only 4% of the potential energy in coal to electricity, but by 2000, the conversion efficiency was raised to 35%. This improvement in efficiency allowed the continuing decrease in electricity prices. With lower prices, more individuals and businesses were able to afford electricity, and more technology using electricity became feasible. Cheap electricity allowed goods to be produced at prices that workers could afford, and the system tended to grow.

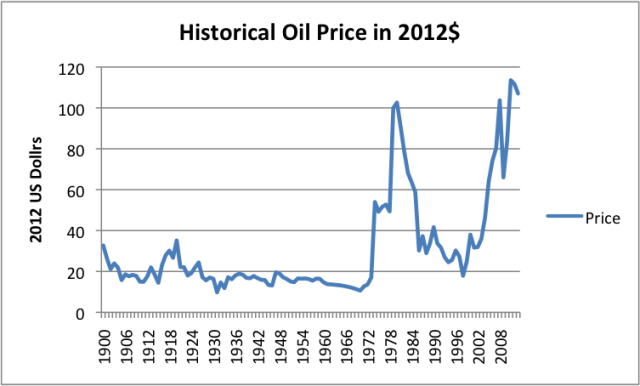

For oil, the price of oil remained relatively flat in inflation-adjusted terms for a very long time, even as engineers developed ever-more-efficient devices to use that oil.

Figure 3. Historical oil prices in 2012 dollars, based on BP Statistical Review of World Energy 2013 data. (2013 included as well, from EIA data.)

We ran into our initial problems extracting oil cheaply in the early 1970s, after US oil production started to decline (Figure 4).

Figure 4. US crude oil production split between tight oil (from shale formations), Alaska, and all other, based on EIA data. Shale is from AEO 2014 Early Release Overview.

Back in the 1970s, we were able to work around the price spike by bringing oil production online in several additional places, including the Alaska, the North Sea, and Mexico. Unfortunately, those areas are now declining as well. Thus, we are increasingly forced to extract oil from areas that are high priced either (a) because of high extraction costs (such as the tight oil now being extracted in the United States) or (b) because of high indirect costs (such as the need for desalination plants and food subsidies in the Middle East). These can only be funded if oil prices are high, allowing governments to collect high levels of taxes.

There is considerable evidence that high oil prices are associated with recession. The Great Recession of 2007-2009 was associated with a huge spike in oil prices. I have written about the way high oil prices contribute to recession in a peer-reviewed article published in the journal Energy called Oil Supply Limits and the Continuing Financial Crisis. James Hamilton has shown that has shown that 10 out of 11 US recessions since World War II were associated with oil price spikes. Hamilton also showed that the effects of the oil price spike were sufficient to cause the recession of that began in late 2007.

Now the cost of oil production is high, and electricity prices have stopped falling. We read U. S. electricity prices may be going up for good, from the L. A. Times. It should be no surprise that economic growth is now a problem.

7. In historical periods, defaults were mostly associated with the transfer of ownership of various productive assets (such as land and factories) from one owner to another. Now, we are vulnerable to changes that could ultimately cut off oil and electricity, and thus bring the system down–not just transfer ownership.

The kinds of things that could bring the system down are diverse. They include:

- War in the Middle East that would vastly disrupt oil exports. We do not have alternative suppliers–the world would have to do without part of its supplies. We are vulnerable now, because oil exporters are getting “squeezed” by prices that have not risen substantially since 2011. This makes it harder for Middle Eastern countries to fund their budgets, making wars and civil disorder more likely.

- A spike in oil prices, perhaps caused by a war in the Middle East, that would vastly disrupt oil exports. Oil importing countries would head back into recession, with many layoffs. Governments are in worse shape for fighting this situation than they were in 2007-2008.

- An increase in interest rates. While Quantitative Easing and Zero Interest rate policy may not look like they are doing much, an increase in interest rates would not work well at all. With higher interest rates, governments would owe more in interest payments, so would need to raise taxes (leading to recessionary effects). The monthly payments required for buying high-priced goods (from cars, to houses, to factories) would rise, cutting back on demand, also tending to lead to recession.

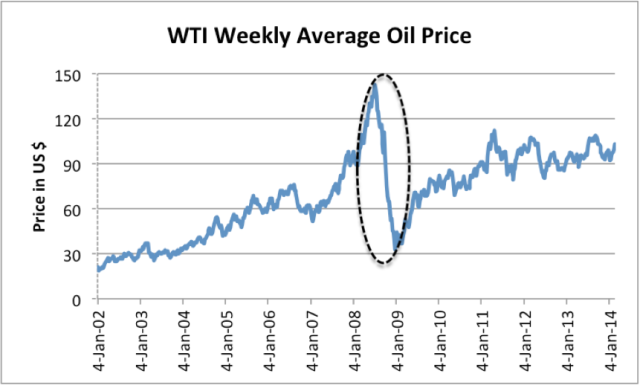

- A decrease in lending, or even a failure of debt to keep rising, would also be a problem. Janet Yellen’s recent IMF speech highlighted the possibility of using regulation to prevent excessive debt. Unfortunately, increasing debt is very much needed to keep oil prices high enough to enable extraction at today’s high cost levels. See my post The Connection Between Oil Prices, Debt Levels, and Interest Rates. If debt levels drop, we run the danger of oil prices dropping as dramatically as they did in late 2008, when lending froze up.

Figure 5. Oil price based on EIA data with oval pointing out the drop in oil prices, with a drop in credit outstanding.

8. The world is now filled with a large number of people in powerful positions who mistakenly think they know answers to questions, when they really do not. The problem is that researchers tend operate in subject-matter “silos.” They build models based on their narrow understanding of a problem. These models may temporarily work, but as we reach limits in a finite world, these models produce misleading results. The users of these models do not understand the problem and make decisions based on badly flawed models.

Economists do not understand energy issues. They seem to think that their models, which ignore energy issues, are fine. All they need to do is fine-tune regulation, or tweak interest rates, and everything will be fine. Unfortunately, these economic models no longer work, as I explained in a recent post, Why Standard Economic Models Don’t Work–Our Economy is a Network.

In fact, the issue is more basic than just bad models that economists are using. The whole “peer-reviewed paper” system, with its pressure to write more peer-reviewed papers, each resting on prior peer-reviewed papers, is flawed. Models are built and used endlessly, in part because that is the way things have been done in the past. Once an approach is used frequently, everyone assumes it is correct. Models can and do have short term-predictive power, but that fact does not mean that the approach works for the long term.

The problem we are running into is the fact the world is finite. Growth can’t continue indefinitely. The way that the physical world enforces the end to growth is not obvious, until we start hitting the limits. The limits are cost of production limits for oil and for our supply of stable grid electricity. (I have talked about selling prices, but selling prices are not really the limits, in themselves. It is the fact that with higher costs of production, either selling prices must go up, or profits and the ability to invest in new production must go down–that is the problem. Right now, the rising cost of production of oil is being hidden in prices that are too low for oil producers. So many assume we don’t have a problem. The issue of adequate government funding is also mixed into the price/cost of production issue.)

Models that are no longer correct fill every area of study, from actuarial models, to financial planning models, to economic models, to models forecasting future oil and gas production, to climate change models.

Some models are deceptively simple–the idea that the number of years of future production of oil (or gas or coal) can be estimated by [Amount of Resources / Current Annual Production] is a simple model. Unfortunately, this model doesn’t work, because we can never get enough investment capital to extract all of the fossil fuel that seems to be available–the price can never go high enough, and stay high enough. High prices simply bring on recession. See my post, IEA Investment Report – What is Right; What is Wrong.

In fact, it is pretty hard to find any model that continues to work, as we reach limits in a finite world. This is not intuitively obvious. If a model worked before, why wouldn’t it work now? Researchers and well-meaning leaders follow models that sort of worked in the past, but don’t really model the current situation. Thus, we have well-meaning leaders, doing their best to make things better, inadvertently making things worse. In a finite world, everything is “connected” to everything else, so things that look beneficial from one perspective can have a bad outcome viewed another way. For example, a reduction in carbon dioxide emissions from closing coal plants risks major electrical outages is New England and seems likely to raise electricity prices. Such changes push the economy toward recession, and perhaps ultimately toward collapse.

Governments are one area squeezed by higher oil and electricity costs. As governments cut back, whether these cut backs are in education, unemployment benefits, military spending, or healthcare spending, there are indirect effects on the economy as a whole. The problem is that government spending creates jobs. As government spending is cut, it pushes the economy toward contraction–even if part of today’s spending is clearly wasteful. It creates a conundrum–fixing one problem makes another problem worse.

Conclusion

We live in perilous times. We have leaders who think they know the answers but, in fact, they do not. The debt problems we face now are not just overspending problems; they are signs that we are reaching limits of a finite world. World leaders do not seem to understand this connection. It is not even clear that they understand the connection of debt problems to the need for cheap-to-produce, high-quality energy products.

World leaders are nevertheless convinced that they know the answers, based on complex, but very flawed, models. Unfortunately, actions taken based on these models have a good chance of making the situation worse rather than better. For example, trying to tie a world economy closer together, when it is already heading toward collapse, seems like a recipe for disaster.

I find Christine Lagarde’s use of numerology in her January 14, 2014 speech at the National Press Club Luncheon disturbing. Is she trying to signal some “in crowd” to make different decisions, in advance of a big IMF announcement? Or is numerology being used for prediction? Such an approach to forecasting would seem to be even worse than using models based on silos of limited understanding.