- BRL rises on prospect of USD sales

- Brazilian macro environment remains dismal

- EM currencies continue to tumble

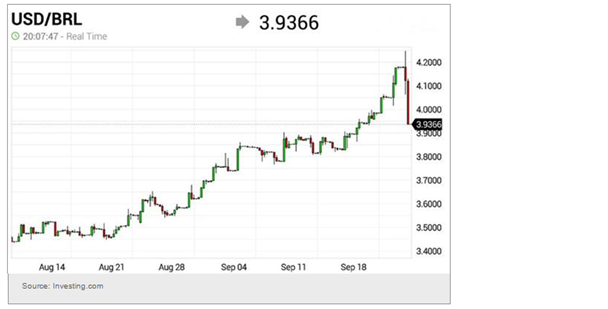

Let's begin with Brazil where the central bank has threatened to use FX reserves to buy the real. Previously Brazil had used "sterilised" interventions (such as FX swaps and dollar repo), which thus far have failed to stem the currency declines. The possibility of outright real purchases (dollar sales) did the trick.

This Brazilian central bank's action spilled across Latin America as the Mexican peso also strengthened after hitting a record low versus the USD.

It remains to be seen if the real stabilization can be sustained as other metrics point to a rapid deterioration in Brazil.

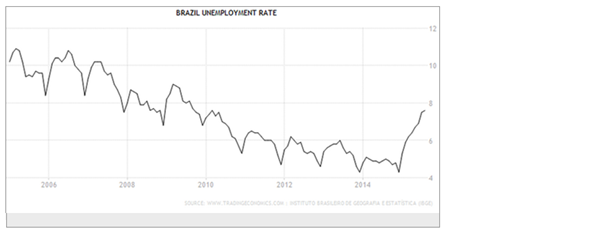

1. The unemployment rate jumped with the government implementing its austerity program. Up until recently Brazil was experiencing labor shortages.

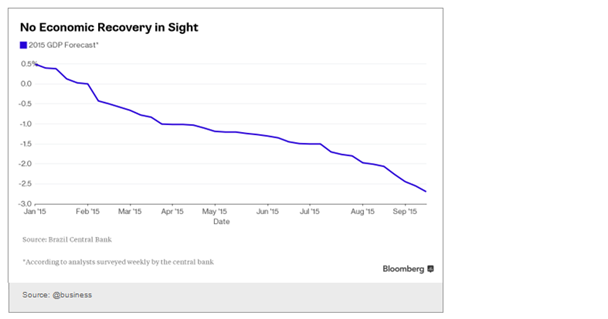

2. The GDP growth forecasts continue to decline as economists increasingly see a much deeper recession than originally thought.

3. Consumer confidence is collapsing.

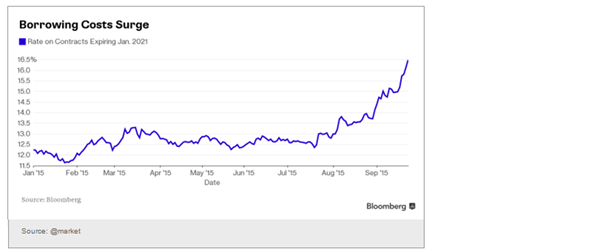

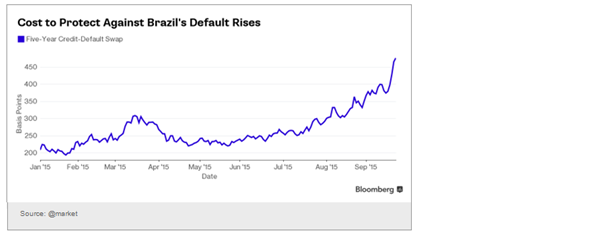

4. Market indicators also show pressure building. Here is the swap rate and the CDS spread.

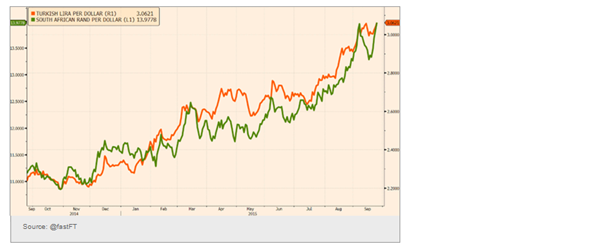

Other emerging market currencies remain under pressure. Here is the South African rand and the Turkish lira hitting fresh lows (USD hitting fresh highs against these currencies). The Malaysian ringgit continued to get clobbered as well.

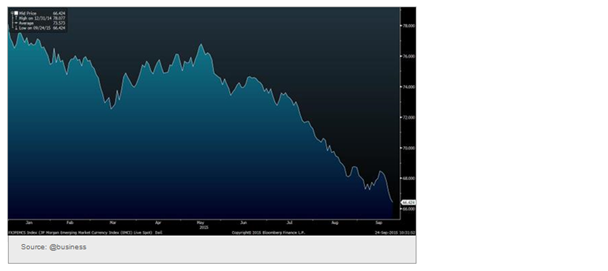

Here is the JPMorgan (NYSE:JPM) EM Currency Index.

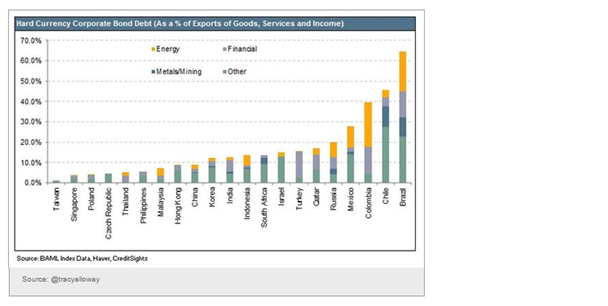

Corporate borrowing in dollars and euros has always been cheaper but now EM currencies' devaluation is becoming costly for firms whose revenues are mostly in domestic currencies. These companies' assets have been devalued relative to the liabilities.

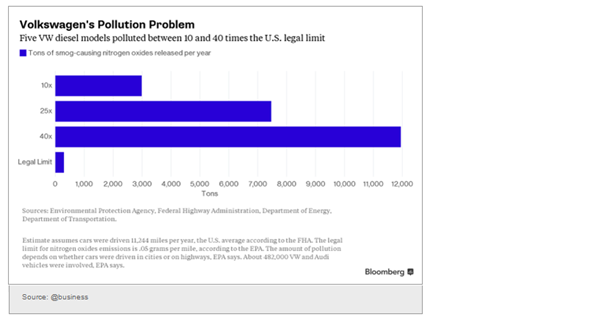

Turning to Food for Thought, Volkswagen (XETRA:VOWG_p) cars have done some serious polluting in the US. How can a firm like this ever return to the US market?

Disclosure: Originally published at Saxo Bank TradingFloor.com