Let's begin with China, where the latest economic reports show stabilisation. Retail sales, industrial production, fixed investments, and GDP (quarter-on-quarter) were all better than consensus.

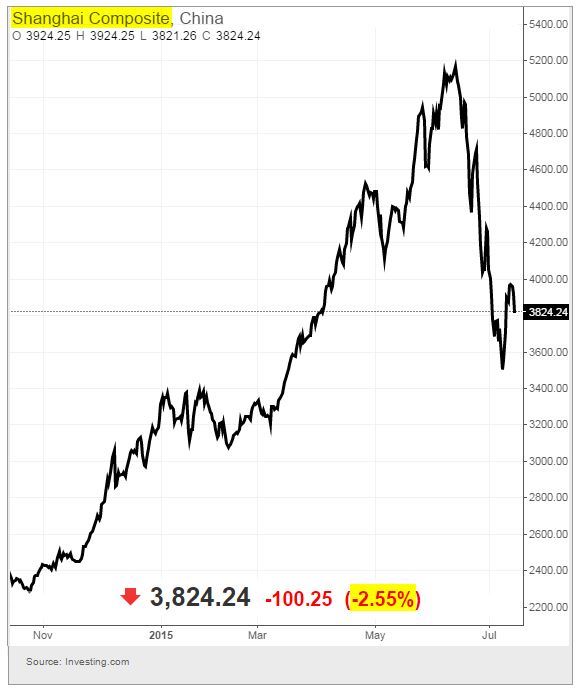

This was not what equity investors wanted to hear, as it may indicate lower chances of immediate fresh stimulus from the Peoples' Bank of China. The equity market took a hit.

On second thoughts, it was probably those evil foreigners illegally manipulating the market.

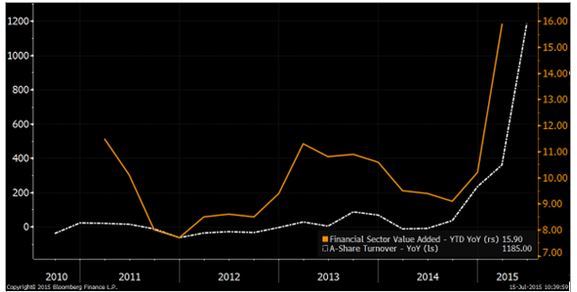

While the latest economic report from China is clearly positive, some have suggested that the rally in the equity markets (through June) created an artificial boost to growth. Brokers' profits spiked due to record trading volumes and rising margin financing, potentially helping GDP.

Of course, if that's the case, we should see a reversal soon.

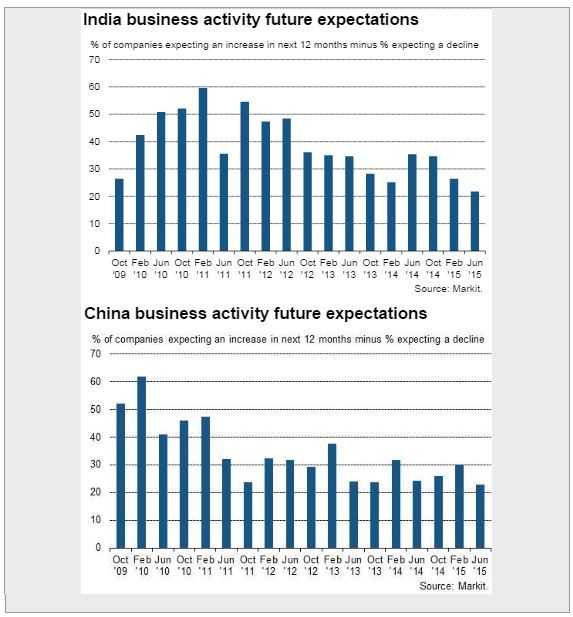

Speaking of China, Markit (NASDAQ:MRKT) came out with their latest corporate outlook survey results. India and China's business outlook hit the lowest level since 2009.

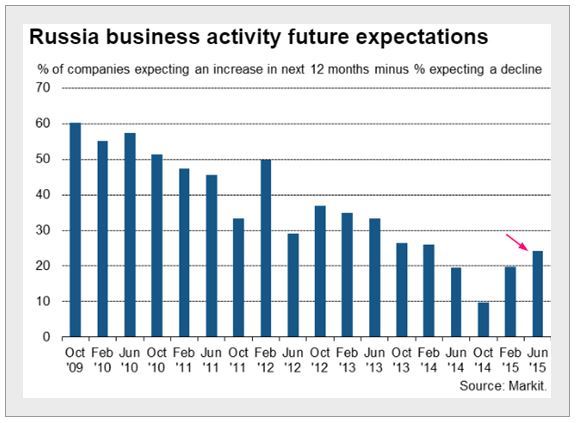

The Markit corporate survey for Russia shows stabilisation (which I discussed before).

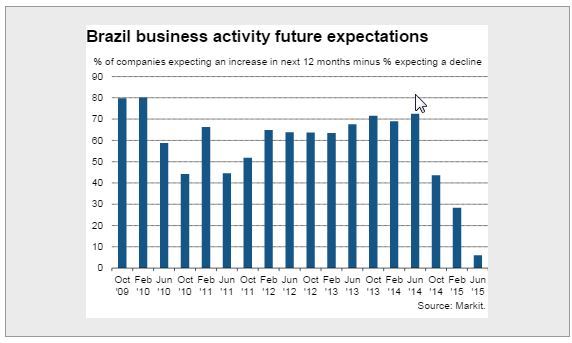

And then we have Brazil...

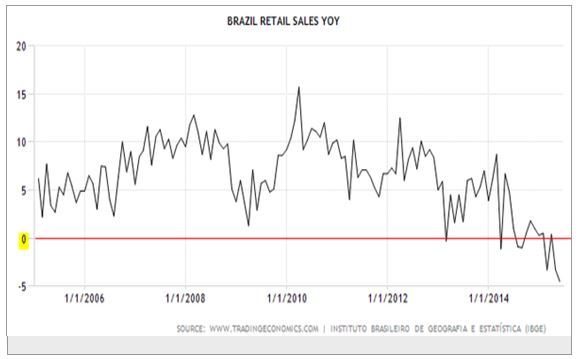

Also, Brazil's retail sales continue to deteriorate. This looks really ugly ...

In other Eurozone developments, we see the Greek crisis taking a bite out of economic sentiment in Germany and across the Eurozone.

Nevertheless, the European Central Bank lending survey shows continuing improvements in demand for credit in the Eurozone.

The area needs to solve the Greek situation soon in order to continue on this path.

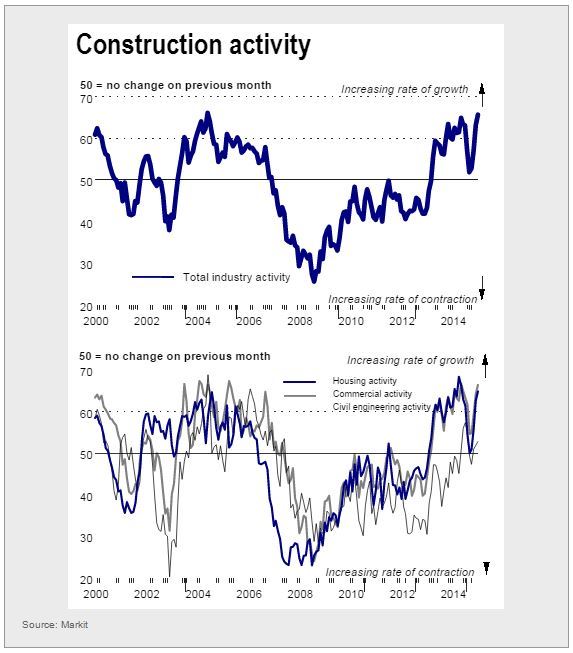

In another positive Eurozone development, Ireland's construction sector just had the sharpest rise in activity since 2004.

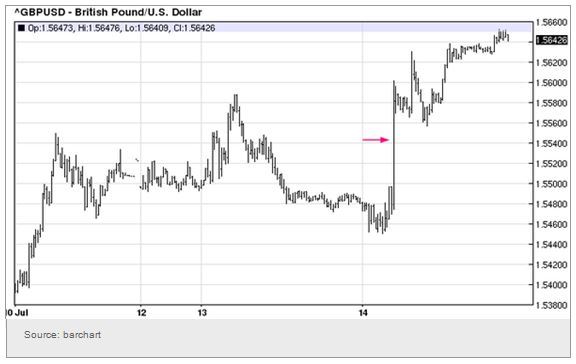

Switching to the UK, the British pound jumped on Mark Carney's talk of a rate hike getting "closer."

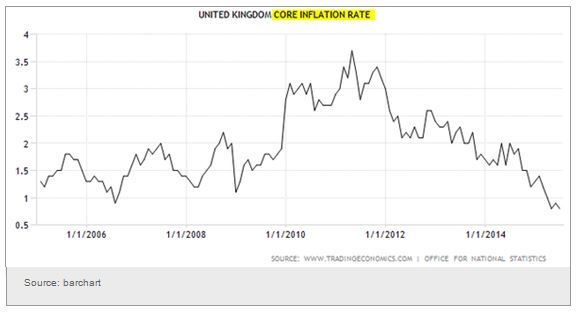

Has Carney seen the latest CPI report? The UK's disinflationary pressures continue to persist – here is the CPI and the "core" CPI chart. I don't think Carney is ready to raise rates just yet.

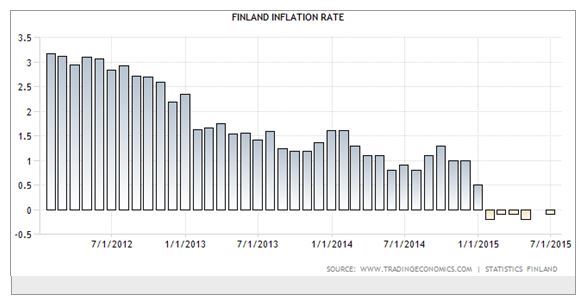

Speaking of CPI, Finland is still in deflation.

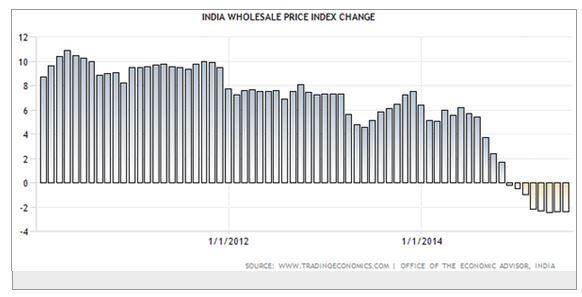

India's wholesale (WPI) deflation continues as well. Some argue that this is irrelevant for the Reserve Bank of India's policy because the central bank focuses on the CPI figures. And the latest CPI report showed an increase. However, that was an aberration (driven in part by a sharp increase in the price of pulses) – the falling WPI will bring consumer price growth lower. With credit and investment growth continuing to moderate, a rate cut could be in the works early next year.

Disclosure: Originally published at Saxo Bank TradingFloor.com