EURUSD

The Euro bounced from 1.24 zone, where higher low was left, clearing 1.2450, Fibonacci 38.2% of 1.2597/1.2360 / broken bull-trendline resistance, to crack 1.2478, daily Tenkan-sen, on approach important 1.25 barrier, Fibonacci 61.8% / former higher base. Gains were so far limited at 1.2485, where daily 10/20SMA’s are intersecting. Yesterday’s positive close, along with positively aligned hourly studies, sees potential for attempt through 1.25 hurdle. Break and close above here to bring the pair in more comfortable position for eventual attempt at 1.26 breakpoint. However, caution is required, as overall picture remains bearish and failure to clear 1.25 barrier would signal further consolidation, with increased downside risk seen on a break below 1.2450, now support. Loss of pivotal 1.24 handle will signal an end of corrective phase and lower top formation.

Res: 1.2500; 1.2541; 1.2566; 1.2597

Sup: 1.2456; 1.2445; 1.2400; 1.2371

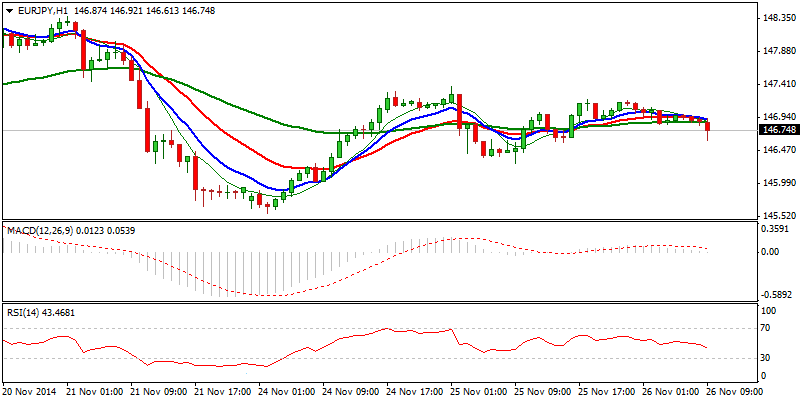

EURJPY

Yesterday’s Doji signals hesitation, after recovery rally from 145.57 low peaked at 147.35 and entered triangular consolidation. Hourly studies are losing traction and 4-hour structure is weak, which, along with daily indicators, descending from overbought zone, would signal fresh weakness. Loss of initial support and higher low at 146.28, to increase risk of return to pivotal 145.57 support and confirm failure swing formation , on a break, for extension of corrective pullback from 149.12. Conversely, holding above 146.28 handle, would signal prolonged consolidative action, with hope of fresh attempts higher in play. Break above 147.35 to confirm near-term bulls for test of 148.00 and 148.41 lower tops.

Res: 147.00; 147.19; 147.35; 147.75

Sup: 146.58; 148.28; 146.00; 145.57

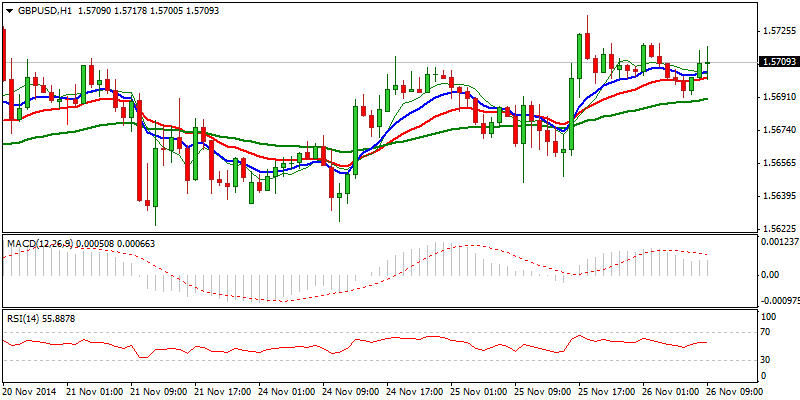

GBPUSD

Cable remains in extended consolidative phase above fresh lows at 1.5590. Yesterday’s close in Doji, signals that despite bullishly aligned near-term structure and break above daily 10SMA, the pair is lacking strength for final push through consolidation ceiling at 1.5735. Break here and 1.5800, Fibonacci 61.8% of 1.5939/1.5888 / daily 20SMA, is required to resume bulls and expose pivotal 1.5939 barrier. Otherwise, expect extended directionless trading on a failure at 1.5735, with increased downside risk, in case of fresh easing below 1.5650, into range’s lower part.

Res: 1.5719; 1.5735; 1.5765; 1.5805

Sup: 1.5691; 1.5650; 1.5624; 1.5590

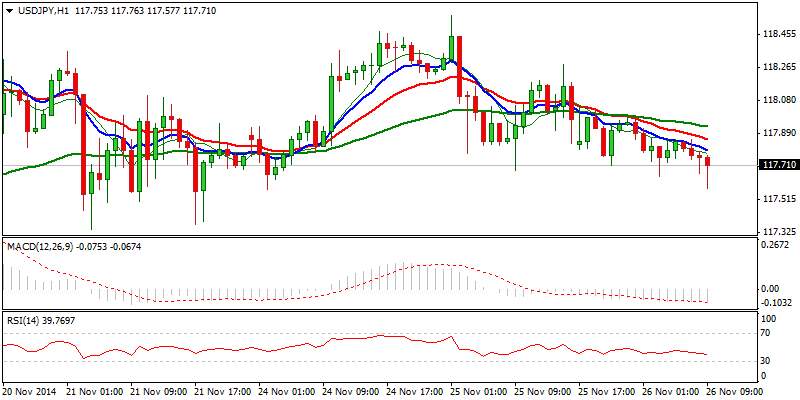

USDJPY

Near-term structure weakens, as recovery attempts off 117.33 low, where the pair attempts higher base, stalled at 118.56 and subsequent easing threatens return to 117.33 base. Yesterday’s close in red confirm near-term weak tone and signals of renewed attack at 117.33, loss of which to confirm lower top formation for extension of corrective phase off 118.96 peak. Prolonged consolidation to be expected while 117.33 holds, however, only break above 118.56 peak would bring bulls back fully in play.

Res: 118.00; 118.28; 118.56; 118.71

Sup: 117.56; 117.33; 117.00; 116.33

AUDUSD

Near-term structure remains negative, as the pair eventually broke below pivotal 0.8539 support and approached psychological 0.85 level. Completion of near-term 0.8539/0.8794 corrective phase, suggests resumption of larger downtrend, with immediate target at 0.8460, bear-trendline, connecting 2008 peak at 0.9848 and Jan 2014 low at 0.8658 and psychological 0.80 support, expected to come in near-term focus. Corrective attempts from fresh lows above 0.85 handle, should not exceed 0.8640, Fibonacci 61.8% of 0.8720/0.8511 descend, to keep bears intact.

Res: 0.8567; 0.8605; 0.8618; 0.8640

Sup: 0.8530; 0.8511; 0.8500; 0.8460

AUD/NZD

The pair eventually broke below near-term congestion floor and pivotal support at 1.0931, to end yesterday’s trading in red and ticks above 200SMA. Today’s fresh weakness below pivotal 1.0914, low of Sep 2014 and 1.09, round-figure support, confirms an end of short-term congestive phase, with fresh bears requiring daily close below, to be confirmed. Former range floor now offers initial barrier, with extended corrective rallies, expected to hold below 1.0984 lower top and yesterday’s high.

Res: 1.0931; 1.0962; 1.0984; 1.10000

Sup: 1.0880; 1.0850; 1.0800; 1.0780

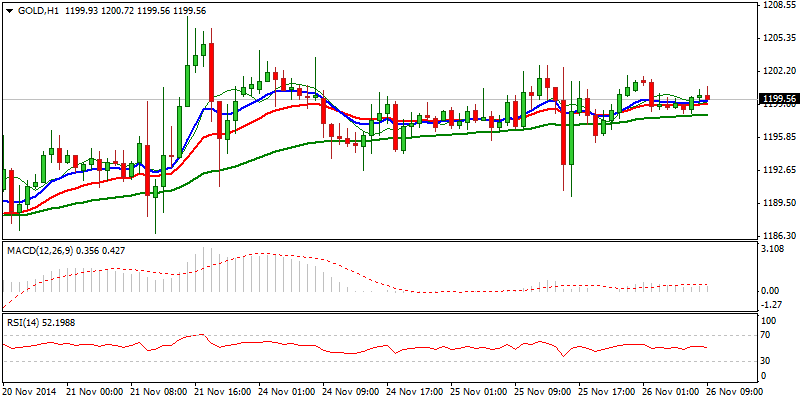

XAUUSD

Spot Gold remains positively aligned in the near-term, but continues to hold under psychological 1200 barrier, following several unsuccessful attempts higher, which keeps pivotal 1204/07 barriers intact for now. Hourly studies are neutral, with 4-hour technicals maintaining positive tone and daily 10/20SMA’s bull-cross at 1179, underpinning. Break and close above 1207 hurdle, to confirm bullish resumption. Only break below initial 1190 support, would delay bulls for corrective pullback. Key support at 1175 higher base, should hold extended dips.

Res: 1200; 1204; 1207; 1214

Sup: 1195; 1190; 1186; 1179

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Market Outlook: November 26, 2014

Published 11/26/2014, 04:57 AM

Updated 02/21/2017, 08:25 AM

Daily Market Outlook: November 26, 2014

FinFX

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.