GBP/JPY Daily Outlook

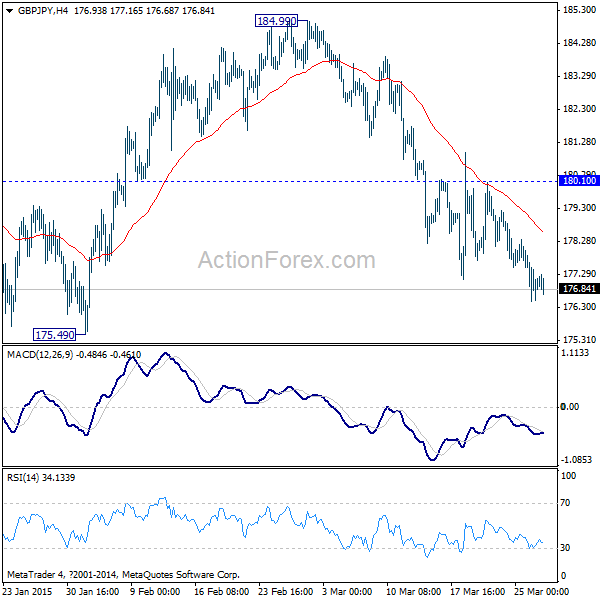

Daily Pivots: (S1) 176.32; (P) 177.12; (R1) 177.76;

Intraday bias in GBP/JPY remains on the downside for 175.49 support first. Break will extend the fall from 189.70 to 168.10 key support level next. Above 181.44 will indicate that fall from 184.99 has completed and will turn bias back to the upside for this resistance.

In the bigger picture, the up trend from 116.83 lost much medium term momentum with bearish divergence condition seen in weekly MACD. Medium term top could be around the corner, if not formed. Break of 168.01 support will confirm this bearish case and bring deeper correction. Though, as long as 168.01 holds, the up trend could still extend to 61.8% retracement of 251.09 to 116.83 at 199.80, which is close to 200 psychological level.

EUR/JPY Daily Outlook

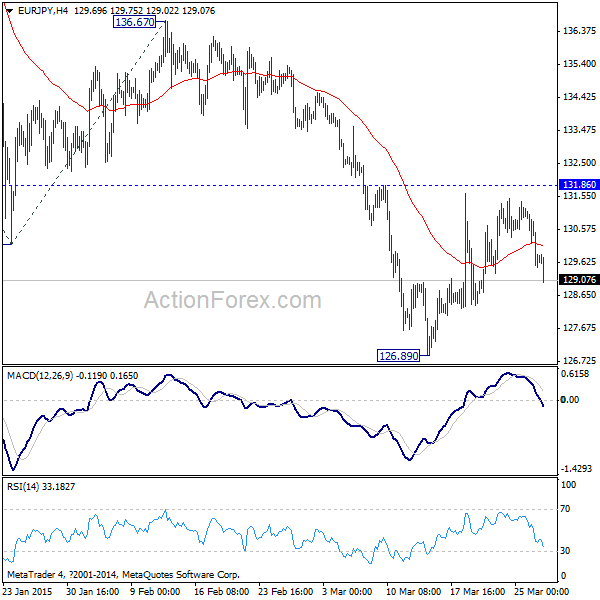

Daily Pivots: (S1) 130.63; (P) 131.02; (R1) 131.46;

Intraday bias in EUR/JPY remains neutral for the moment. With 131.86 intact, recent decline is expected to resume sooner rather than later. Below 126.89 will target 61.8% projection of 149.76 to 130.13 from 136.67 at 124.53 next. However, break of 131.86 will indicate short term bottom and bring stronger rebound to 136.67 resistance.

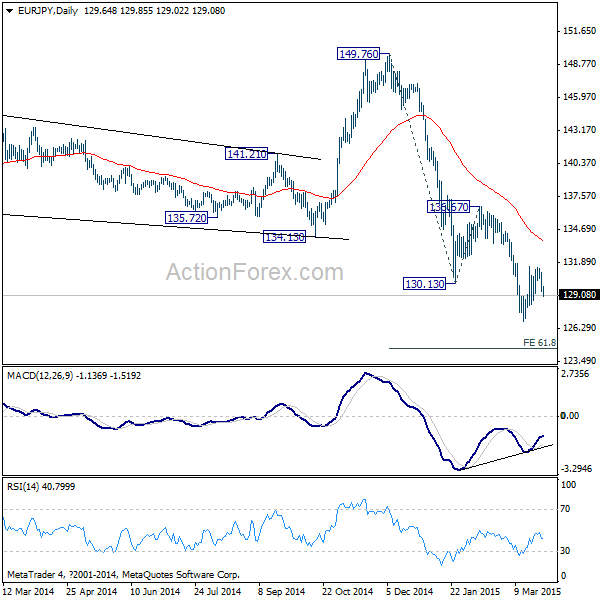

In the bigger picture, the correction from 149.76 medium term top is still in progress and took out 38.2% retracement of 94.11 to 149.76 at 128.50 already. Such fall would now extend to 61.8% retracement at 115.36, which we might find strong support. In any case, outlook will stay bearish as long as 136.67 resistance holds and deeper decline is expected.