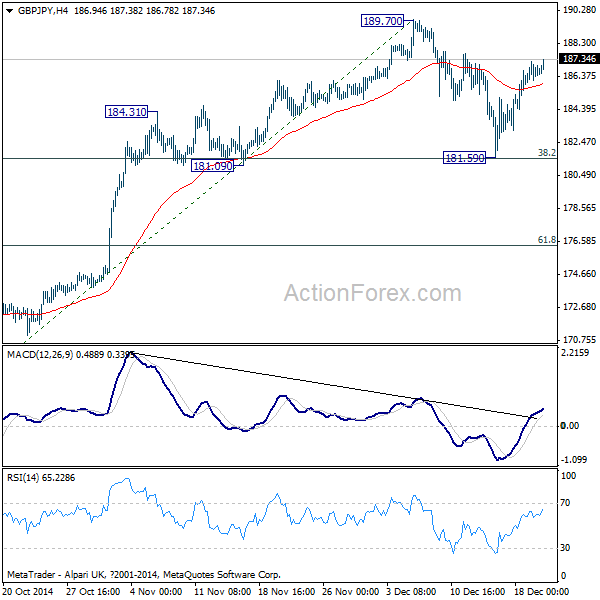

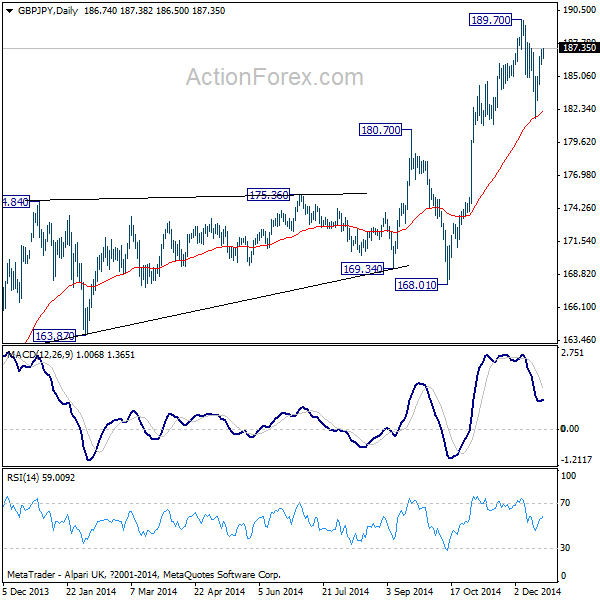

GBP/JPY Daily Outlook

Daily Pivots: (S1) 186.05; (P) 186.64; (R1) 187.26;

Intraday bias in GBP/JPY remains mildly on the upside for retesting 189.70. Break there is needed to confirm rally resumption. Otherwise, we'd expect more corrective trading in near term. In case of another decline, we'd expect strong support from 181.09, 38.2% retracement of 168.01 to 189.70 at 181.41, to contain downside and bring rebound.

In the bigger picture, the up trend from 116.83 is still in progress for 61.8% retracement of 251.09 to 116.83 at 199.80, which is close to 200 psychological level. On the downside, break of 168.01 support is needed to confirm medium term topping. Otherwise, outlook will stay bullish in case of pull back.

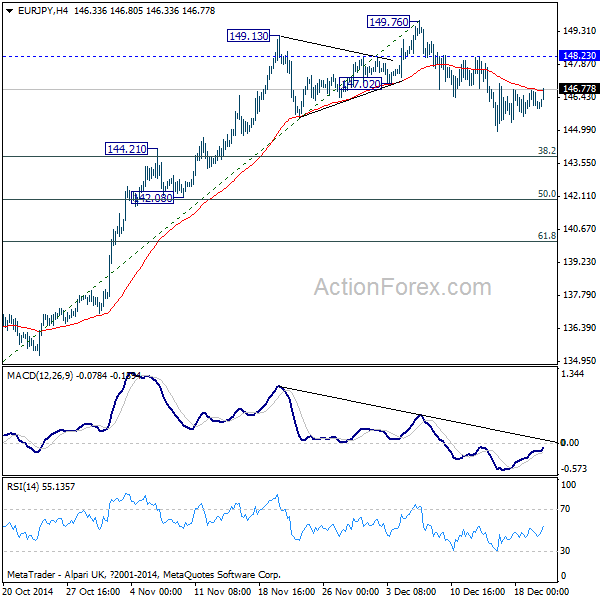

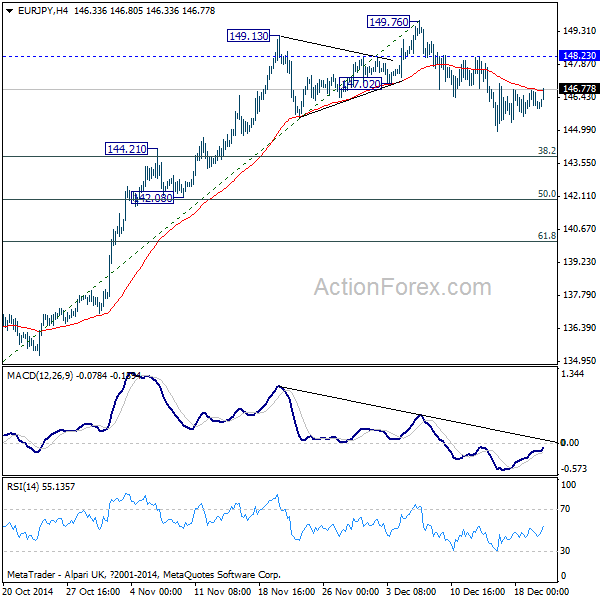

EUR/JPY Daily Outlook

Daily Pivots: (S1) 145.74; (P) 146.24; (R1) 146.55;

With 148.23 minor resistance intact, correction from 149.76 is expected to extend lower. At this point, we'd expect strong support from 142.08, 50% retracement of 134.13 to 149.76 at 141.94, to contain downside and bring rebound. On the upside, above 148.23 minor resistance will turn bias back to the upside. But break of 149.76 is needed to confirm rally resumption. Otherwise, we'd expect more corrective trading in near term.

In the bigger picture, the up trend from 94.11 long term bottom is still in progress for 76.4% retracement of 169.96 to 94.11 at 152.59 next. Break of 152.59 will target a test on 169.96 (2008 high). On the downside, break of 134.13 is needed to confirm medium term reversal. Otherwise, outlook will stay bullish.