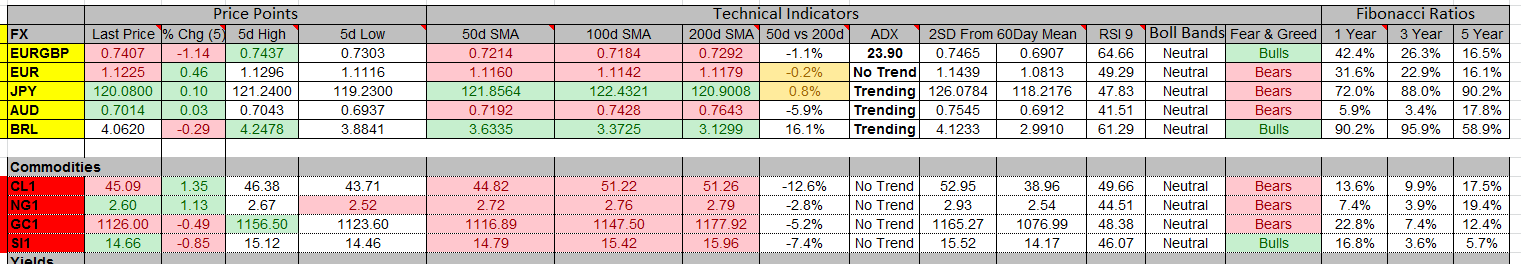

Currencies

- EUR/USD: The pair is trading in a descending triangle pattern on a 4 hour time frame. The next resistance is at 1.146 and the support is at 1.1024.

- USD/JPY: The pair is trading in a symmetrical triangle pattern on a 4 hour time frame. The next resistance is at 124.13 and the support is at 115.92.

- GBP/USD: The pair has bounced from its support zone of 1.5087-1.5132 (which we MENTIONED yesterday) on a 4 hour time frame. The resistance is near the 1.5232 and the next support is at 1.508

Indicators

- Asian Markets closed higher on the final trading day of the week. The Nikkei index was the best performing index with a gain of 0.01% and over the last 5 days it is up by 0.87%.

- European markets are trading higher during the early hours of trading. The CAC40 index is the best performing index during the session and it is trading higher by 1.30%. The index is up nearly 3.05% nearly during the past five days.

- US futures are trading higher ahead of the ISM manufacturing data. The S&P index was the best performer during the last session and it closed higher by 0.21%.

TOP News

- The Australian retails sales m/m came in at 0.4 matching the forecast.

- The Spanish unemployment change data fell short of expectations with the reading og 26.1K while the forecast as 17.9K.

- The UK construction PMI came well ahead of forecast with the number of 59.5. The forecast was for 57.5.

Things to Remember

- Use your stops and manage the risk

Market Sentiment

- Crude Oil: The black gold has formed a symmetrical triangle pattern on a 4 hour time frame. The next support is at 43.50 and the resistance is at 49.

- Gold: The precious metal is trading below its 50 and 100 day moving average on a 4 hour time frame. The next support is at 1100 and the resistance is at 1130.

- The VIX index dropped nearly 8.68% during the last session.

Top Economic data

08:30 GMT

GBP – Construction PMI

12:30 GMT

USD Non- Farm Employment Change

12:30 GMT

USD Average Hourly Earnings m/m

12:30 GMT

USD Unemployment Rate

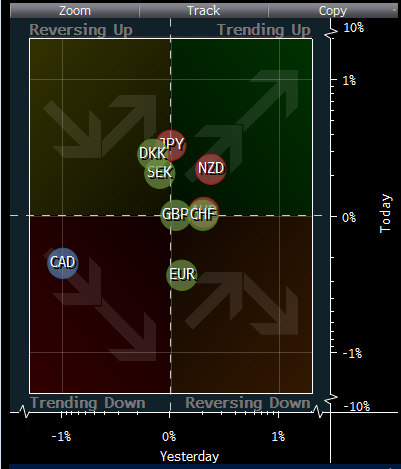

Trends

The below chart shows NZD, JPY and AUD are trading higher against the USD.

DISCLOSURE & DISCLAIMER: The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.

by Naeem Aslam