The holiday week saw the dollar consolidate against most of the major currencies. The yen was the main exception as its losses were extended under the aggressive signals coming from the new Japanese government.

At the end of the week, the other key consideration, the US fiscal cliff made its presence felt. The recent pattern remained intact. News that gives the participants a sense that the cliff may be averted encourages risk taking, which means in the foreign exchange market, the sale of dollars and yen.

News that makes participants more fearful that the political dysfunction failed to avert the cliff and will send the world's largest economy into recession, generally sees the dollar and yen recover. This is what happened in very thin markets just ahead of the weekend as Obama's last ditch negotiating stance seemed to reflect a retreat from his earlier compromises.

While negotiations will continue over the weekend, time is of the essence and a vote in the Senate could be held Sunday December 30. With Tokyo markets closed on December 31, liquidity may be even thinner than it has been in recent days, which could make for some dramatic price action.

The debt ceiling, which is a separate issue from the fiscal cliff, does not appear likely to be resolved as the Republicans seem likely to hold on to it as part of the political fight with the President. It means that the navel-gazing, rancorous fighting, largely over relatively small differences will not end with whatever fiscal compromises are struck in the coming days/weeks.

The new week then begins with fiscal wrangling in the US and finishes with the December jobs data. Although the US economy appears to have slowed considerably in Q4 from the 3.1% annualized pace in Q3, private sector job growth should remain near the recent (3-month) trend near 150k, which is above the H2 average of about 136k. In addition, December auto sales are expected to remain at relatively elevated levels, near the four-year high set in November.

The monthly purchasing managers' surveys will also be released. Taken together, they will likely show that Europe and Japan remain in contracting modes, while slow growth is still evident in the US.

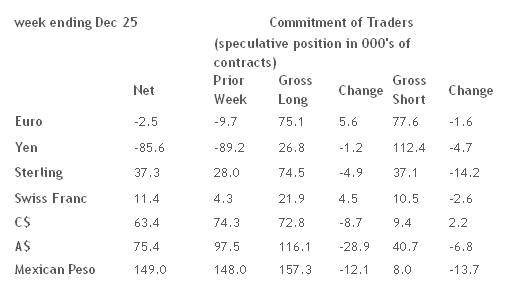

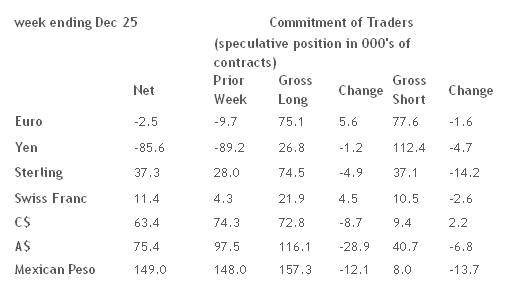

Given the lighter participation in the foreign exchange market due to the holiday and year-end considerations, it is difficult to find strong signals in the recent price action, which was largely consolidative in nature. As the table below illustrates, both longs and shorts moved to the sidelines in most of the currency futures. The exceptions were the euro and Swiss franc futures, where small new longs were established and small shorts were covered.

The Canadian dollar was the other exception, where longs were cut and shorts grew. The dollar-bloc more generally lagged behind the European currencies in the modest moves against the US dollar. The weakness of the yen, driven by both carry and momentum strategies, and the recovery in the Chinese stock market (amid talk of more economic and financial support for the economy) did not bolster the Australian dollar.

On balance, we are hesitant to attribute too much significance to the recent price action, but anticipate additional near-term dollar losses.

At the end of the week, the other key consideration, the US fiscal cliff made its presence felt. The recent pattern remained intact. News that gives the participants a sense that the cliff may be averted encourages risk taking, which means in the foreign exchange market, the sale of dollars and yen.

News that makes participants more fearful that the political dysfunction failed to avert the cliff and will send the world's largest economy into recession, generally sees the dollar and yen recover. This is what happened in very thin markets just ahead of the weekend as Obama's last ditch negotiating stance seemed to reflect a retreat from his earlier compromises.

While negotiations will continue over the weekend, time is of the essence and a vote in the Senate could be held Sunday December 30. With Tokyo markets closed on December 31, liquidity may be even thinner than it has been in recent days, which could make for some dramatic price action.

The debt ceiling, which is a separate issue from the fiscal cliff, does not appear likely to be resolved as the Republicans seem likely to hold on to it as part of the political fight with the President. It means that the navel-gazing, rancorous fighting, largely over relatively small differences will not end with whatever fiscal compromises are struck in the coming days/weeks.

The new week then begins with fiscal wrangling in the US and finishes with the December jobs data. Although the US economy appears to have slowed considerably in Q4 from the 3.1% annualized pace in Q3, private sector job growth should remain near the recent (3-month) trend near 150k, which is above the H2 average of about 136k. In addition, December auto sales are expected to remain at relatively elevated levels, near the four-year high set in November.

The monthly purchasing managers' surveys will also be released. Taken together, they will likely show that Europe and Japan remain in contracting modes, while slow growth is still evident in the US.

Given the lighter participation in the foreign exchange market due to the holiday and year-end considerations, it is difficult to find strong signals in the recent price action, which was largely consolidative in nature. As the table below illustrates, both longs and shorts moved to the sidelines in most of the currency futures. The exceptions were the euro and Swiss franc futures, where small new longs were established and small shorts were covered.

The Canadian dollar was the other exception, where longs were cut and shorts grew. The dollar-bloc more generally lagged behind the European currencies in the modest moves against the US dollar. The weakness of the yen, driven by both carry and momentum strategies, and the recovery in the Chinese stock market (amid talk of more economic and financial support for the economy) did not bolster the Australian dollar.

On balance, we are hesitant to attribute too much significance to the recent price action, but anticipate additional near-term dollar losses.