Talking Points:

- US Dollar Gaps Upward to Start the Week, Hits 1-Month High

- S&P 500 Declines to the Lowest Since April Amid Greece Woes

- Gold Treading Water as Crude Oil Drops to Three-Month Low

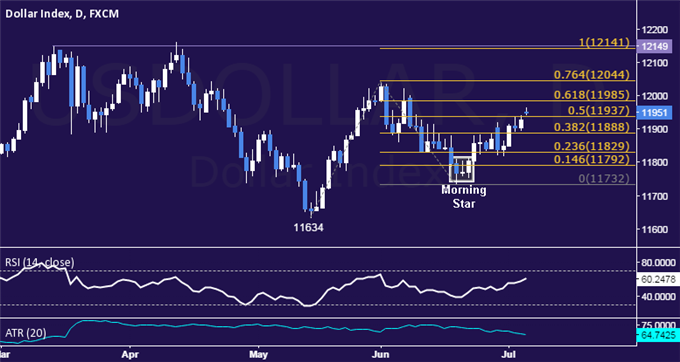

US DOLLAR TECHNICAL ANALYSIS – Prices advanced as expected after putting in a bullish Morning Star candlestick pattern. Near-term resistance is at 11985, the 61.8% Fibonacci expansion, with a break above that on a daily closing basis exposing the 76.4% level at 12044. Alternatively, a move below the 50% Fib at 11937 opens the door for a challenge of the 38.2% level at 11888.

S&P 500 TECHNICAL ANALYSIS – Prices turned lower anew, resuming an expected downturn following a brief correction higher. A break below the 38.2% Fibonacci expansion at 2058.60 exposes the 50% level at 2049.80. Alternatively, a move above the 23.6% Fib at 2069.50 targets the 14.6% expansion at 2076.20.

GOLD TECHNICAL ANALYSIS – Prices continue to consolidate in familiar territory after probing the lowest level in four months. A daily close below the 61.8% Fibonacci expansion at 1162.64 exposes the 76.4% level at 1152.47. Alternatively, a move above the 50% Fib at 1170.86 targets the 38.2% expansion at 1179.07.

CRUDE OIL TECHNICAL ANALYSIS – Prices continue to press downward after clearing trend line support, dipping to the lowest level in nearly three months. A daily close below the 38.2% Fibonacci retracement at 60.27 exposes the 50% level at 57.39. Alternatively, a turn back above the April 21 low at 61.63 targets falling trend line resistance at 63.97.