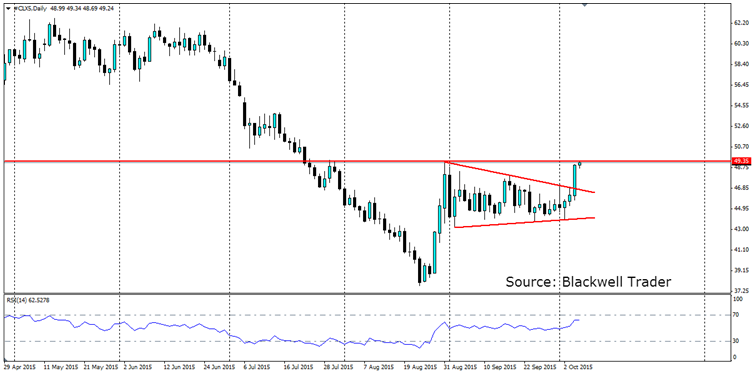

The range consolidating pattern that crude has been stuck in for the past month has been breached by an upside breakout on optimism that global supply might be curtailed. The rally has met some fierce resistance which could provide a short term opportunity for traders.

The breakout came on the back of some bullish news that could lead to higher long term prices. Russia announced that it was willing to meet with both OPEC and non-OPEC nations to discuss the long term stability of prices. Russia has been reluctant to curb their production as it has become even more reliant on oil export receipts ever since sanctions were imposed by the west.

More bullishness came from the American Petroleum Institute crude inventories report which showed a significant fall in oil stockpiles by 1.2 million barrels. This was a bit of a surprise for the market which is expecting inventories to build during October thanks to the seasonal shutdown of US oil refineries. The market will be watching the official EIA figures due in the US session tomorrow for further bullish cues. At the moment the market expects an inventory build of 2.5m barrels.

The last of the bullishness came from the EIA’s world demand forecast. They released their latest predictions which suggested demand would continue to pick up in 2016 with demand rising 100kbpd to 1.41mbpd. That may see a higher long term crude price, but a lot will depend on how China’s economy shapes up over the rest of the year. Any further slowing and crude prices could be in trouble.

On the whole, there is enough to cause a bullish breakout of the range, but nothing to really suggest a fundamental change in the oversupply. In fact, the magical $50 a barrel mark for WTI is generally considered the breakeven point for US shale producers. If prices breach the $50 mark, production in the US could ramp up again as producers respond to the healthier bottom lines.