Crude Hangs Hopes On Bullish Inventories Report

Crude Oil has managed to regain its footing in Asian trading today as investors turn to upcoming US inventories data for guidance. Meanwhile, the precious metals remain in a precarious position as fading geopolitical concerns threaten the allure of the safe-haven assets.

The WTI and Brent Oil benchmarks faced another barrage of selling pressure on Tuesday. An absence of fresh oil impacting news flow from the Middle East has likely eased fears over supply disruptions from the region. This may leave the commodity to turn its attention back to the US and the upcoming DOE Weekly Petroleum Status Report for its bearings.

Recent figures from the government agency have painted a somewhat mixed picture. The latest round of data revealed a rise in total stockpiles, which remain well above their seasonal average. Yet, a drawdown in gasoline and distillate inventories also suggests robust demand for the commodity. Another ensemble of mixed figures may fail to spur a sustained recovery for crude. However, given the extent of the commodity’s recent declines the potential for a corrective bounce should not be overlooked.

Precious Metals Exposed As Geopolitical Concerns Ebb

Gold and Silver have managed to catch their breath during the Asian session today after sustaining further declines on Tuesday. An unwinding of safe-haven positioning in the precious metals was compounded by a buoyant greenback following a positive set of US housing figures.

The yellow metal remains vulnerable to a continued correction in the absence of an escalation on the geopolitical front. However, lingering uncertainty surrounding Eastern Europe may still offer a small source of support which could help slow gold’s descent.

The Fed’s July Meeting Minutes may also offer the metals some guidance from the US Dollar side of the equation. Traders will be scrutinizing the communique to gauge the degree of policy maker’s concerns surrounding the US labor market. The greenback may struggle to sustain a recovery if a dovish tone is retained, which in turn could see some of the weight lifted from gold’s back.

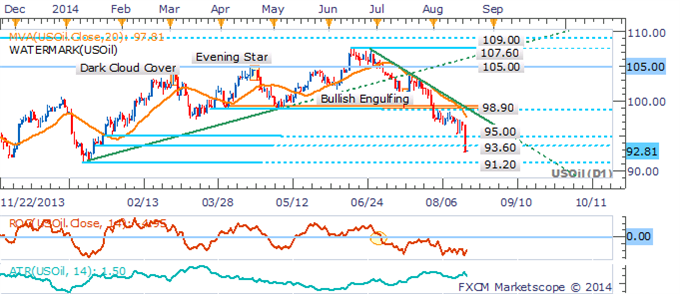

CRUDE OIL TECHNICAL ANALYSIS

Downside risks remain for crude over the coming weeks with a backdrop of a sustained downtrend alongside negative momentum (signaled by the ROC). However, given the speed and magnitude of the commodity’s descent, the potential a short-term corrective bounce should not be neglected. A daily close above the descending trendline and 98.90 barrier would be required to signal a shift in sentiment to the upside and to mark a small base.

Crude Oil: Facing Further Weakness With Downtrend Intact

GOLD TECHNICAL ANALYSIS

Gold has managed to post a daily close below the 1,305 floor that had kept the precious metal supported over recent weeks. This makes for a convincing break which casts the immediate risks lower. Sustained weakness would likely be met by buying interest near the July lows at 1,280. Meanwhile, a climb back within the 1,305 to 1,320 trading band would suggest a renewed range-bound environment.

Gold: Daily Close Below 1,305 Opens Knock On 1,280

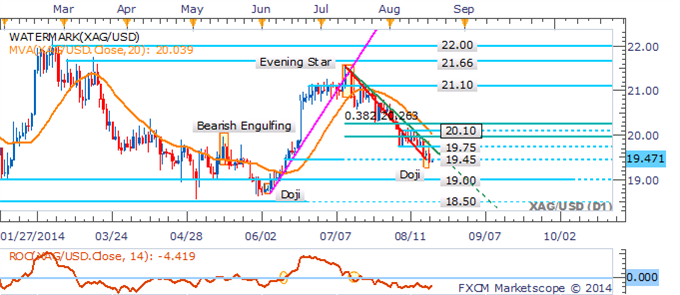

SILVER TECHNICAL ANALYSIS

Silver may be set to continue its journey towards the 19.00 target that had been offered in recent commodities reports. The sustained presence of a short-term downtrend on the daily reinforces the prospect of further weakness for the precious metal. A daily close above the descending trendline and 20.10 ceiling would be required to shift the bias to the upside.

Silver: Targeting 19.00 Handle With Downtrend Intact

Copper TECHNICAL ANALYSIS

The spotlight remains on the $3.00/01 floor following a failure to climb back over the 3.12 hurdle. Bearish technical signals including the double top formation and sustained presence of a downtrend also remain for the base metal. The prospect of a sustained recovery seems questionable at this point after a Piercing Line pattern failed to find much follow-through.

Copper: Downside Risks Remain Sub 3.12

PALLADIUM TECHNICAL ANALYSIS

Palladium has retreated slightly after hitting the 900 target that was offered in recent reports. An Evening Star formation on the daily warns of a correction, yet awaits confirmation from an ensuing down session. At this stage buying dips is preferred against the backdrop of a core uptrend.

Palladium: Evening Star Warns Of A Correction Within Uptrend

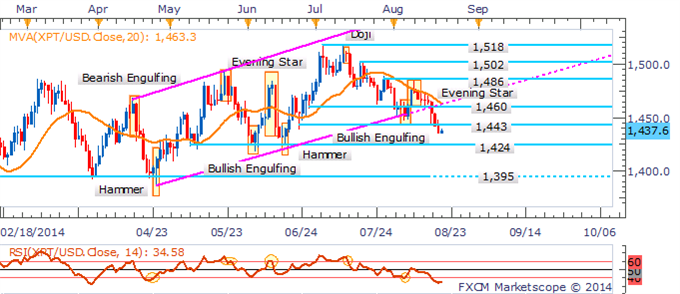

PLATINUM TECHNICAL ANALYSIS

Platinum may face further weakness following its clearance of the ascending trend channel on the daily. This is reinforced by the sustained presence of a downtrend (denoted by the 20 SMA), as well as an Evening Star formation near 1,486. A daily close below the nearby 1,443 barrier opens the July lows near 1,424.

Platinum: Crashes Through Trendline Support