- Greece set to default if no bailout agreement is reached

- Focus remains on Greek referendum on July 5

- A vote for “No” likely to cause significant market volatility

Greek negotiations with the Euro Working Group (EWG) took a sharp turn for the worse as Greek representatives walked away from the negotiating table and called for a national referendum ahead of a key deadline. As of June 30, Greece is fast on its way towards technical default as it misses a payment to the International Monetary Fund. What are the next critical deadlines for the at-risk Hellenic government and broader markets? Here are some of the dates to watch in the weeks and months ahead.

Key Dates for Greece Continue to Warn of Substantial Volatility

It seems as though the Greek Government has had a critical deadline in every single one of the past number of weeks, and still it remains solvent and a decline in euro and broader financial market volatility suggests that danger has receded. Yet this is misleading for a simple reason: the central Greek Government has almost certainly run out of funds with which to pay mounting debts. Default is effectively guaranteed if it does not reach an agreement for a bailout extension with the EWG and IMF.

A Greek debt default would likely lead to a much-larger domestic crisis, an exit from the Euro Zone, and the establishment of an alternate Greek currency. This remains the major risk to broader financial markets and systemically-connected economies.

What’s the Most Important Date on the Calendar?

In concrete terms, the single most significant deadline on the calendar is likely the European Central Bank bond repayment due on July, 19—assuming that the Greek Government remains solvent up until that point. Ahead of that, a national referendum on July 5 will also prove potentially pivotal as a number of European leaders claim it is tantamount to a referendum on whether Greece will stay in the Euro Zone.

Current signs suggest that the Greek people will vote “No” and reject the current bailout offer from the Euro Working Group, and volatility is virtually guaranteed on such a result. Such an outcome would send negotiators on both sides back to the table and ostensibly strengthen Greek Prime Minister Tsipras’ hand in negotiations. It is difficult to say that this would make a deal more likely, however, and the stakes would grow ever-larger ahead of the potentially game-changing payment due to the European Central Bank on July, 19.

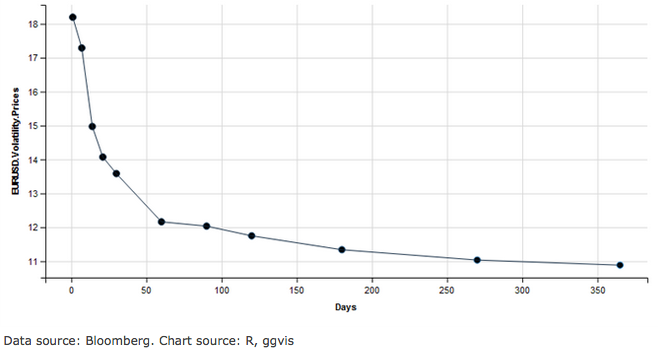

A look at forex market volatility prices for the Euro/US Dollar underlines the sense of urgency: some of the most sophisticated traders in the world believe that the coming four weeks will bring substantially more uncertainty than the coming year.

Euro Volatility Prices Substantially Higher in Near Term than Coming Year

Euro Reactions are Far from Predictable

We’re entering a critical stretch for the ongoing Greek sovereign debt crisis, but the clear difficulty is pinpointing the exact moment at which traders should take extra caution.

If the upcoming referendum does indeed produce a “No” result, we could see substantial Euro volatility and broader financial market turmoil. Heightened sovereign risks could discourage market makers from making prices in EUR pairs, and in effect this means that the Euro could both rally and fall sharply on any news headlines.

Any surprises could force substantial market moves, and traders should limit trading leverage—particularly in EUR pairs—ahead of the key dates. Caution is advised until we see a true breakthrough in negotiations.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com