Earnings Concerning For Bulls

In the markets, everything matters. Common sense tells us that stocks in the long run are tied to corporate earnings. Therefore, it is not particularly surprising that stocks have been going nowhere fast in recent months given the recent negative slant on earnings expectations. From CNBC:

Analysts are widely expecting S&P 500 companies to post their first year-over-year decline since the third quarter of 2012. U.S. markets struggled in the first quarter as investors worry over the impact of falling oil prices on overall earnings and the effect of a strong dollar on multinational companies, whose products are more expensive in foreign markets when the greenback firms up.

Bullish Door Not Closed Yet

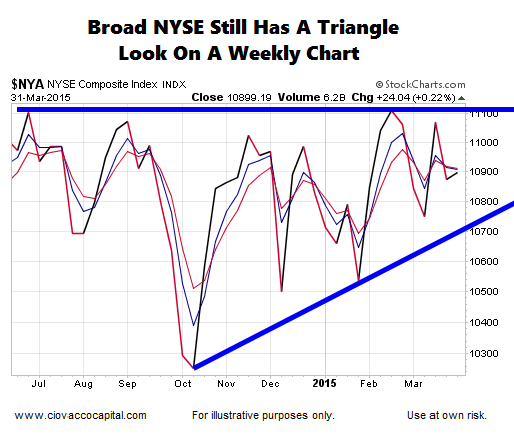

With respect to earnings, the easy thing for investors to do is to extrapolate the recent bearish trend several months down the road. While earnings reports may meet bearish expectations, it is also possible that future guidance comes in above low expectations. Is there any support for the “things could turn out better than expected” scenario? Yes, one example comes from the easy to understand triangle formation shown on the weekly chart of the NYSE Composite Stock Index below.

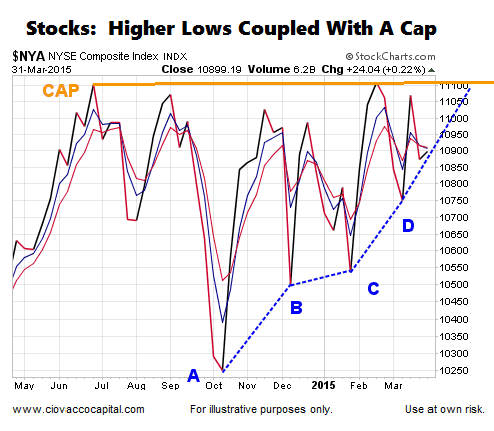

Triangles Are A Reflection Of Conviction

Points A, B, C, and D in the chart below show a series of higher lows. The higher lows tell us that buying conviction has exceeded selling conviction at higher and higher levels in recent months. Another way to visualize the formation of the triangle is that dip buyers have been less and less patient since the October 2014 low. The higher lows are the good news for the bulls. The bad news is that based on numerous concerns, including earnings and the Fed, buying conviction has not been strong enough to exceed the “cap” (see orange line below).

What Does History Tell Us?

The formal name of the pattern above is an “ascending triangle”. According to Investopedia:

An ascending triangle is generally considered to be a continuation pattern, meaning that it is usually found amid a period of consolidation within an uptrend. Once the breakout occurs, buyers will aggressively send the price of the asset higher, usually on high volume. The most common price target is generally set to be equal to the entry price plus the vertical height of the triangle.

All patterns speak to probabilities, rather than certainties. Is it possible the bears seize the day in the coming weeks and stocks experience a correction? Sure, it is possible. Even if the bearish scenario plays out, the charts above can still assist us by giving us a reference point to spot a lower low.

A Bullish Bias, But Momentum A Big Concern

A reader of our recent posts may have a fair argument along the lines of “you clearly have a bullish bias”. The bias is the market’s and has nothing to do with our personal opinions at CCM. The following statement is factual…”the stock market has a bullish bias”. How do we know that? The hard data/facts still side with the bulls. The series of higher lows since the October 2014 low is observable…and it also leans bullish until the chart morphs into a series of lower lows and lower highs. While the weight of the evidence still sides with the bulls, a portion of the evidence is screaming “slowing momentum…be open to lower lows and a correction”.

This video clip puts some additional context around some observable changes that would increase our concerns about the stock market.