Similar to buying gainers and selling off losers, it is advisable to hold on to stocks that appear promising for the long term. Is Constellation Brands Inc. (NYSE:STZ) one such stock? Let’s find out.

This wine and spirits company, which holds a big name in the alcohol-beverage space, has been benefiting from its robust brand portfolio, solid strategic initiatives and spectacular earnings history. Notably, shares of the largest wine company in the world have jumped 17.1% year to date.

Constellation Brands has a formidable portfolio of well-known brands, which provides it with a competitive edge and bolsters its well-established position in the market. Further, the company’s constant focus on brand building and its initiatives to include new products in its wine and spirits business are the key revenue drivers for the stock.

Backed by its strategic endeavors, the company is witnessing robust depletion trends and increasing market share in the U.S. wine and spirits category. Also, it strives to enhance points of distribution at retail and effectively execute its strategic merchandising initiatives to boost sales.

Moreover, Constellation Brands has been undertaking meaningful acquisitions and joint ventures, which appear promising and beneficial for its business. These factors, along with the company’s constant shareholder-friendly moves bode well, instilling confidence among investors.

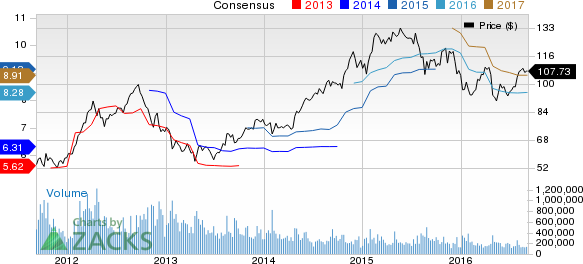

Now taking a look at the company’s spectacular earnings history, we note that the bottom line has outperformed the Zacks Consensus for seven successive quarters now, with an average surprise of nearly 8.1%.

Notably, in the last reported quarter Constellation Brands’ top and bottom lines registered double-digit growth and exceeded expectations. Results continued to be backed by the company’s effective integration and growth of its acquired brands, higher margins across its portfolio, along with strong consumer demand. Also, strength in the company’s beer business, improving trends at its wine and spirits business, and solid overall depletion trends aided the beat.

While all these factors bode well for the company, we note that the risk of increasing taxes continues to be a concern. Also, intense competition, the seasonal nature of business and currency fluctuations remain hurdles to Constellation Brands’ operating performance.

Nonetheless, we believe that the robust growth drivers, along with management’s encouraging outlook for fiscal 2017 place the Zacks Rank #3 (Hold) company well, as it heads toward its next earnings release. However, whether the company can keep its solid momentum going remains a question, to be answered only when it reports second-quarter fiscal 2017 results sometime next month.

Stocks to Consider

Some better-ranked stocks in the same industry include Castle Brands Inc. (NYSE:ROX) , with a Zacks Rank #1 (Strong Buy) and Craft Brew Alliance, Inc. (NASDAQ:BREW) , with a Zacks Rank #2 (Buy). Another stock worth considering in the related beverage-soft drinks space is Primo Water Corporation (NASDAQ:PRMW) , carrying a Zacks Rank #2.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

CASTLE BRANDS (ROX): Free Stock Analysis Report

PRIMO WATER CP (PRMW): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

CRAFT BREW ALLN (BREW): Free Stock Analysis Report

Original post

Zacks Investment Research