Intel Corporation’s (NASDAQ:INTC) recent deal wins is anticipated to strengthen its footprint and improve its competitive position against NVIDIA (NASDAQ:NVDA) in the self-driving car market. The company recently created a new division called Automated Driving Group (ADG), which focuses on this fast-emerging market.

Per Intel, the company has already won self-driving car deals worth $1 billion this year. Most prominent among them is the partnership with German carmaker BMW and Mobileye (NYSE:MBLY) for developing self-driving car technology.

Auto parts maker Delphi and Mobileye have also chosen Intel chip to power their self-driving vehicles. Initially, they would be using Intel’s Core i7 chip and later on upgrade to an even faster processor that is expected to be launched by the chip-maker in a few weeks time.

Intel has said that it is currently involved in 30 vehicle programs, but that number would swell to 49 by 2020. Moreover, the company’s venture capital division will invest $250 million over the next two years into autonomous driving technology. The fund will support the development of self driving and other technology (connectivity, communication, context awareness, deep learning, artificial intelligence (AI), safety and security) for cars globally.

Self-driving Car Participants

According to data available from BI intelligence, 10 million self driving cars will be on the road by 2020. Per Statista estimates the market for the fully autonomous vehicles will grow to almost $6 billion by 2025. According to Boston Consulting Group estimates, the autonomous car market will be worth $42 billion by 2025, which will be around 12–13% of the total automotive market.

Self-driving car market’s rapid growth potential has attracted many technology players like NVIDIA, Alphabet (NASDAQ:GOOGL) , Apple (NASDAQ:AAPL) and Baidu. Car makers like Tesla (NASDAQ:TSLA) , General Motors (NYSE:GM), Toyota, BMW, Volvo, Nissan, Ford, Daimler, Honda and Hyundai have also been in the fray.

Notable collaborations include the Ford and Baidu’s partnership to jointly invest $150 million in Veldyne Lidar, a maker of light sensor technology. Alphabet has also partnered with Fiat Chrysler under which Google will incorporate its self-driving technology into 100 Chrysler Pacifica minivans to be used as test vehicles.

Separately, Google and Ford Motor (NYSE:F) have partnered to lead a coalition of companies that will push for federal approval of autonomous cars in the near future. Uber, Lyft and Volvo are other members of this coalition.

Further, we note the recent collaboration between Tesla and Microsoft (NASDAQ:MSFT). Under the terms of the partnership, Tesla will use Microsoft’s Azure to develop AI technology for its self driving cars.

Where Does Intel Stands Against NVIDIA?

NVIDIA is already a dominant name in the self-driving car space based on its DRIVE Automotive Technology platform. Moreover, the company’s Tegra brand of mobile processors is adaptable for in-car use. The company is also partnering with major car makers like Audi, Tesla, Volvo and Mercedes-Benz.

On the other hand, Intel is a relatively new name in the self-driving car space. The company’s recent endeavors into the space are a part of its diversification strategy, as its products face intensifying competition in the high performance computing (HPC) market. Moreover, declining PC sales is impacting its top-line growth.

Intel expects autonomous vehicles to be a core component in the world of Internet of Things (IoT), due to massive amount of data they will generate. Per Intel’s Chief Executive Officer (CEO) Brian Krzanich by 2020, average autonomous car will create about 40 gigabytes of data each minute.

The company anticipates that its chips will be used by autonomous vehicles to process this massive data, which will improve the self-driving technology. Moreover, it has also made some strategic acquisitions like Yogitech, Arynga and Itseez that have expanded its capabilities in terms of security and machine learning technology.

Although NVIDIA is still a dominant power in the self-driving car market, we believe that Intel is fast catching up as a formidable challenger.

Stock Price Movement

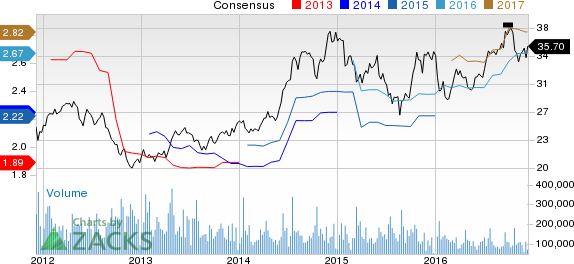

We note that Intel’s stock price has underperformed the broader Zacks Electronic Semiconductors industry over the last one year. While the stock generated a modest return of 2.16%, the sector generated a strong return of 30.17%.

We also note that Intel’s performance is less impressive compared with NVIDIA over the same period. However, Intel’s investments in IoT, security and memory could pay off this year. We believe that these investments will help the stock rebound going ahead.

Zacks Rank & Key Picks

Currently, Intel carries a Zacks Rank #3 (Hold). NVIDIA is a better-ranked stock sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 "Strong Buy" stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 "Strong Sells" and other private research. See these stocks free >>

TESLA MOTORS (TSLA): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

NVIDIA CORP (NVDA): Free Stock Analysis Report

ALPHABET INC-A (GOOGL): Free Stock Analysis Report

Original post

Zacks Investment Research