The Canadian Dollar has seen some strong data in recent weeks, but has failed to make any ground against a rampant US Dollar. It would pay for traders to begin to explore some cross pairs, particularly European currencies, as they will provide opportunities for a strengthening CAD.

Source: Blackwell Trader

The US dollar has taken the markets by storm as the US labour market continues to strengthen and the prospect of an increase in interest rates sometime next year becomes ever more likely. This has left the Canadian dollar a little overshadowed, and a turnaround for the Canadian economy is not likely to be seen in the USDCAD pair as the US economy is likely to act in the same way.

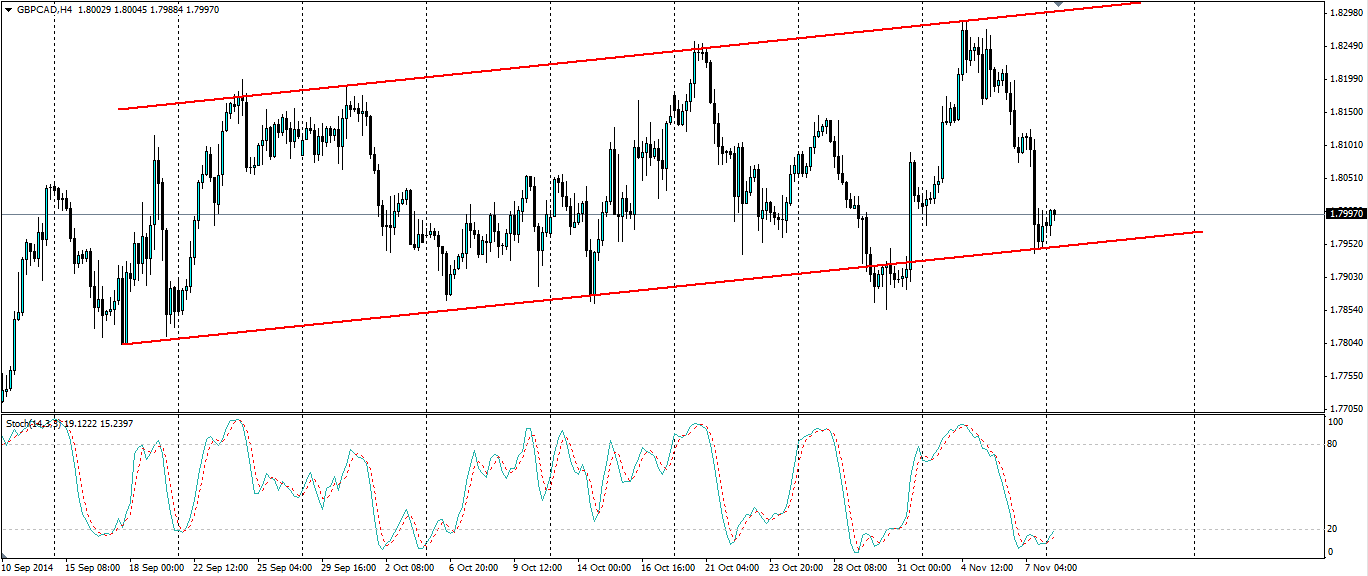

The GBPCAD pair could be one to watch with an upward intraday channel that is likely to be tested. There have been a couple of false breakouts, however, for the large part the channel has remained intact. The recent news out of Canada last week saw the unemployment rate unexpectedly fall from 6.8% to 6.5%. The Employment change also well and truly beat forecasts with 43.1k vs -5.0k. This is on the back of a 74.1k rise last month vs 20.0k expected.

Further positive news saw building permits rise 12.7% m/m and the trade balance improve. This was countered by the Ivey PMI, which surveys the whole country and all sectors, fall unexpectedly from 58.6 to 51.2. GDP has caused a little bit of concern, slipping into negative territory at -0.1% m/m, however, an improving labour market is likely to spill over into GDP as people spend their wages.

The UK on will also be expecting a fall in its unemployment rate this week, however, anything less will see the market punish the pound. The UK is still growing at a decent rate (0.7% q/q) but with an inflation rate that is falling, we are unlikely to see any moves from the Bank of England any time soon. We have also seen the Services PMI pull back from recent highs, which could prove troublesome as the services sector makes up over 80% of the UK economy.

The current channel on the above GBPCAD H4 chart could be breached if the UK employment figures are not to the markets liking. If this is the case, look to catch the momentum of a breakout of the channel. In the long term, if the Canadian economy continues to strengthen and the UK falters, this pair will be one that moves more than the USD/CAD.