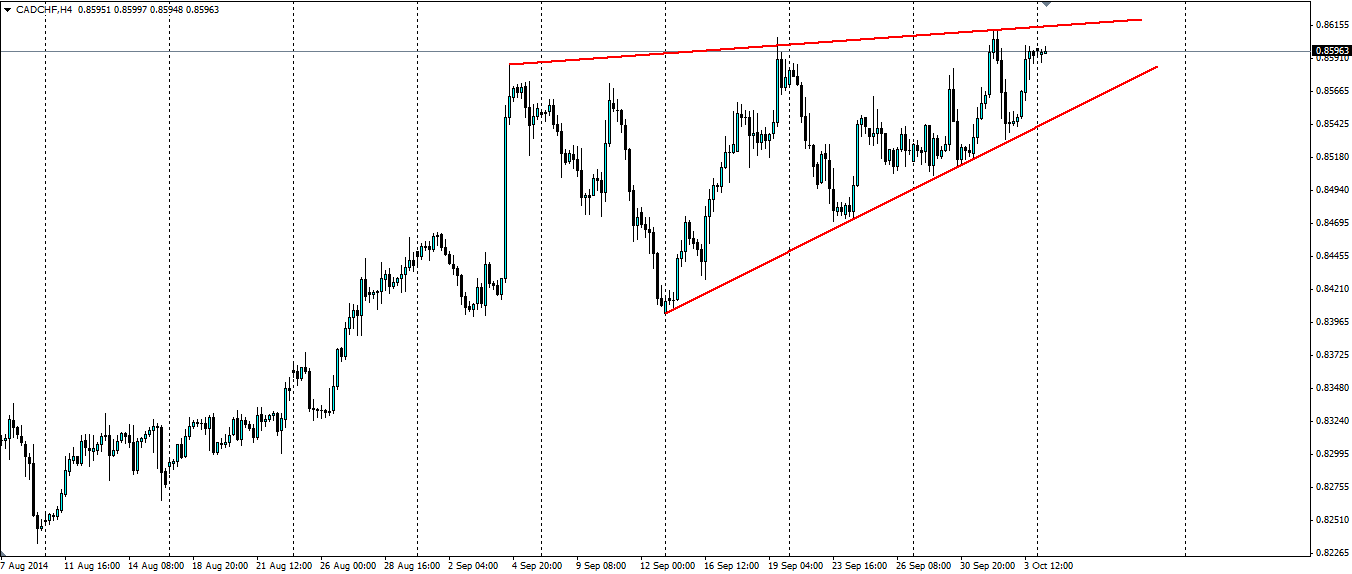

The Canadian dollar/Swiss franc is not a pair that is on many traders’ radars. But a rising wedge in an uptrend may entice some to take a look and potentially take advantage it.

Source: Blackwell Trader

Both of these currencies have larger neighbours that steal much of the limelight when it comes to economic news and the situations in the larger countries can rub off on the smaller ones. The Canadian dollar is likely benefiting from the improving labour market in the US which saw 248,000 jobs added to the nonfarm payroll last month. The franc has seen the threat of EU deflation spill into its own price index and the ECB stimulus packages have clearly weighed on the Swiss currency.

The above fundamental situation has seen an uptrend form between March and now, and the technical pattern we currently see should lead to a bearish breakout. We may see some more consolidation before a real test of the bottom of the shape, but nonetheless, the textbooks will tell you a rising wedge in a bullish trend will lead to a breakout lower.

Some news this week that could play their parts include the Canadian Ivey PMI, which takes a sample of Canadian business for all sectors and is expected to rise from 50.9 to 52.8. Later this week Canadian employment data is expected to show 20,000 jobs added to the economy last month, however, the unemployment rate is expected to stay put at 7.0%. Swiss CPI and Retail sales on Tuesday will no doubt add a bit of volatility as inflation is expected to rise from 0.0% to 0.2% m/m.

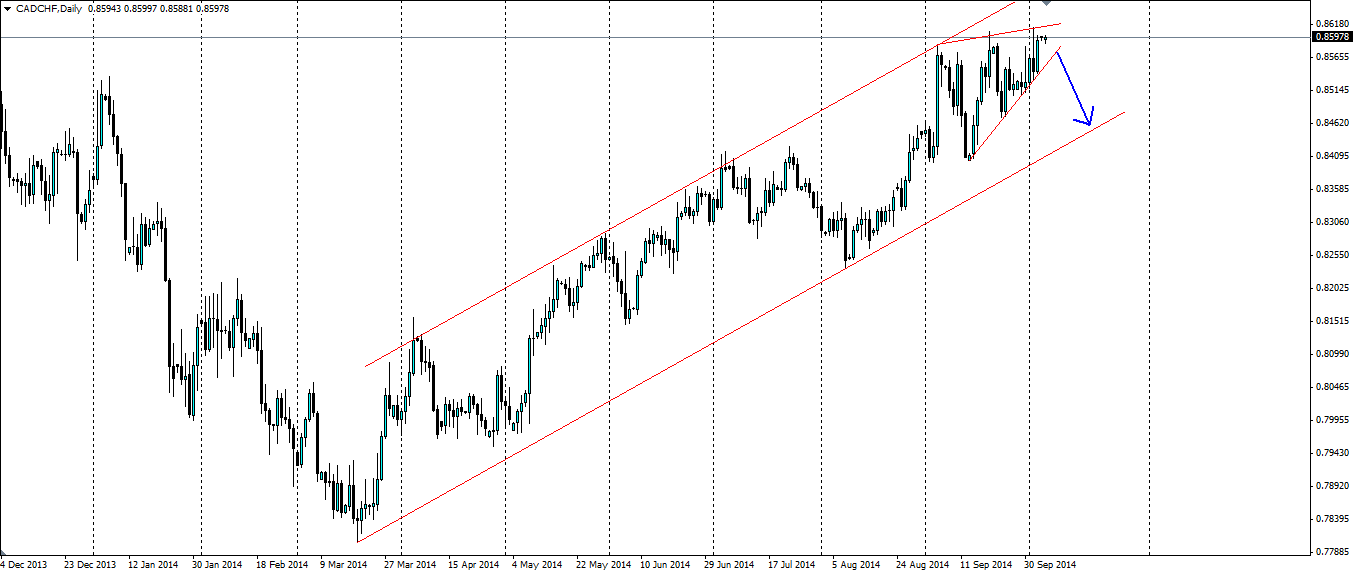

An interesting feature about this set up is the uptrend forms a bullish channel and a downside breakout of the rising wedge could see the price test the trend line, something it has not done since August.

Source: Blackwell Trader

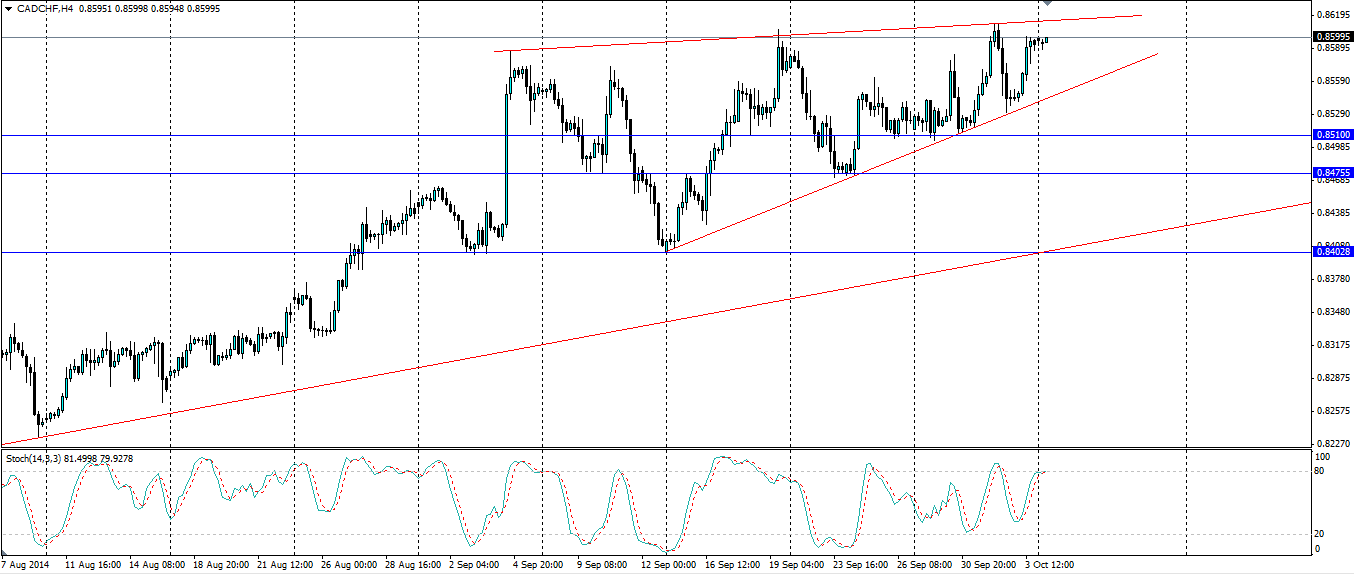

We can take advantage of a downside breakout, by setting a stop sell just outside the bottom line of the shape and move it up in line with the price consolidation. Look for levels of support to act as potential exit points in a downward movement. Support at 0.8510, 0.8475 and 0.8403 will all likely hold the price up as it moves down. Of course, there is the bullish trend line to note as this is likely to act more firmly that any other in terms of support and is likely to be found before the price reaches 0.8403.

Source: Blackwell Trader

A rising wedge on the CAD/CHF chart is likely to lead to a downside breakout and traders can take advantage of this setup. A breakout is likely to find the long term bullish trend line.