Markit had new reports out yesterday on service activity in China and Japan.

The former shows a bit of growth, the latter contraction. Because the reports are diffusion indices that give no weighting to the size of the companies reporting, one must look at these reports with a broad brush.

Japan Business Activity Contracts

The Markit Japan Services PMI shows service sector business activity contracts in February.

Key points

- Service sector activity falls, while new business remains just inside growth territory

- Input price inflation eased at Japanese services firms

- Business sentiment strengthens

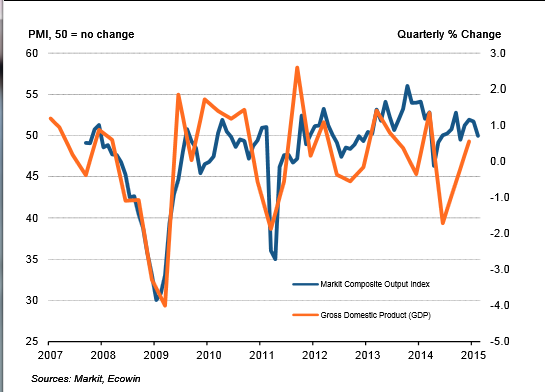

Japan Composite PMI

Summary

Latest data highlighted a general weakening of business conditions in the Japanese service sector. Activity contracted, while new orders growth slowed to a marginal pace. Subsequently, service sector providers reduced workforce numbers for the first time in eight months. Meanwhile, inflationary pressures eased, as input prices rose at a slower rate. The headline seasonally adjusted Business Activity Index posted at 48.5 in February, down from 51.3 in January, thereby signalling worsening business conditions at Japanese services providers. Although only moderate, the rate of contraction was quicker than the average since the increase in the sales tax was implemented in April 2014.

Reports of weaker demand conditions and a decline in activitiy subsequently led service sector providers to cut their staff numbers for the first time since June 2014 in February. Although only fractional, the decline in employment levels was quicker than the long-run series average. Meanwhile, manufacturers continued to hire staff, although at a fractional pace. Inflationary cost pressures eased at Japanese services companies in February, as input price inflation slowed to the weakest rate in 28 months.

The negative side of the depreciation of the yen was still felt at Japanese manufacturers, as purchasing costs rose sharply due to a steep hike in raw material prices. Output charges, on the other hand, declined for the first time since August 2014, but at only a slight pace.

Modest Expansion in China

The Markit HSBC China Services PMI shows business activity growth at five-month high.

Key Points

- Manufacturers and service providers both see stronger expansions of business activity and new orders

- Job creation slows at service providers, while manufacturers cut staff numbers fractionally

- Sharp decline in input prices in manufacturing sector contrasts with solid increase in service sector cost burdens

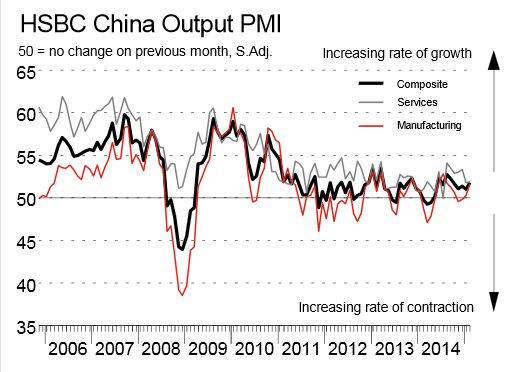

China Composite PMI

Summary

HSBC China Composite PMI ™ data (which covers both manufacturing and services) pointed to a further increase in Chinese business activity in February, thereby extending the current trend to 10 months. Though modest, the rate of expansion quickened to a five-month high, with the HSBC Composite Output Index posting at 51.8 in February, up from January’s recent low of 51.0.

February data signalled divergent trends with regard to unfinished workloads, with back logs falling at service providers, but rising at manufacturers. That said, outstanding business declined only slightly in the service sector, offsetting a slight increase at the start of the year. Overall, backlogs of work rose marginally at the composite level. Service sector cost burdens rose solidly over the month, with the rate of inflation picking up to a four-month high in February . In contrast, manufacturers continued to benefit from the recent fall in global oil prices, and signalled a further sharp reduction in average input costs.

At the composite level, input prices fell moderately. Average selling prices set by service providers rose marginally in February, offsetting a slight reduction at the start of the year. Meanwhile, prices charged by manufacturers continued to decline, albeit at a weaker rate. Chinese service sector companies remained optimistic towards future activity growth in February. That said, the degree of overall positive sentiment weakened slightly since January’s 10-month peak.

PBOC Rate Cut Seen

Growth in China, assuming one believes the reports is expected to be seven percent this year. It appears as if the tread-water PMI mark in China delivers such growth.

Nonetheless, Bloomberg reports PBOC Seen Cutting Again as China’s Economy Slows, Survey Shows.

The People’s Bank of China will cut benchmark deposit and lending rates again next quarter as the economy slows, according to economists surveyed by Bloomberg.

The median forecast is for a deposit rate of 2.25 percent and a lending rate of 5.10 percent in the April to June period, the survey of analysts from March 2 to March 3 showed. That’s 25 basis points lower on both from the previous survey.

China’s leaders are gathered in Beijing this week where they’ll map out policies on state-owned enterprises, the environment, and deliver the nation’s budget. Premier Li Keqiang is expected to announce a 2015 economic growth goal of about 7 percent, down from last year’s 7.5 percent.

“The economy remains in a downturn,” Larry Hu, head of China economics at Macquarie Securities Ltd. in Hong Kong, wrote in a March 3 note. “Deflation pressure still lingers and we expect will prompt further policy easing.”

Hu forecasts one more interest-rate cut in the second quarter and three more reductions to banks’ reserve ratio requirements this year.

The PBOC announced a cut of a quarter percentage point each in the benchmark lending and deposit rates on Saturday. A day later, a factory gauge for February signaled contraction for a second month, underscoring the need for looser policy.

Reflections on China

It's interesting that various indicators in China routinely go in and out of contraction, yet China constantly delivers growth that would make the rest of the world envious.

Chinese growth is certainly overstated, but not because of any PMI reports.

Rather, shadow bank lending of dubious quality adds to GDP (but shouldn't). Mal-investments of all sorts add to GDP (but shouldn't). And finally, pollution (not factored in at all), should subtract from GDP.

None of the above is factored in.

I don't know and cannot guess China's true GDP, but without a doubt, China's GDP is overstated and slowing. The entire world is slowing.

By the way. Rate cuts are precisely the wrong thing to do. There is no need for a "looser policy". China needs to rebalance and rate cuts prolong the status quo of over-dependence on housing and infrastructure.