Economy Is Not In Bear Market Territory

Is the global economy in “rip-roaring healthy” shape? No, in fact it is far from it. However, as Friday’s employment data showed, it is still holding its own. From Bloomberg:

U.S. stocks rose Friday as data showed payrolls pushed past their pre-recession peak for the first time in May. “The market likes this steady state of economic improvement,” Timothy Ghriskey, chief investment officer at Solaris Asset Management LLC in New York, which helps manage about $1.5 billion in assets, said in a phone interview. “A really weak number would raise economic concerns that the economy is rolling over, and a too-strong number would cause concern about the Fed accelerating its tightening timetable. It’s a sweet spot for the market.”

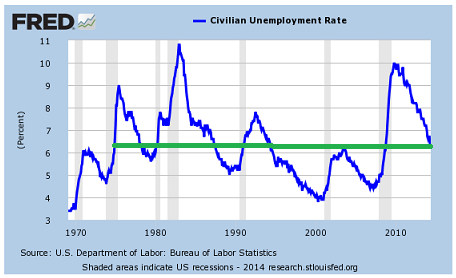

We know many question the government’s numbers, but the numbers are the numbers and they are what the market looks at to make decisions. Recent improvement in the unemployment rate has brought the chart into middle-of-the-pack territory (see green line below). The chart below is not in a showstopper trend for stocks.

The Market Does Not Care What You Think

Many have been bearish on the stock market and U.S. economy for years, and yet, the market continues to rise. How can that be? Asset prices are set not by the opinion of individuals, but rather by the aggregate or net opinion of all investors around the globe. Until we understand where our personal opinions and ego fit into the larger economic picture, it is difficult to make objective and productive investment decisions. While ego is a difficult topic, if you plan to do some studying this weekend, the concepts outlined in this article are a great place to start: Want To Reduce Missteps? Become A 2-Faced Investor. Our personal opinions, including mine, have little-to-no impact on the value of our investments…think about that. While it is a harsh expression, the market doesn’t care what you think, captures how asset markets function in the real world.

The Aggregate Opinion Is Shifting

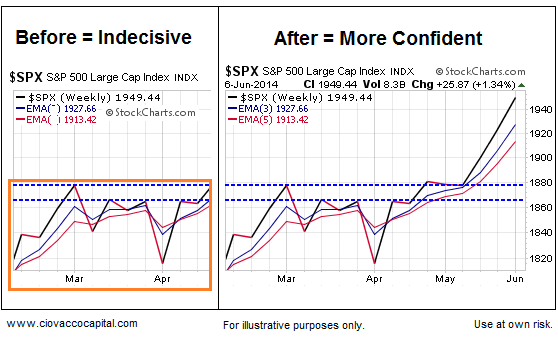

Since the market determines the value of our 401ks and IRAs, shouldn’t we be asking what does the market think? The answer, which is evident on the charts of the S&P 500 below, is the market was indecisive, now it is more confident, which favors bullish outcomes from a probabilistic perspective looking out several weeks and months. If you are experienced in the markets, it is difficult to say the resolution shown below is anything other than good for the stock market bulls.

Fed No Stranger To A Rock…

Friday’s labor report and the market’s recent breakout is moving the Fed closer to being between a rock and a hard place. The economic numbers look better on the surface, but underneath concerns remain. From The Wall Street Journal:

The combination of low market volatility and ultralow interest rates give investors an incentive to use borrowed money to buy risky assets. So far, that doesn’t seem to be happening, but the Fed cannot know how long this will last. Nor can it know exactly what is happening in lightly regulated areas of the market. That argues for starting the process of raising short-term rates up from zero sooner rather than later. Yet trying to stomp out the possibility of excessive risk-taking when there is still so much slack in the job market could also be dangerous. First, it could push more people permanently out of the workforce, putting the economy on a lower growth path. Second, it could set back the day when wages are advancing quickly enough to push inflation, running at 1.4% excluding food and energy, to the 2% pace the Fed aims for.

Still Not Convinced? Review The Weight Of The Evidence

Having studied charts for years, we can tell you with 100% certainty that when stocks are doing well you can always find a handful of charts that support the bearish case. To improve our odds of success, we make decisions based on the weight of the evidence, not just a few charts that happen to support our personal bias, most recent forecast, or ego. In fact personal bias + forecasting + ego is a recipe for high stress, sleepless nights, and disappointing results in the financial markets. What does the weight of the evidence tell us now? The answer is in this week’s stock market video.

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

Still Wasting Time On The VIX

Despite the hard “stop stressing over a low VIX” evidence we presented on May 29, the endless talk about a “investor complacency” continues. From Reuters:

The VIX, which tends to rise when volatility increases or the market drops, has been on the decline for months and is well below its historical average of 20, which some see as a sign that investors are ignoring concerns that could derail the rally.

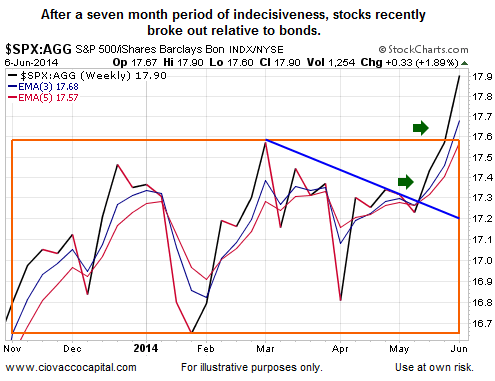

Stocks Take The Lead Versus Bonds

Another example of a recent bullish resolution in the battle of investor indecisiveness is the recent breakout by stocks relative to bonds. The chart below, which shows demand for growth-oriented stocks increasing relative to defensive-oriented bonds, tells us economic confidence is better today than it was a few weeks ago. As long as that trend continues, it increases the odds of good things happening in stocks over the coming weeks and months.

Investment Implications - Continued Allocation Migration

If you read our articles over the past few months, many have stated something along these lines:

Until the market breaks from this pattern of economic indecisiveness, we will continue to hold a mix of stocks, bonds, and cash.

Since our market model makes decisions based on observable data from the market’s pricing mechanism, our allocation as of June 6 can be summed up this way:

As conditions have improved over the past several weeks, we have reduced our exposure to bonds (TLT) and cash, and increased our exposure to stocks.

We still hold iShares Barclays 20+ Year Treasury (ARCA:TLT), just not as much as we did before. Over the past few weeks, we also have been building positions in leading sectors, such as technology (SPDR Select Sector - Technology (NYSE:XLK), industrials (Industrial Sector SPDR Trust (ARCA:XLI), and economically-sensitive stocks (PowerShares S&P 500 High Beta (NYSE:SPHB). The sector ETFs are paired with more diversified positions, such as the S&P 500 (SPDR S&P 500 (ARCA:SPY), total stock market (Vanguard Total Stock Market (ARCA:VTI), and an equal-weight S&P 500 holding (Rydex S&P Equal Weight (NYSE:RSP). We will hold these positions as long as the market’s pricing mechanism allows. These positions may not be appropriate for your personal situation or risk tolerance. You should perform your own due diligence before making any investment decision. Since tweeting the “we are adding to the growth side” tweet below, the S&P 500 has tacked on 49 points.

Markets Don’t Go Straight Up

Could we see a down week or two within the context of a longer-term and ongoing advance in stocks? Sure, it happens all the time. The market never makes anything easy on anyone. Our job is to discern between “volatility to ignore” and “volatility to respect”, which acknowledges that down days are always part of the equation. If you are looking to spark your creative juices, the following link lists past articles that might be of interest to you: Weekend Reading. More links and charts on Twitter.