Fed Stays Easy

The Federal Reserve provided a mixed message Wednesday, but the tone remained equity friendly. From Reuters:

The Federal Reserve on Wednesday reaffirmed it was in no rush to raise interest rates, even as it upgraded its assessment of the U.S. economy and expressed some comfort that inflation was moving up toward its target. “Labor market conditions improved, with the unemployment rate declining further,” the Fed said in a statement. “However, a range of labor market indicators suggests that there remains significant underutilization of labor resources.”

Stock Market Risk

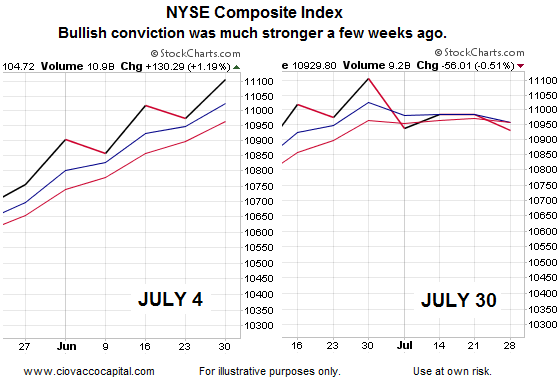

When intraday volatility picks up, it is often difficult to see small changes that are taking place. For example, it may surprise some that the S&P 500 is down for the week through Wednesday; it has given back 8 points since last Friday’s close. The weekly chart on the left below shows the broader NYSE Composite Index as of July 4. The chart on the right is as of Wednesday’s close. What can we learn from them? While the big picture still favors bullish outcomes, the odds of the stock market morphing into a correction are higher today than they were on Independence Day.

Stocks Or Bonds?

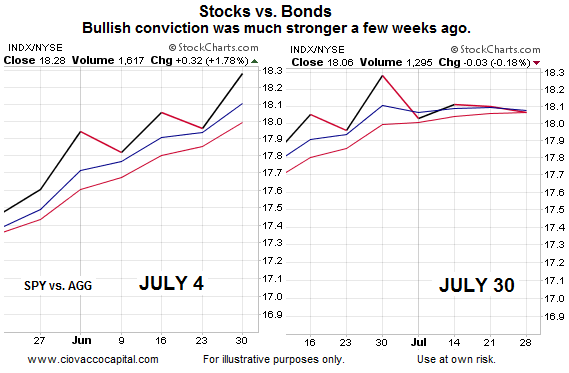

Conventional wisdom is that stocks are a better place to be when the economy is expanding and interest rates are rising. The charts below show stocks (SPDR S&P 500 (ARCA:SPY)) relative to bonds (iShares Core Total US Bond Market (ARCA:AGG)). The conviction to own stocks over bonds was stronger on July 4 than it is today. In fact, the basket of bonds is beating the S&P 500 this week.

Since weekly charts only plot one point per week (Friday’s close), the look of the charts above after the bell Friday is more important than intraweek.

GDP And The Fed

Wednesday started with a better than expected reading on the U.S. economy, which increased jitters heading into the 2:00 p.m. EDT Federal Reserve statement. From Bloomberg:

Today’s Commerce Department report showed gross domestic product expanded at a 4 percent annual pace in the second quarter, confirming the Fed’s view that a first-quarter contraction was transitory. Consumers, whose spending accounts for 70 percent of the economy, have grown more confident as the labor market improves and rising share prices boost wealth. “The GDP print this morning had given the market some pause as to how hawkish the Fed might be,” Stacey Nutt, chief investment officer at ClariVest Asset Management LLC in San Diego, California, said in an interview. “Now it seems like they were not as hawkish as feared.”

Investment Implications – The Weight Of The Evidence

Our approach is fairly simple, since the risk of bad things happening is marginally higher today, we prefer to take less risk than what we were willing to accept on July 4. Less risk does not mean “bearish”, “no risk”, “short”, or “100% bonds”. It simply means a lower allocation to stocks (Vanguard Total Stock Market (ARCA:VTI)) and a slightly higher allocation to cash and bonds (iShares Barclays 20+ Year Treasury (ARCA:TLT)). If stocks are backed by improving conviction in the coming weeks, we are happy to increase the equity side of our portfolios. Conversely, if the charts continue to roll over in a bearish manner, we have already taken the first risk-reducing step. Currently, the weight of the evidence says, “stay long for the most part, but it is prudent to pay closer attention until things improve.” We will enter Thursday’s session with a flexible and open mind.