Nearly every writer, speaker, analyst and prognosticator has convinced market participants that bond yields can only go higher from here. The rationale? U.S. economic growth is expanding, employers are hiring and the Federal Reserve is itching to back away from emergency level stimulus. In fact, the hype is persuading many that the Fed is certain to announce curtailing its quantitative easing (”QE”) program on Wednesday, December 18.

Battered Yields

Yet the tapering message that the Fed awkwardly began telegraphing in May has already sent 10-year yields from 1.6% to 2.9%. Certainly, monetary policy leaders are aware that the changes in interest rates have adversely impacted the real estate recovery, from declining refinancing activity to evaporating mortgage applications to home builder uncertainty. Equally troublesome, the decimation to treasury-bond prices caused shock waves in asset classes that are sensitive to interest rates, including emerging market stocks, foreign bonds, real estate investment trusts, pipeline partnerships and non-investment grade corporate debt. What’s more, investors abandoned U.S. bond mutual funds by the largest amount since 1994 — the last year that treasury bond fund ownership contributed negatively to portfolios.

As recent as September, the popular opinion was for a solid reduction in the $85 billion per month in Federal Reserve stimulus. Instead, the Fed decided to wait for more data. The result? The yield on the benchmark 10-year note dropped from 2.85% to 2.5% in a matter of weeks.

Already Priced In

As of Tuesday -- one day before the Fed’s decision -- yields are once again back up to the 2.85% level. Even if Chairman Bernanke announces a slight decrease in its money-for-bond-buying activity, isn’t it reasonable to assume that the markets have already anticipated the expected announcement? Doesn’t it stand to reason that bond funds and bond ETFs have been sold on the rumor of Federal Reserve action, leaving an opportunity to buy bond assets on the actual news?

Paint me skeptical, but I find it hard to believe that the same leaders who orchestrated one of the more phenomenal single-year run-ups in risk assets will suddenly turn into “grinches” with two weeks to go in 2013. My sense is that they may try to have their cake and eat it in the holiday season. Specifically, if the Fed announces any specific action, it will be so minor in scope that bond yields may actually fall. Additionally, they may continue to descend well into the New Year.

Realistic Possibilities

What if U.S. economic growth actually expands at a sub-standard and/or disappointing pace in Q4 2013 and Q1 2014? A weaker-than-expected economy may very well encourage the new Chairwoman, Janet Yellen, to delay additional tapering or even increase asset purchases. That might send the 10-year from a lofty perch of 3.0% down to a range between 2%-2.25%.

And then there’s the issue of deflation. Federal Reserve officials maintain that they desire low interest rates until either unemployment drops below 6.5% or inflation rises significantly above 2 % annually. This has yet to occur. However, inflation has decelerated dramatically over the prior 12 months, plunging to a meager 1.0% annually through October 31, 2013. Not only is this an ominous sign, but central bankers at the Federal Reserve want no part of Japanese style deflation that has plagued the island nation for more two decades. It follows that Federal Reserve officials may be far less concerned about stimulating for too long and far more concerned about tightening prematurely.

Smart Move

Add it all up, and buying Bond ETFs when the 10-year is close to 3.0% may be a savvy contrarian move for 2014. Not only is the Fed likely to work towards keeping bond yields in and around 3.0% — not only is quantitative easing (QE) almost certain to be used by the Fed for a longer period than many expect — but Bond ETFs may a be less risky than most market pros would have you believe.

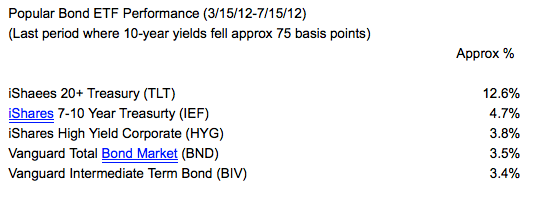

So what if economic data does weaken? What if foreign investors rekindle their former notion of safe harboring in U.S. treasuries? Perhaps the best answer to that question would be to assess the last time that the 10-year yield dropped roughly 75 basis points (3/15/12-7/15/12).

Keep in mind, these are total return results for a 4-month period, not a full-year period. If one assumes the 75 basis-point drop for a full-year period, an investor would also get the yield that the respective asset produces over an ensuing 8 months. In other words, there’s every reason for a contrarian investor to see modest income production if the Fed is successful at keeping 10-year yields near 3% in 2014. And, a contrarian that sees a 10-year yield ending 2014 closer to 2.25% might actually secure a venerable total return.

Mild Exposure

I intend to keep some bond exposure in client accounts, albeit mild. I am unlikely to make a substantial contrarian bet on rates falling substantially. By the same token, I expect the U.S. Federal Reserve to balk at any substantial tapering in 2014. Once investors begin to realize that QE will not end — that data-dependency guidance will keep the monthly money printing at a fairly high level — bond short-sellers will get squeezed and Bond ETFs will start seeing more inflows than outflows.